As an avid follower of the UK retail sector, I’ve had my eye on the Next (LSE:NXT) share price for quite some time. This high street stalwart has been deftly outperforming many of its peers, yet I can’t help but feel its share price still doesn’t quite reflect its true value. Let me share why I believe Next’s stock could be poised for a move higher.

Steady growth

First off, let’s talk numbers. The company has been delivering the goods when it comes to financial performance. With earnings growth of 12.7% over the past year, the company is showing it knows how to keep the tills ringing even in challenging times. And the future looks bright too, with analysts projecting earnings to grow steadily by 1.91% annually. In the world of fashion retail, where many companies are struggling to keep their heads above water, the company is comfortably swimming.

But here’s where it gets really interesting. Despite this stellar performance, the shares are currently trading at about 14.8% below what’s considered a fair value, at least according to a discounted cash flow (DCF) calculation.

Now, let’s put the company’s performance in context. Over the past year, the Next share price has surged by 25.2%. That’s compared to the broader FTSE 100 that managed only a 6.1% gain over the same period.

Staying flexible

So what’s driving this success? Well, management has shown it’s not afraid to adapt when required. While many retailers have struggled with the shift to online shopping, the firm embraced it very early on. It’s managed to strike a balance between physical stores and building a meaningful online presence, creating a seamless shopping experience that keeps customers coming back.

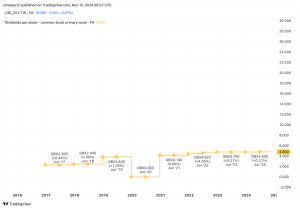

But it’s not just about growth. Management is also taking care of shareholders. The company has been aggressively buying back the stock, with authorisation to repurchase up to 19,056,000 shares, representing 14.99% of its issued share capital. Such a move can boost the value of the remaining shares, and suggest to the market that those in charge think the price is trading at a discount. There’s also a decent dividend, at a current yield of 2.4%. With a payout ratio of 31%, there’s plenty of room for that dividend to grow in the future.

Risks remain

Of course, no investment is without risk. The business does carry a significant £890m of debt, which could limit its financial flexibility. And let’s not forget the retail sector (especially fashion) is as cutthroat as they come, with consumer preferences changing quickly. There’s also the broader economic picture to consider — as a retailer, the company’s fortunes are tied to consumer spending, which can be fickle in good times as well as uncertain times.

Solid potential

But even with these risks, I believe the potential outweighs the challenges. It’s proved its ability to adapt and thrive in a tough environment. Its strong brand, diversified product range, and successful online strategy provide a solid foundation for future growth.

In my view, the market hasn’t fully recognised Next’s strengths. While the share price has performed well, I believe there’s still room for it to climb. And for those seeking opportunities, Next might just be worth a closer look. After all, in the world of investing, sometimes the best bargains are hiding in plain sight.

This post was originally published on Motley Fool