Investors holding BT (LSE:BT.A) shares must have been pleased at news Bharti Enterprises is set to buy 25% of the company from Patrick Drahi’s firm Altice. The stock jumped 7% as a result.

Over the last decade though, investors haven’t had much to celebrate. A falling share price hasn’t been encouraging, but there are some important lessons to learn from this.

10-year returns

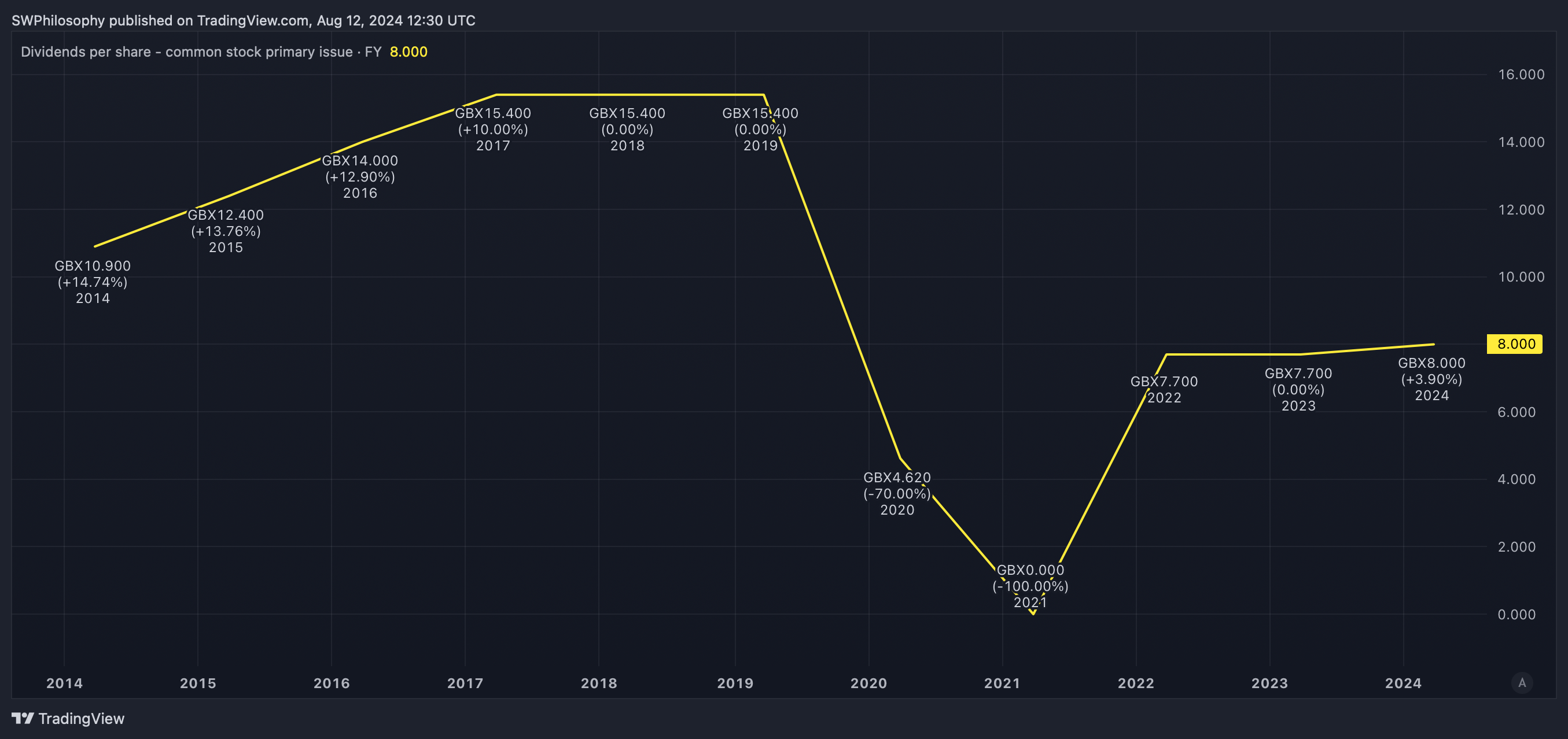

A decade ago, £1,000 would have bought me 269 BT shares. Today, that would have a market value of £374, but I’d also have received dividends each year along the way.

Over the last 10 years, the company’s distributed £1.02 per share in dividends to investors. With 269 shares, that amounts to £274.

BT dividends per share 2014-24

Created at TradingView

Together, that makes a total return of £648, which represents a 35% loss on my original investment. And even if I’d reinvested the dividends along the way, things wouldn’t have been much better.

On average, BT shares have come with a 4.5% dividend yield. Reinvesting the dividends at that rate might have taken the passive income up to £379 – a big increase, but still not enough to break even.

BT dividend yield 2014-24

Created at TradingView

Buying low

The BT share price is down from where it was a decade ago, but it hasn’t been a linear decline. Over the last 10 years, there have been plenty of opportunities for investors willing to take them.

If I’d bought the stock four years ago, the market value of my investment would be up 30%. And that’s in addition to the dividends I’d have received during that time.

Predicting where share prices will go next is often far from straightforward. But in August 2020, there were some clear signs the stock was unusually cheap.

BT price-to-earnings ratio 2014-24

Created at TradingView

One is the fact the stock was trading at a low price-to-earnings (P/E) ratio relative to its average over the last decade. And in general, this has been a good indication that the stock is unusually cheap.

Where are we now?

Right now, the stock’s trading at a P/E ratio of 16, which is relatively high. But from an investment perspective, there’s something I’m more concerned about.

With a company like BT, the business makes investments in infrastructure and then looks to earn a return on its assets. The trouble is, the company’s return on assets has been falling steadily over time.

BT return on assets 2014-24

Created at TradingView

One reason for this is the increased pace of innovation. As new communication technology requires upgraded connectivity, BT has had to increase its infrastructure investments.

Another problem is declining customer numbers. The company’s been increasing prices to try and offset this, but this could well make things worse over the long term.

Should I buy?

The last point is the important one from my perspective. With most UK households already having a broadband connection, the only way to recover from declining customer numbers is to win them back.

That’s going to be difficult while raising prices. And that’s the dilemma that BT is facing, which is why I’m staying away from the stock despite the dividend yield reaching 5.75%.

This post was originally published on Motley Fool