The earliest an investment journey begins, the better. If a 30-year-old began making monthly contributions of a few hundred pounds in a Stocks and Shares ISA today, they could — by the time they hit State Pension retirement age — potentially get a seat on millionaire’s row.

This is thanks to the mathematical miracle of compounding. Making a return on past returns can, over decades, result in transformational wealth.

Let me show you how.

Sage words

Investing in shares, trust and funds can be a bumpy ride. As we’ve seen in recent days, stock markets can sharply reverse depending on geopolitical and maroeconomic conditions.

In this case, share prices have dropped amid fears of growth-crushing trade tariffs between the US and its major trading partners, and the potential impact of these import taxes in fuelling inflation.

Yet it’s also important to remember that, over the long term, share prices tend to recover and grow, rewarding patient investors who stay the course.

I’m reminded of billionaire investor Warren Buffett‘s wise words on the stock market’s remarkable bouncebackability. The so-called ‘Sage of Omaha’ once pointed out that:

In the 20th century, the United States endured two world wars and other traumatic and expensive military conflicts; the Depression; a dozen or so recessions and financial panics; oil shocks; a flu epidemic; and the resignation of a disgraced president. Yet the Dow rose from 66 to 11,497.

Today, the Dow Jones sits around 41,453 points.

A £1.6m pension pot

This is a perfect example of how investing with a long-term approach can pay off.

Since its inception in 1957, the S&P 500 has also delivered mighty shareholder profits. Its average annual return is an impressive 10.2%. If this continues, a 30-year-old regularly investing in the index in a Stocks and Shares ISA could build a life-changing retirement fund.

Let’s say they invest £300 each month between now and their State Pension age of 68. Thanks to the wealth-building power of compounding — and the tax-saving qualities of the ISA — they’d have generated a whopping £1,639,317 to retire on (excluding broker fees).

Remember though, that 10.2% return I’ve described isn’t guaranteed.

Taking the simple route

By creating a diversified portfolio, our investor could stand a much better chance of retiring with a substantial nestegg. Purchasing shares across a variety of industries, sub-sectors and geographies can help them mitigate risk and capitalise on many different investment opportunities.

To target that 10.2% average annual return simply, our 30-year-old could choose to buy an exchange-traded fund (ETF) that tracks the performance of the S&P. The HSBC S&P 500 (LSE:HSPX) is the one I hold in my own portfolio.

With its ongoing charge of 0.09%, it’s one of the most cost-effective index-tracking funds out there.

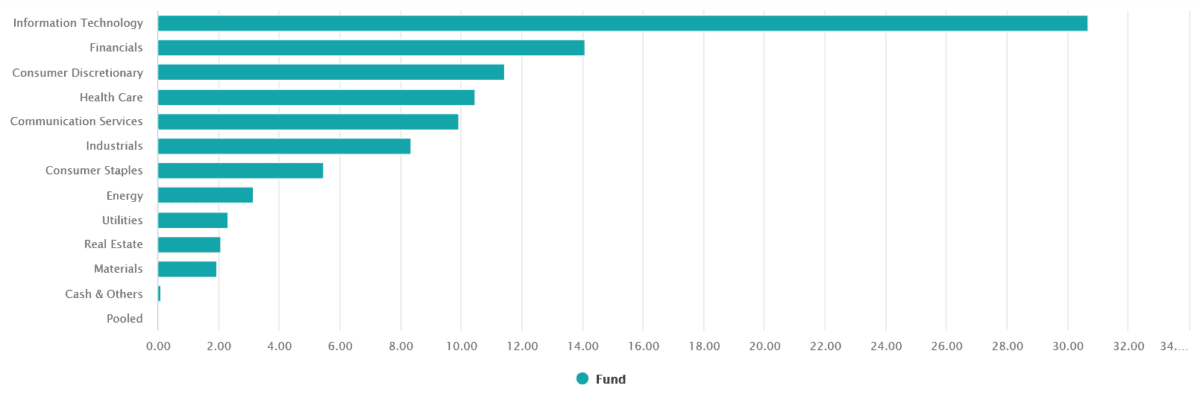

As you can see from the breakdown, the fund allows investors to effectively diversify across a range of sectors. And with tech shares like Nvidia, Microsoft and Apple making up a large portion of the fund, it also has significant long-term growth potential as the digital revolution rolls on.

The fund could face headwinds if sentiment towards US shares as a whole weakens. But overall, I think it’s a great one to consider as a way for investors to aim for a large retirement pot.

This post was originally published on Motley Fool