The IAG (LSE: IAG) share price is at a ridiculously low level, I feel. With a price-to-earnings ratio of just 3.96, this is one of the cheapest stocks on the entire FTSE 100.

The British Airways-owner took a beating in the pandemic as fleets were grounded. And its shares are still stuck on the runway as the world starts flying again.

IAG’s poor performance is even more surprising given that it posted a “strong” first half on 2 August, with sales climbing 8.4% to €14.7bn. Profit before tax dipped 1.1% to €905m but comfortably beat estimates.

The stock pays dividends again

IAG’s core North Atlantic, Latin America and intra-Europe markets are doing nicely, with revenues up 7.8% to €8.3bn. Better still, the board announced it was resuming dividends as free cash flow surged to €3.2bn.

The shares rose 3% that morning but have idled since. Investors who thought they’d spotted a bargain will have been disappointed. IAG shares are up just 3.93% in 12 months.

That seems harsh to me. Traffic and revenues are rising, albeit a little bumpily, while fuel prices are falling. Wages are now rising faster than inflation which should put money into customers’ pockets. Yet still investors remain wary of IAG.

The airline sector is inherently volatile and Middle East tensions and potential US recession have further deterred buyers. Also, IAG still carries net debt of €9.25bn, albeit down from €10.39bn in 2022. Perhaps that’s holding it back.

But it’s a sunnier picture at AIM-listed budget carrier Jet2 (LSE: JET2), whose shares are up 18.99% over one year and 88.5% over five. They still look good value though, trading at a modest P/E of 7.32 times earnings.

On 11 July, it posted a 9% increase in full-year operating profit to £428.2m, while revenue grew 24% to £6.3bn amid record passenger numbers. Margins rose too.

It offers growth

This is a smaller operation, with a market cap of £2.93bn compared to IAG’s £8.42bn. Arguably, that gives it more scope for growth. Jet2 takes delivery of 146 new aircraft from Airbus over the next decade. While some are straight replacements, its fleet will increase from today’s 127.

Like IAG, its low valuation suggests that investors remain sceptical. However, net debt is scarcely a concern here. After excluding advance customer deposits, it totals just £124m. Cash reserves of £484.4m are up more than 50% in a year.

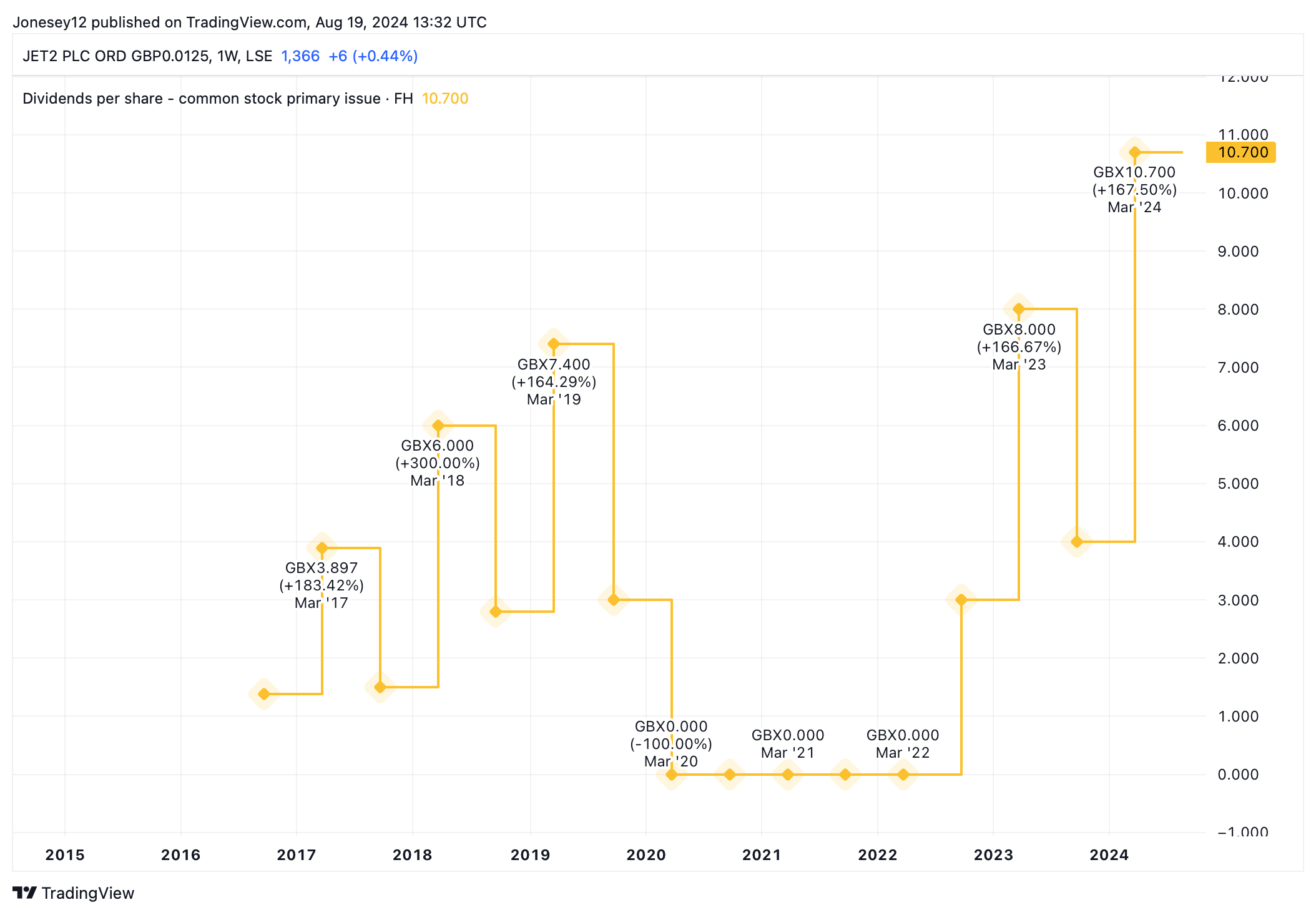

Jet2 resumed dividends in 2023, suggesting a stronger balance sheet than IAG. In 2023, Jet2’s board hiked the full-year dividend by a third, from 11p to 14.7p per share. Let’s see what the chart says.

Chart by TradingView

The dividend yield is disappointingly low at 1.1%. However, it’s covered 12.6 times by earnings, giving room to grow. Obviously, I have to expect there could be a lot of volatility involved in this stock, so it’s not without risk. Airlines have high fixed costs while passenger demand is vulnerable to shocks, whether political, military, economic or volcanic. As we’ve seen with the pandemic, they don’t bounce back overnight.

I’m tempted by IAG but a little wary of falling into a FTSE 100 value trap. Instead, I’ll buy Jet2 when I have the cash.

This post was originally published on Motley Fool