Investing in growth shares can be a great way to build wealth. Just ask anyone who has been invested in Apple over the last 10 years (it’s soared).

Recently, I asked ChatGPT to list five growth shares that could make me a lot of money between now and 2030. Here’s a look at the names it gave me.

ChatGPT’s growth picks

ChatGPT told me that identifying high-growth stocks involves looking for companies with strong fundamentals, growth potential, and innovation. That’s a fair statement.

It added that before making any investment decisions, it’s crucial to conduct thorough research and consider financial goals and risk tolerance. That also makes sense.

As for the five growth stocks it gave me, they were:

- Nvidia – ChatGPT expects the stock to keep performing due to the high level of demand for its AI chips

- Amazon (NASDAQ: AMZN) – It’s relentless innovation and diversified business model position it for continued growth, according to ChatGPT

- Shopify – ChatGPT believes it will benefit from the growth of the e-commerce industry

- Airbnb – With its scalable platform, Airbnb’s well-positioned for long-term growth

- First Solar – It sees this solar power company as a good play on the renewable energy industry

I already own three!

It’s an interesting list of stocks. What’s funny is that I already own three of them. Currently, Amazon is my largest individual stock holding. This is a company I’m really excited about.

Today, Amazon operates in a wide range of growth industries including e-commerce, cloud computing, AI, semiconductors, video streaming, digital advertising, digital healthcare, and self-driving cars. So I’d be very surprised if it didn’t make me money over the next half-decade.

There are no guarantees it will, of course. If we see a major economic collapse in the next five years, Amazon’s growth could stall and its share price could fall. I’m optimistic that its revenues and earnings (and share price) will be significantly higher by 2030 however. That’s why I’ve gone all in on it.

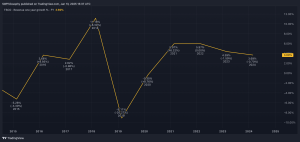

The other two stocks I currently own are Nvidia and Shopify. Nvidia’s one of my largest holdings because it has recently shot up. I continue to believe it has substantial growth potential due to the fact it’s the leader in the AI chip space. Shopify’s a smaller position for me as I view it as more speculative. I expect this company to do well on the back of the e-commerce boom but I see it as higher risk due to the fact its profits are still quite small.

I’ll point out that I used to own Airbnb stock. I sold it recently after deciding that government regulation could be a challenge for the company in the years ahead.

As for First Solar, which specialises in solar technology, it’s an interesting idea. However, the outlook for renewable energy companies looks a bit murky to me now that Donald Trump’s going to be US President.

I was hoping for more

Overall, I think ChatGPT’s investment ideas were reasonable. I believe three out of the five stocks have a lot of potential.

I’m a little disappointed that the app didn’t list some really exciting new ideas for me though. I was hoping to learn about some obscure growth company capable of generating huge wealth for me over the next five years.

This post was originally published on Motley Fool