The London Stock Exchange is filled with passive income opportunities. What it lacks in high-tech growth shares, it makes up for in high-yielding dividend stocks. And among some of the most popular in the FTSE 100 lies BT Group (LSE:BT.A).

The telecommunications giant’s share price has been on a roller coaster ride for almost a decade. And investors who’ve held on throughout this period aren’t exactly pleased with the result. After all, the stock is down more than 70%!

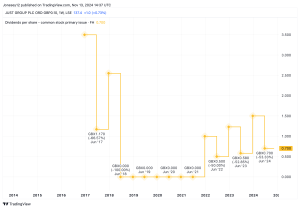

Needless to say, that doesn’t exactly generate much confidence. However, it also means the stock currently offers a market-beating yield of 5.7%. That means if I were to invest £10,000 in BT shares today, I could immediately unlock £570 passive income. And that’s before factoring in the potential for future dividend hikes.

What’s more, the potential for capital gains also seems to be making a comeback. Since May this year, the stock is actually up by 35%! What exactly is going on?

Is the turnaround finally here?

BT’s problems as a business aren’t exactly a secret. In fact the firm is actually one of the most shorted shares on the British market because of this. After years of mismanagement and numerous CEOs trying to right the ship, BT has accumulated a lot of debt while profits have suffered. That’s why the stock has subsequently performed so poorly over the last eight years. Yet based on the latest results, a spark of hope might have emerged.

When Allison Kirkby took over the helm of the business earlier this year, investor expectations weren’t exactly high. After all, the group has already gone through numerous management shake-ups and organisational changes to try and fix the problems. However, unlike her predecessors, Kirkby seems to be delivering results.

The group’s £3bn cost-savings initiative has been completed a year ahead of schedule. And it seems Kirkby has found more opportunities to improve operational efficiency since another £3bn cost-cutting programme has been launched.

Meanwhile, BT Group’s capex related to rolling out full-fibre broadband has reached its peak. That means management should have more free cash flow (FCF) at its disposal moving forward. And internal predictions estimate FCF to land at £1.5bn by the end of this year, reaching £3bn by the end of 2030. That means more money to bring down debts as well as generate more passive income for long-term investors.

The elephant in the room

There’s no denying the group’s latest results were a pleasant surprise. That’s clearly evident given the sudden spike in share price on the back of this report. However, the company still has a long road ahead to mend the cracks in the balance sheet.

Besides the £23.5bn in debt & equivalents, BT’s pension deficit is a concern. Even after pouring in another £800m between March 2023 and 2024, it still increased by £1.7bn to £4.8bn. The increased free cash flow generation in the coming years will undoubtedly help reduce both loan and pension obligations. But should the group’s latest round of cost-saving efforts fail or a new source of capex emerges, pressure on investor dividends is likely to rise.

All things considered, BT’s balance sheet appears to be getting healthier. But in the interest of passive income security, I think there are better dividend opportunities to be found elsewhere.

This post was originally published on Motley Fool