Putting money into an ISA is a great way to build wealth. With no tax due on returns generated, one can really get ahead financially with these products.

Here, I’m going to look at how much money an investor could potentially have by 2030 if they put £700 a month into a Stocks and Shares ISA starting today. Let’s dive in.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

High returns available

From a wealth building perspective, a Stocks and Shares ISA is far more powerful than a Cash ISA. With the former, one can invest in funds, ETFs, and individual stocks – all of which can potentially generate gains in excess of 10% per year over the long run. With the latter, however, one can only earn interest on savings, meaning that returns are likely to be much lower. That’s why I’m focusing on the Stocks and Shares ISA here.

Now, the returns one can generate within an investment ISA can vary dramatically, depending on what they invest in. But if one is savvy, and constructs a proper investment portfolio, it’s not unreasonable to expect returns of around 8%-10% per year on average over the long run. There’s no guarantee that this kind of return will be achieved, of course, as the financial markets can be volatile at times. But history shows that over the long term, those with proper investment portfolios tend to do well.

Building a portfolio

What does a proper portfolio look like? Well, it depends on who you ask. For me, it consists of both funds and individual stocks. I see funds as a great portfolio foundation as they provide diversified exposure to the markets and ensure that one has the basic building blocks right. Meanwhile, I see stocks as a great way to juice things up and aim for higher returns.

Here’s an example. Let’s say an investor was just starting out today and wanted to build a great portfolio. For this investor, the Vanguard FTSE All-World UCITS ETF (LSE: VWRP) could be a great fund to consider as a core holding. With this ETF, the investor would get access to over 3,500 stocks from many different countries. So, the product could serve as a great portfolio foundation.

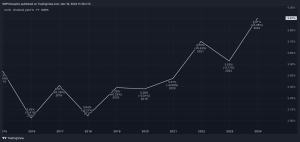

Over the last five years, this ETF has returned about 11% per year (ignoring platform fees). Now, past performance isn’t an indicator of future returns. If global stock markets experience a rough patch due to economic weakness or a ‘black swan’ event, this ETF is likely to underperform. As markets rise over time, however, this fund should provide solid returns.

So, let’s say the investor puts 80% of their money into this product. They could then spice things up by putting the remaining 20% into stocks that have the potential to beat the market. For example, they could buy some shares in Amazon. This stock has an incredible long-term track record – over the last 20 years, it has returned around 25% per year.

A decent amount of money

Going back to my original scenario, let’s say the investor puts £700 per month into a Stocks and Shares ISA and they’re able to generate a return of 10% per year on their money in the years ahead.

I calculate that by the end of 2030, they could have around £65,000. That’s a decent amount of money from just £700 a month.

This post was originally published on Motley Fool