I’ve been investing for a while. I have a rather simple strategy: I buy top-quality FTSE shares I think are trading below their intrinsic value. While I’m certainly more equipped than I was back when I started, there are still plenty of things I can do to become a better investor.

We all can. That’s the beauty of the stock market. It’s forever changing. That means as investors we must stay on the ball.

While I’m an advocate of buying shares with the aim of keeping them in my portfolio for decades, that doesn’t mean I shouldn’t stay abreast of what’s going on. After all, I’m always hunting for my next value buy.

Yet what if I had to start again today from zero but with the knowledge I’ve gathered along the way? It took some time to decide, but this would be the first stock I’d buy.

Games Workshop

FTSE 250 constituent Games Workshop (LSE: GAW) would be my pick. The business operates in the miniature wargames industry.

In the sector, it’s the frontrunner by some margin. And that’s the first reason I’m a fan of Games Workshop.

Legendary investor Warren Buffett is renowned for investing in companies with moats. These are competitive advantages that allow businesses to stay ahead of their competition.

With such a dominant position in the market, the FTSE 250 stalwart has just that. If it works for Buffett, it most certainly works for me.

Growth

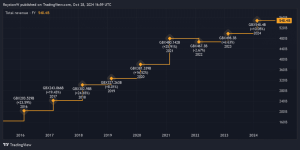

I also like to invest in businesses that show ambition. Even after posting impressive growth in the last decade, the management team of Games Workshop is showing zero intent of stopping here.

They’ve done a pretty good job at growing the core side of the business. Next on the agenda is the licensing side.

They’ve made good headway with that so far. Most recently, it announced a deal with Amazon that will see its Warhammer universe turned into a string of TV and film content. That will expose it to millions of new potential customers.

Passive income

I’ve also come to realise the importance of making passive income with my investments. With a dividend yield of 4.1%, the stock offers a higher payout than both the FTSE 100 and FTSE 250 averages.

Say I invested £10,000 in the stock today. That would earn me £410 a year in passive income a year. There are a few things I could do with that.

I could bank it and use it to pay my bills or treat myself. Or, and this is what I do, I could reinvest it back into buying more shares. By doing that, I’d benefit from ‘dividend compounding’.

Risks

There are risks. For example, it could experience a drop in sales during an economic downturn. That means its share price is prone to bouts of volatility. While it’s the leader in the space, I also think competition will ramp up in the years to come.

Buying more

Performing an exercise like this is a good way to audit my portfolio and focus on what sort of businesses are worth owning for the long term. And despite the risks, I’m bullish on the stock.

With that in mind, I’m keen to add to my position in Games Workshop. If I had the cash, I’d do it today.

This post was originally published on Motley Fool