Shares in InterConintental Hotels Group (LSE:IHG) aren’t an obvious choice for income investors. A 1.6% dividend yield and an inconsistent record don’t exactly jump off the page.

I think this is a missed opportunity. The FTSE 100 isn’t exactly short of quality dividend stocks, but I think InterContinental Hotels Group might be as good as any.

Dividends

InterContinental Hotels isn’t a Dividend Aristocrat and it won’t be one for a long time. The company has lowered its dividend five times in the last 20 years, most recently in 2020.

Despite a patchy recent history, there are a few things investors should note. The first is that the company actually has a very good record over the long term.

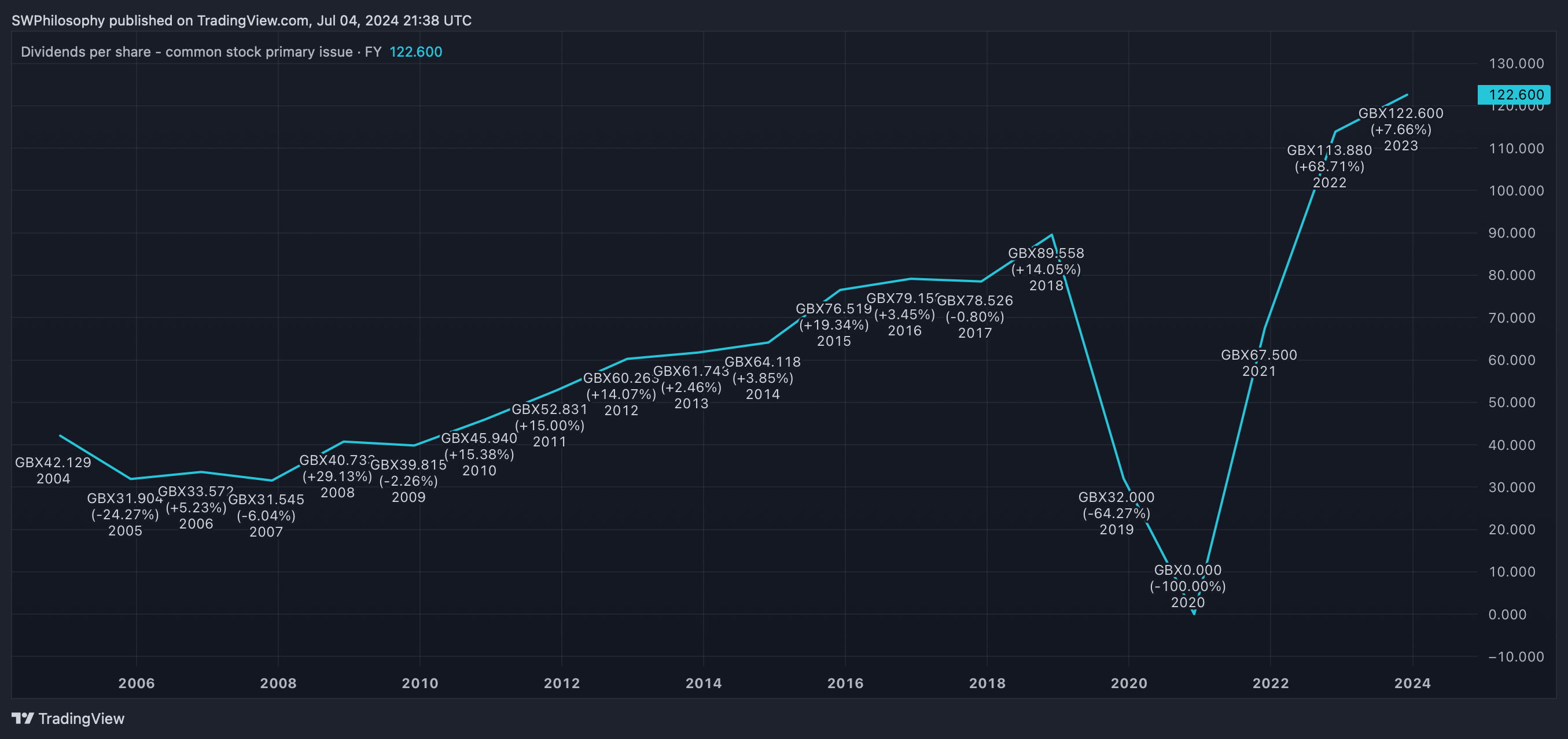

InterContinental Hotels Group dividend per share 2004-24

Created at TradingView

Investors who bought the stock in 2004 and stayed the course to the present day have gone from receiving 42p per share to £1.23. That’s an average annual increase of 5.5%.

Furthermore, the company’s rebounded strongly from the Covid-19 pandemic and its dividend’s currently at record levels. And there’s reason to think it might stay there.

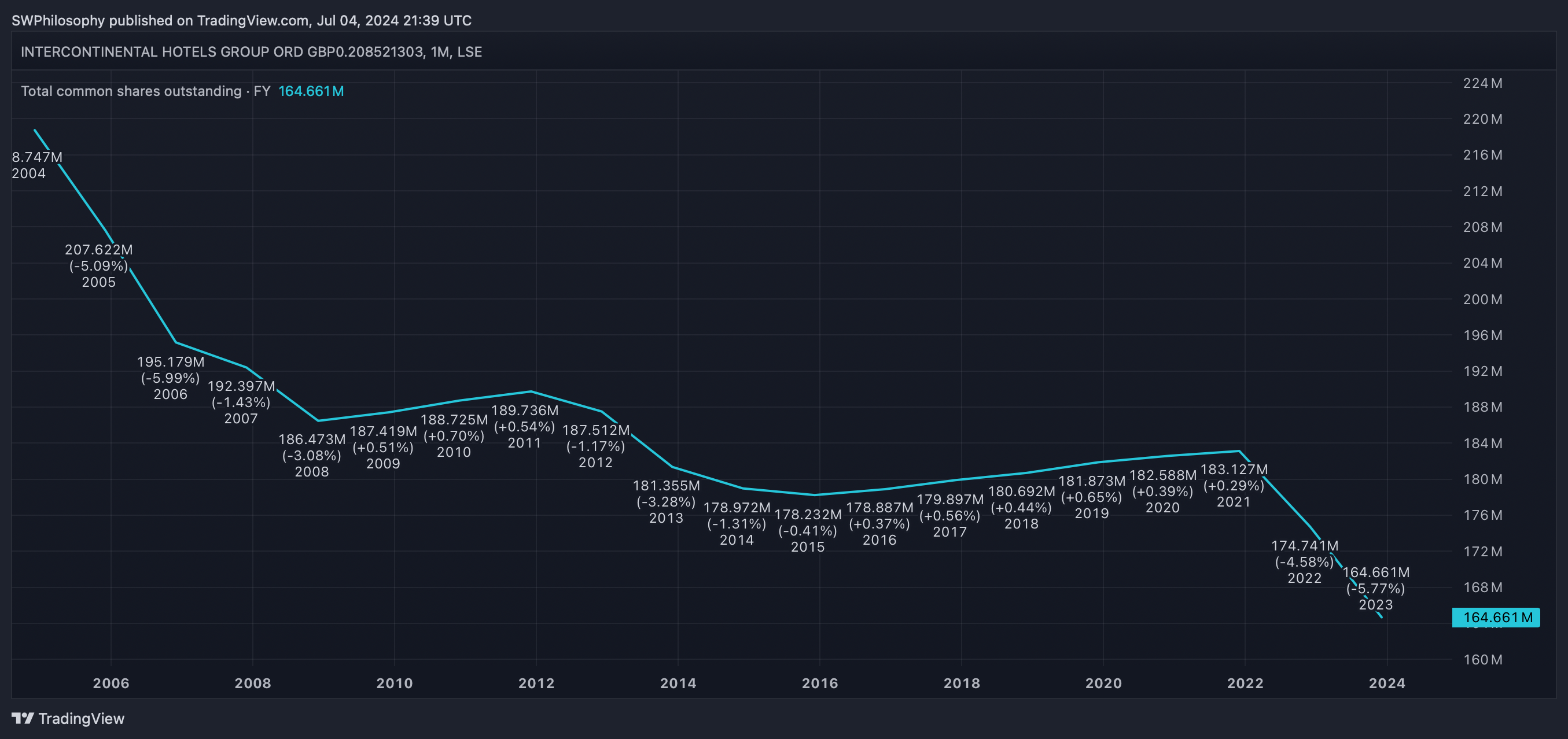

InterContinental Hotels Group shares outstanding 2004-24

Created at TradingView

The company’s been steadily reducing its share count using share buybacks. As a result, there are fewer InterContinental shares outstanding than at any point in the last 20 years.

Put simply, fewer shares overall means more of the total cash distributed by the business for each shareholder. So a record low share count makes the dividend much easier to maintain.

A magnificent company

InterContinental’s impressive dividend growth’s been due to the strength of the underlying business. And the key to this is the company’s franchise model.

The firm doesn’t own the hotels in its network. Instead, it provides marketing, booking and technology support in exchange for a fixed fee and a percentage of the hotel’s revenues.

This means InterContinental avoids virtually all of the costs associated with running hotels. These include maintaining buildings, employing staff and paying energy bills.

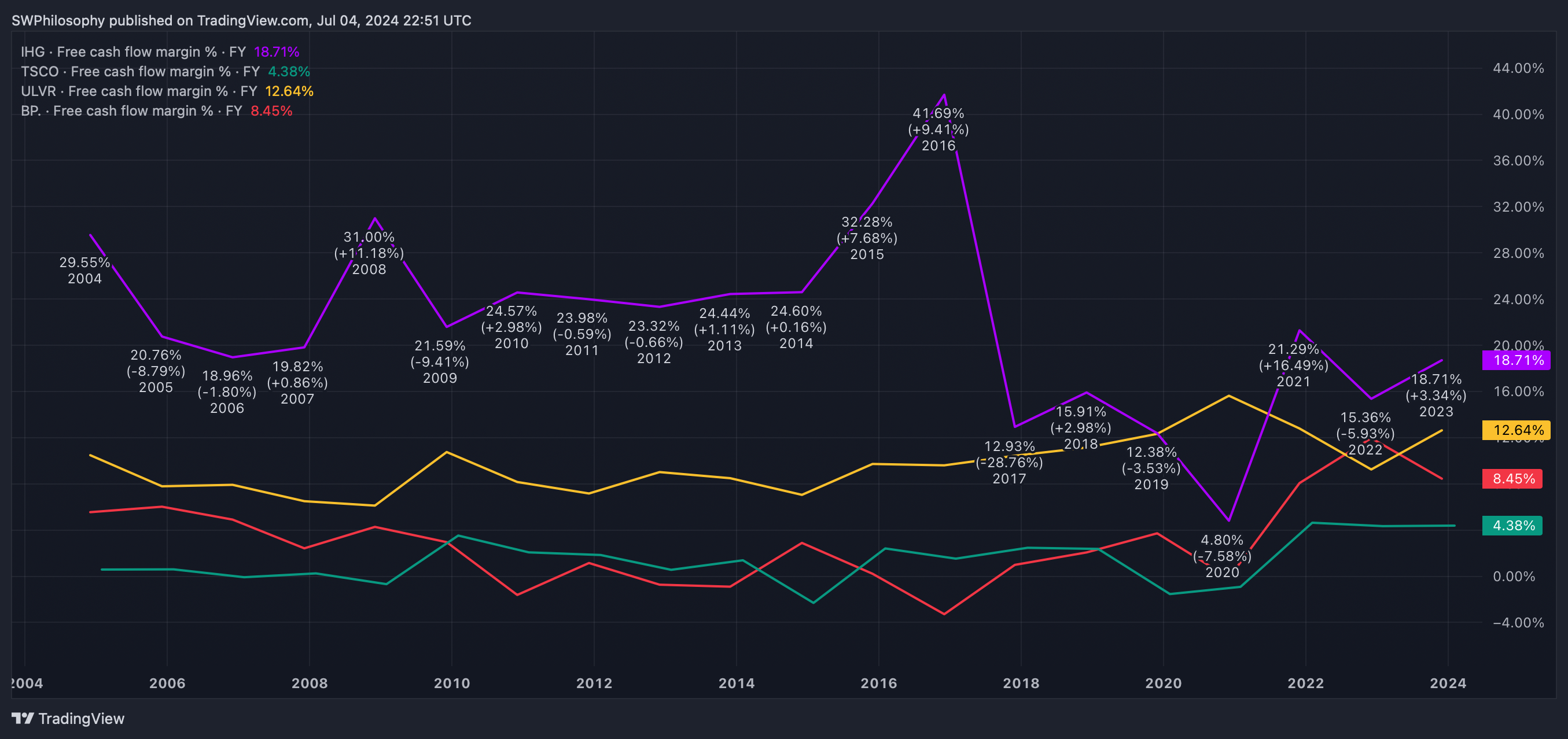

As a result, the company’s extremely efficient at generating cash. This shows up in its free cash flow margin, which is consistently higher than the likes of BP, Tesco, and Unilever.

InterContinental Hotels Group free cash flow margin 2004-24

Created at TradingView

The stock trades at a price-to-earnings (P/E) ratio of 24, which is expensive with interest rates at 5.25%. This is a risk and investors need to consider whether or not it’s worth it.

I think it is. I expect the company’s cash-generating ability to allow it to keep bringing down its share count and increasing its profits – as it’s done for the past two decades.

That second income

A £1,000 second income from InterContinental Hotels Group would require 819 shares. That would cost £68,000, which is beyond me right now but might be achievable with time.

Investing £1,000 a month would bring me to this level in around five years. And I could reinvest the dividends I receive along the way to get me to this target more quickly.

InterContinental Hotels Group shares are expensive. But the bottom line is that I’d rather own a small amount of an exceptional business than a larger share of an ordinary one.

This post was originally published on Motley Fool