Passive income’s often seen as the holy grail of investing. And for good reason. For an investor, the idea of £1,999 landing in their bank account every month without active effort is undeniably appealing.

With a Stocks and Shares ISA, this goal becomes much more achievable, provided the investor’s willing to embrace a long-term strategy and let compound returns do the heavy lifting.

The appeal of a Stocks and Shares ISA

A Stocks and Shares ISA is one of the most tax-efficient ways to grow wealth in the UK. Unlike a Cash ISA, which typically offers minimal returns, a Stocks and Shares ISA allows investments in equities, funds, and other assets that have historically delivered far superior returns.

Over the past decade, the average annual return for a Stocks and Shares ISA has been around 9.64%. This kind of growth can transform a modest investment into a reliable source of passive income.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Running the numbers

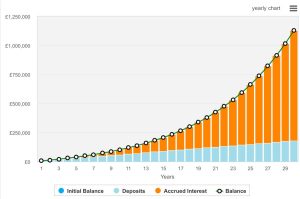

To generate £1,999 a month — or £23,988 a year — an investor would need a portfolio of roughly £479,760. This assumes a dividend yield of 5%. While this is a significant sum, it’s not an unattainable goal. With consistent monthly contributions, reinvested dividends, and time, even smaller portfolios can grow to this size.

For instance, starting with £20,000 and contributing £250 a month, it would take around 24.5 years to reach £479,760, assuming a 9.64% annual return. The earlier the investor starts, the less they’ll need to save each month, thanks to the power of compound interest.

Building the portfolio

The key to success lies in patience and discipline. An investor should focus on building a diversified portfolio of quality stocks, exchange-traded funds (ETFs), or funds that align with their risk tolerance. While £479,760 might seem daunting initially, it’s important to remember that every investment journey begins with a single step.

Starting small, staying consistent, and allowing time and compounding to work their magic can make this goal a reality.

However, many novice investors lose money. That’s because they chase quick gains and don’t diversify. With that in mind, novice investors may want to consider a diversified trust like The Monks Investment Trust (LSE:MNKS).

This trust, managed by Baillie Gifford, focuses on long-term capital growth through a diversified global equity portfolio of growth stocks. It targets innovative businesses addressing specific challenges, aiming to reduce costs or improve service quality. Over the past decade, the trust has delivered strong returns, with a 10-year share price total return of 200.4% and a net asset value (NAV) growth of 186.5%.

However, like all investments, it carries risks. One significant risk is gearing (or leverage) — the trust borrows money to make further investments, which can amplify losses if the value of those investments falls. This leverage increases the potential for volatility and capital erosion, particularly during market downturns.

Despite this, the trust’s patient, growth-oriented approach has historically rewarded long-term investors. Nonetheless, I’ve added this one to my daughter’s Self-Invested Personal Pension (SIPP).

This post was originally published on Motley Fool