Analysts have a 21% 12-month average price target on the FTSE 100 company Frasers Group (LSE:FRAS). I’m also bullish on the business for its stellar valuation, strong market position, and relative recession resistance.

Frasers continues to develop

The company is a leading UK-based retailer that operates across sports, premium lifestyle, and luxury retail. Some of its most famous subsidiaries include Sports Direct, Flannels and Jack Wills.

Management is actively pursuing international expansion, particularly in Europe. I expect this will help it to deliver strong future growth.

Also, it’s focusing on enhancing the retail experience through improved store concepts with digital capabilities. Furthermore, it has introduced Frasers Plus, which is a financial services product offering credit facilities and loyalty rewards. Both of these areas are likely to help it to strengthen its customer relationships.

High growth but great value

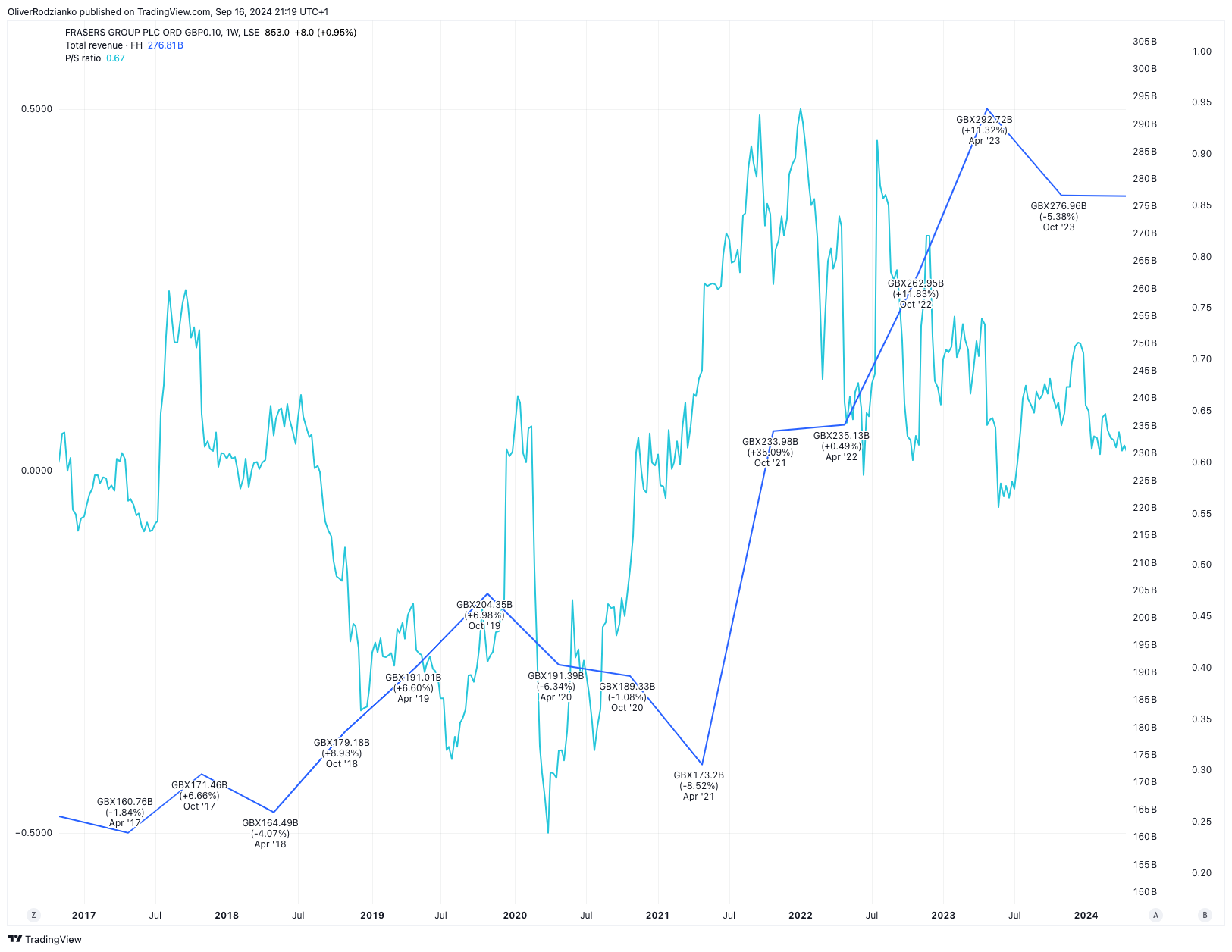

The company has experienced massively expanding growth rates. Over the past 10 years, its median revenue growth rate has been just 13%. However, as it stands, it’s currently nearly 22%.

To contrast this, its median price-to-sales (P/S) ratio over the past 10 years has been 0.67. That’s exactly equal to its ratio right now. Also, it shows that the company is currently selling for only 67% of its total revenue. That’s exceptionally good value.

Assessing the risks

Frasers competes with some extremely formidable businesses in its field, including JD Sports Fashion and Decathlon. It also competes with online marketplaces, including those like eBay and Amazon, which are challenging the traditional retail focus of Frasers.

This opens up market risks, and I believe the heavier digital strategy from Frasers management is wise. As I mentioned above, it has shown signs of this, which is good to see.

However, also at the moment there is a cost-of-living crisis. This usually hits businesses that rely on purchases from non-affluent consumers the most. Frasers falls into this category, so I’m aware there could be some slower growth in the future.

Luckily, its focus is also on high-end consumers and this protects it somewhat from recessions. That’s because as prices rise, affluent customers can afford to continue shopping for non-essentials more than those on a budget.

The long-term returns I expect

While the near-term return of 21% expected by analysts is appealing, it’s worth remembering that a large part of this is due to the fact that the stock is currently potentially undervalued.

If the market begins to value the company more appropriately moving forward, its stock price gains will be more dependent on its growth rates. The current consensus from analysts is that this company will deliver 5.3% revenue growth as an annual average over the next three years. This is quite low, so I expect strong near-term growth based on valuation and steadier, slower long-term growth following this.

Frasers isseemsa good short-term buy, but as a Fool, I only look for long-term investments. This doesn’t appear to be one with massive growth on the horizon over many years, and it also doesn’t pay a dividend right now. Therefore, I’m sitting on the sidelines of this company for the time being.

This post was originally published on Motley Fool