I decided to have a bit of fun with ChatGPT and asked what it thought of the worst-performing UK stock in my portfolio.

The company is FTSE 250-listed luxury car maker Aston Martin (LSE: AML). Yes, yes, I know, only an idiot would buy that. But last September, I decided its shares had fallen so far there was surely a chance of making money.

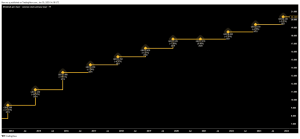

Instead, I’m staring at a 35% paper loss — but I suppose it could be worse. Over 12 months, the Aston Martin share price has plunged 45%. Over five years, it’s collapsed 96%.

So I asked my AI chatbot buddy for its view on what is thankfully my worst share purchase (although Ocado Group might have something to say about that).

The Aston Martin share price is a car crash

My question was: Exactly how stupid was I? Happily, my boon robot companion was programmed to be polite and replied: “You weren’t necessarily stupid to invest in Aston Martin, but you did take on significant risk in a company with a volatile history“.

Personally, I think stupidity does come into it. At least I only invested the scrapings of my cash account, rather than a larger sum.

My assumption that Aston Martin was through the worst wasn’t entirely unreasonable, I was happy to hear. “The problem is that a falling stock doesn’t necessarily mean it’s undervalued. Sometimes, it’s a warning sign of deeper, ongoing issues”, ChatGPT said.

It noted that the stock was floated in 2018 at a wildly optimistic valuation of £19 per share. The reality has been brutal, with the shares down to £1.05.

ChatGPT noted that Aston Martin has a history of high debt and poor cash flow, forcing multiple equity raises that diluted shareholders and made recovery harder. “Even after securing backing from investors like Mercedes-Benz and executive chairman Lawrence Stroll, the company still struggles to turn a consistent profit”, it added.

Aston Martin may have an iconic brand but competes against Ferrari, “which operates with higher margins and a more stable financial model“.

Happily, there are reasons for optimism. “Aston Martin has been refreshing its lineup, and the brand’s Formula 1 presence helps keep it relevant. If its new models sell well, revenue could improve.”

This FTSE 250 stock is driving me to drink

If Aston Martin can drive efficiencies and profitability, it could turn a corner (I see what you did there, ChatGPT). Or it could be acquired by a larger automaker or investor looking for a turnaround project.

But ChatGPT had concerns too, warning the group’s £1.3bn net debt limits growth opportunities, especially with interest rates high. The luxury market also continues to struggle.

Overall, ChatGPT isn’t convinced, concluding: “The stock remains highly speculative, and its future depends on execution and external conditions”.

Personally, I would have been harder on myself. I was dazzled by the brand and, worse, by the shallow notion that the shares could snap back and hand me a quick profit.

Most of my portfolio is in solid FTSE 100 blue chips, so maybe I was due a bit of rash fun. I’ll hold onto the shares but won’t take this kind of punt again. It’s making my portfolio look messy and me feel like a chump. Even if ChatGPT is too polite to say.

This post was originally published on Motley Fool