When Warren Buffett is looking for investments to buy for his portfolio, the master investor searches for companies that exhibit several qualities.

High-quality companies

The most important quality he is looking for is what he has frequently referred to as an economic moat around the business.

5 Stocks For Trying To Build Wealth After 50

Markets around the world are reeling from the coronavirus pandemic… and with so many great companies trading at what look to be ‘discount-bin’ prices, now could be the time for savvy investors to snap up some potential bargains.

But whether you’re a newbie investor or a seasoned pro, deciding which stocks to add to your shopping list can be a daunting prospect during such unprecedented times.

Fortunately, The Motley Fool UK analyst team have short-listed five companies that they believe STILL boast significant long-term growth prospects despite the global upheaval…

We’re sharing the names in a special FREE investing report that you can download today. And if you’re 50 or over, we believe these stocks could be a great fit for any well-diversified portfolio.

In simple terms, this means the business must have a competitive advantage. An advantage that helps it earn and maintain higher profit margins than the competition. This means it can generate fatter returns for its shareholders and return more money to investors.

As well as these qualities, Buffett is looking for businesses that are well managed and have plenty of room for growth over the next decade.

Unfortunately, the number of companies that meet his criteria are few and far between. This is why he rarely trades in and out of positions and sticks with stock holdings for decades.

The billionaire investor also rarely invests outside his home market. With the largest equity market in the world, Buffett does not really need to invest outside the US, although he has been expanding his international footprint in recent years.

Still, even though he rarely invests outside of the US, that does not mean we cannot replicate his strategy in the UK. As such, here are three UK shares with Buffett-like qualities I would buy for my portfolio today.

Top UK shares

Focusrite is a global music and audio products group that develops and markets proprietary hardware and software products. These products are incredibly specialist because artists rely on their hardware and software to produce good content. This gives the company a competitive advantage.

Artists are not likely to choose a cheaper product as it may impact quality, which could affect the listener experience. That is why I believe this is the sort of outfit Buffett would like to own. What’s more, as the music industry expands, it has tremendous potential.

All of these types of companies exhibit Buffett qualities, but I think it would be a mistake to say that their growth can be taken for granted. Each one faces a unique set of challenges. Rising prices and competitive forces are just two factors. Even though they exhibit attractive qualities, they need to keep investing in growth to stay ahead of the competition.

Renishaw also appears to exhibit the sort of qualities Buffett would like to see in a corporation. The business helps manufacture precision instruments for the engineering and health care sectors. These instruments are highly accurate, and customers will not skimp on the cost.

As one of the largest manufacturers in Europe producing these kinds of components, the company has a substantial competitive advantage and, like Focusrite, it seems unlikely customers will move elsewhere.

Warren Buffett stock

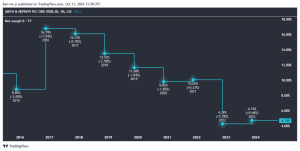

Finally, I think A.G. Barr exhibits the sort of qualities the billionaire is looking for in an investment. The owner of the Irn-Bru brand has similar attributes to Buffett’s most famous investment, Coca-Cola, although its international footprint is significantly smaller.

Despite this drawback, I believe this is one of the best UK shares to buy with Buffett-like qualities today. I think it would make a perfect addition to my portfolio, alongside the businesses above.

5 Stocks For Trying To Build Wealth After 50

Markets around the world are reeling from the coronavirus pandemic…

And with so many great companies still trading at what look to be ‘discount-bin’ prices, now could be the time for savvy investors to snap up some potential bargains.

But whether you’re a newbie investor or a seasoned pro, deciding which stocks to add to your shopping list can be a daunting prospect during such unprecedented times.

Fortunately, The Motley Fool is here to help: our UK Chief Investment Officer and his analyst team have short-listed five companies that they believe STILL boast significant long-term growth prospects despite the global lock-down…

You see, here at The Motley Fool we don’t believe “over-trading” is the right path to financial freedom in retirement; instead, we advocate buying and holding (for AT LEAST three to five years) 15 or more quality companies, with shareholder-focused management teams at the helm.

That’s why we’re sharing the names of all five of these companies in a special investing report that you can download today for FREE. If you’re 50 or over, we believe these stocks could be a great fit for any well-diversified portfolio, and that you can consider building a position in all five right away.

Click here to claim your free copy of this special investing report now!

Rupert Hargreaves has no position in any of the shares mentioned. The Motley Fool UK has recommended AG Barr, Focusrite, and Renishaw. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

This post was originally published on Motley Fool