Billions. That’s probably the right word to use when talking about Glencore (LSE: GLEN). The mining firm saw £175.4bn in revenue from sales of metals and other natural resources last year. Earnings came in at £9.3bn and of that, £3.4bn was paid out to shareholders as dividends. Those many, many billions are why I and many others see Glencore shares as a good dividend stock for passive income.

Chunky

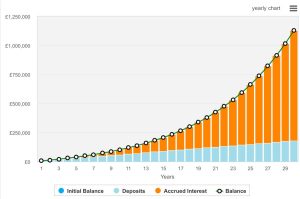

One useful way to target a passive income is to break it down into small chunks. One of those chunks could be a £1,000 a year payout.

That’s not much in the grand scheme of things. I’m hardly retiring on about three quid a day. But if I can target that amount from a single stock then I can be one step closer to retiring with an income stream that will mean less worry about bills or whatever the government is doing with the triple lock.

So is Glencore the right stock to be aiming for this income? A lot of people might say no. The dividend yield currently stands at 2.58%. I could get a much higher yield from dozens of other FTSE 100 stocks and that shows in the lump sum needed to hit my goal.

A £1,000 yearly passive income would require a £38,760 stake or 10,204 shares on the price as I write. Such a hefty outlay might have most folks looking elsewhere.

But mining is a cyclical industry. Revenues and profits ebb and flow with the demand for natural resources and other factors. That yield is as low as it’s been for years. It was over 8% only 12 months ago.

Reasonable

So rather than looking at the yield in any one year or another, I’m looking at the company to give me a consistent payout. If Glencore can pay a 5% dividend over the long term, and its track record suggests it can, then my £1,000 target would need a £20,000 stake. Much more reasonable.

And that figure may come down depending on future demand for metals. The International Monetary Fund has said that clean energy may require “unprecedented metals demand in coming decades” and highlights the importance of metals like nickel, cobalt, copper and zinc.

What are Glencore’s four most important metals (as listed on its own web page)? Well, it’s nickel, cobalt, copper and zinc.

In terms of risks, the company does have a spotty history with breaking the law. Only in 2022, Glencore pleaded guilty to bribery and seven counts of it.

I wouldn’t blame anyone who wants to steer clear of a company that had to pay a £280m fine because some of its representatives got into the habit of sliding money under the table.

On the whole though, I see a bright future for the firm and its passive income potential. This is why I hold the stock myself.

This post was originally published on Motley Fool