Passive income is the holy grail for many of us. In fact, I see my Stocks and Shares ISA like a pension. I’m building it today by investing in some of the best growth-oriented stocks around, and one day — hopefully a long time before retirement age — I’ll start taking an income from it.

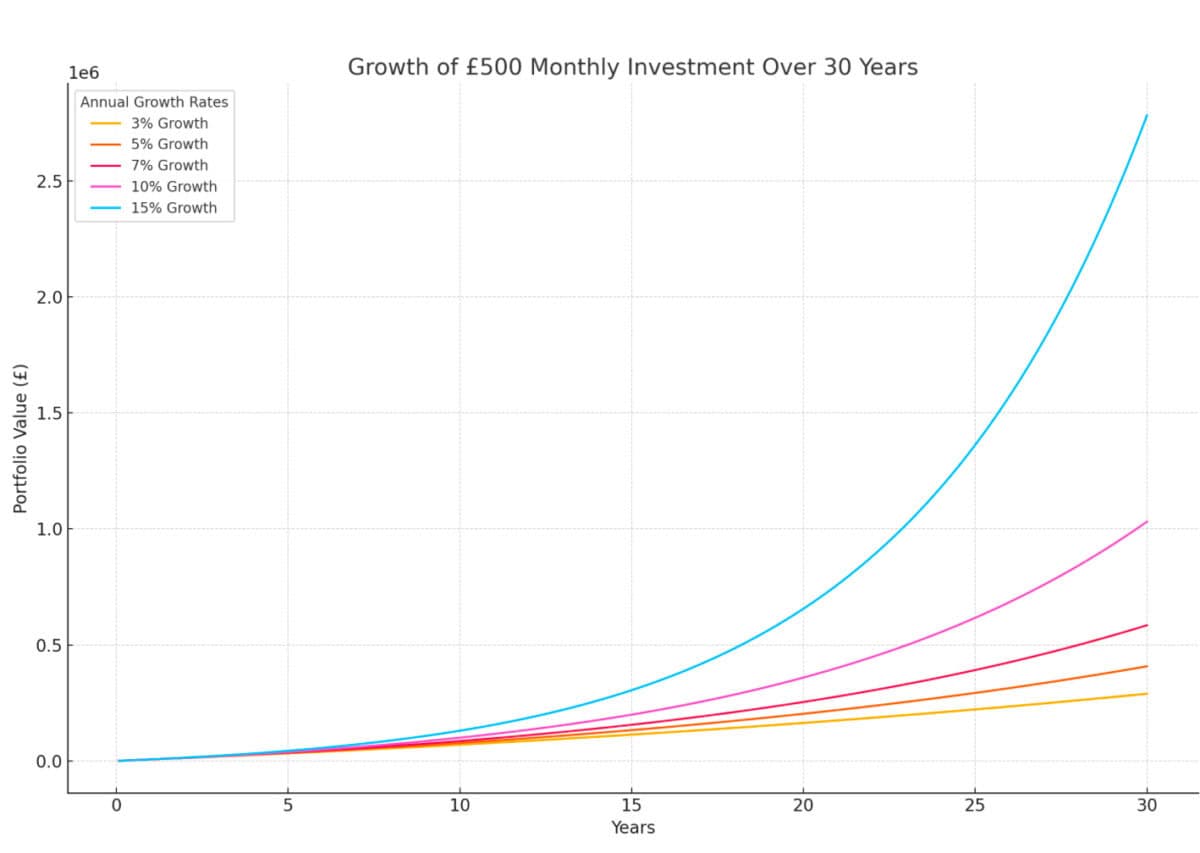

Want to see how investing for passive income works? Well, here’s how much an investor could generate by taking a long-term approach and reaping the benefits of compound returns.

Returns may vary

If a UK resident were to open a Stocks and Shares ISA today and start investing £500 a month in stocks, they’d need to accept that the growth of their investments is by no means guaranteed.

Stock markets are inherently volatile, with values fluctuating based on economic conditions, corporate performance, and global events. However, by making sensible investment decisions, individuals can increase their chances of achieving their financial goals over the long term.

On the other hand, if we invest in the wrong assets, we could be looking at negative returns. And if we lose 50% on an investment, we’ve got to go 100% to get back to where we were. That’s why billionaire investor Warren Buffett’s first rule is: “Don’t lose money”.

Here you can see how higher growth rates dramatically accelerate the portfolio’s value over 30 years, emphasising the importance of intelligent decision-making and compounding in long-term investing.

At the higher end of the above example, these investment — worth nearly £3m — could easily generate £150,000 in passive income annually. At the lower end, well, investors might have to settle for less than £15,000.

Investors could consider Celestica

So where could investors start? Well, one company to consider with attractive valuation metrics, strong momentum, and benefitting from supportive trends is Celestica (NYSE:CLS).

Celestica has emerged as a beneficiary of the ongoing revolution in artificial intelligence (AI) and the surging demand for high-performance hardware. The Toronto-based company specialises in manufacturing advanced computing systems, switches, and other critical components that power data centres — the backbone of AI infrastructure.

These supportive trends have been clearly reflected in sales, earnings, and the share price. In the last quarter, sales were up 22% year on year, earnings +60%, and the share price has surged more than 200% over 12 months.

The downsides? Just 10 customers represent more than two-thirds of sales. This introduces an element of concentration risk and it’s something worth bearing in mind.

However, investors will likely be buoyed by the earnings growth forecast — around 30% annually over the next three to five years. This growth expectation leads us to a price-to-earnings-to-growth (PEG) ratio of 0.88. That’s attractive by historical standards and exceptional in the current market.

This post was originally published on Motley Fool