Taylor Wimpey (LSE: TW) shares are down 22% since September. They’ve dropped to a near-52-week low. The fall has bumped the dividend yield up to one of the highest across the FTSE 100 too. All this has taken place while a newly-elected government has been crowing about how we’re going to build more houses than we’ve achieved in most people’s memories.

Anyone looking for a big Footise yield in a thriving sector might be wondering: is it time to snaffle up a bargain?

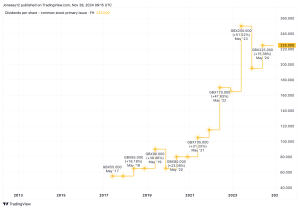

The dividend indeed looks very good, on the surface. It’s been growing steadily since the pandemic and now pays out a yield of 7.14%. That’s set to go higher too. Analysts have the next three years’ payouts at 7.34%, 7.44% and 7.7%.

Anyone looking to invest a sum of £10k might be looking at a cash return of £714 a year, and rising, on dividends alone. If all goes well, those dividends would turn my cash stake into £12.4k over the next three years.

Building more?

With all that said any discussion of handsome dividend payouts does need to be tempered with discussion of the company itself. After all, I’m not really interested in a cash-paying asset that decreases in value more than I get back. And while that 22% drop could be a discount, it could also be a sign of things to come. Simply, I don’t want to be left holding the bag here.

The first point is we have a government that wants to build more houses. That should be good for Taylor Wimpey, shouldn’t it? Private firms are going to be a key part of hitting a target of 300k homes a year, an amount we haven’t comes close to since the 1970s when local authorities were still doing meaningful amounts of building. We might expect less tight regulations or even subsidies to house-building firms.

A buy for me?

However, all the talk of “getting British building again” sounds like empty words when companies are facing extraordinary energy prices, some estimates say industrial electricity in the UK is the highest anywhere on the planet.

Labour costs too will rise with a bump to Employer’s NI and minimum wage increases coming in. It’s perhaps telling that Taylor Wimpey shares rose 15% after Labour was elected but have dropped 20% since the Budget.

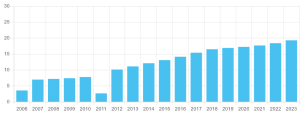

I own shares in Taylor Wimpey and think things look relatively bright. The dividend’s one positive. High earnings growth’s another, with 21% expected over the next three years compared to an industry average of 14%.

For these reasons I won’t be selling, but the shares aren’t as cheap as they once were, so I’m not buying. A price-to-earnings ratio of 18 is pretty pricey in London these days.

This post was originally published on Motley Fool