When I look at the London stock market today, what I see mostly is a potential passive income gold mine.

The Footsie is packed full of companies that generate bags of cash. And, for some reason, the market often has them on much lower valuations than similar US-listed stocks.

Some great high-yield stocks have risen in price over the past year. And that means they’re not such big bargains as they might have been a year ago.

But if a stock is only very cheap today, rather than stupidly cheap last year? In my books, that’s still a great reason to consider buying.

Long-term favourite

Today I’m looking at one of my top long-term holdings. It’s the the largest multi-line insurance company in the UK, Aviva (LSE: AV.).

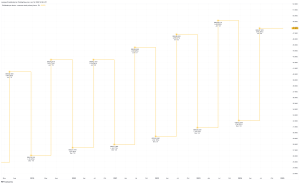

And just look at the chart below to see how the stock has come back in the past 12 months.

Even after that ride though, the forecast dividend yield is still up at 6.8%.

Even if the share price doesn’t gain another penny, that dividend alone should be enough to come close to the UK stock market’s long-term annual returns.

Now, that does bring up the first risk we have to face with an investment like this. Unlike Cash ISA interest, share dividends are not guaranteed.

Should something bad happen, that hoped-for 6.8% yield could evaporate. Remember the financial crash of 2008, and then the pandemic crash of 2020? We won’t forget them in a hurry.

In the clear yet?

Though the financial sector has made leaps and bounds this year, the UK economy is very much not out of the woods. Interest rates are still high, and inflation blipped back up a bit in July to 2.2%.

Aviva is in a volatile, cyclical, business too. So I would absolutely expect ups and downs over the years, more so than the market in general.

But I’ve been following the insurance sector for decades now, and buying and holding shares. To my mind, it’s possibly one of the best businesses to be in for long-term passive income. But investors do need to expect short-term dry spells sometimes.

For anyone with a similar outlook to me, I really think Aviva is worth considering.

How much?

So, we have a 6.8% dividend yield. And I want to pocket £1,000 a year. For that, I’d need a pot of £14,700. On the share price as I’m writing, that’s 2,941 Aviva shares.

I don’t have that many yet, but I’m getting there. And if I keep reinvesting the dividends I get from that fat yield each year into new shares, I don’t think I’ll be far away.

Now, £1,000 per year isn’t a lot. But it’s only one stock in my passive income portfolio. To cope with possible future sector problems, I make diversification a key priority.

And I won’t need that many different stocks earning £1,000 per year to add a tidy little sum to my pension plans.

This post was originally published on Motley Fool