There are several tactics investors can use to earn a chunky second income. But one of the easiest is to snap up dividend shares while they’re cheap. After all, when dividends are high and prices are low, the yields can be mouth-watering.

Looking at the FTSE 100 today, there are still plenty of companies that fit this bill, especially in the real estate sector. Publically traded landlords are often priced based on the market value of their properties. And with interest rates sending market prices into the gutter, many of these businesses have seen their valuation slashed.

That includes Londonmetric Property (LSE:LMP) which, despite market conditions, has continued to hike dividends for nine years in a row.

Big yields, small prices

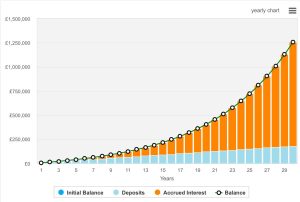

With the shares trading near 200p and dividends at 10.65p, investors in Londonmetric are currently reaping a market-beating 5.2% yield. So if I were to buy 10,000 shares right now, I could immediately unlock a passive income of £1,065 just from dividends. And given that would only cost around £20,000 it’s a relatively cheap bargain compared to other FTSE 100 stocks.

Of course, when it comes to investing in high yields, there are always risks to consider. Most crucially is whether this business can maintain its chunky payouts. After all, there’s nothing worse than investing in a company for dividends only to see it get cut shortly afterwards. Apart from the lost income, such an announcement would also likely send shares plummeting.

Sustainability of income

Real estate’s a diverse sector, and Londonmetric also has quite a diverse portfolio of property types. The bulk is concentrated in logistics warehouses. However, following the recent merger with LXi, the firm’s also gained exposure to theme parks (including Thorpe Park, Alton Towers, and Warwick Castle), hospitals, and convenience stores.

Needless to say, that’s quite a diverse list of assets. But more importantly, they’re all likely to remain in demand for decades to come, improving long-term cash flow reliability. That’s evident by the group’s current 99% occupancy. And this factor’s also supported by management’s focus on finding large-scale tenants who are far less likely to miss rental payments.

In fact, this reliability is precisely how Londonmetric has been able to keep growing its dividends even in the recent economic turmoil.

Risks to consider

The firm has a lot of desirable traits for investors seeking to build a second income. But it’s far from a risk-free enterprise. As previously mentioned, the merger with LXi significantly expanded the group’s property portfolio. But it also means management’s overseeing properties in sectors in which it previously had very little to no experience.

Mismanagement of these assets could compromise growth or worse, dividends. Meanwhile, the firm’s holding a pretty chunky pile of debt and equivalents worth just over £2.1bn. This leverage isn’t breaking the balance sheet, but with more cash flow dedicated to interest rate payments, that leaves less available to fund growth, potentially creating opportunities for competitors.

Regardless, with interest rates already starting to fall, I’m cautiously optimistic about the long-term income-generating capabilities of this business. That’s why I’ve already begun building up a position in my passive income portfolio.

This post was originally published on Motley Fool