Millions of us in the UK invest through a Stocks and Shares ISA. The main advantage to this is that we don’t pay tax when we sell shares for a profit and we don’t pay tax on any dividends we receive. This means the Stocks and Shares ISA is an excellent vehicle for creating a passive income stream, possibly one to complement a pension or retirement fund.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

The passive income formula

At its core, the passive income formula focuses on maximising tax-free returns from dividends and capital growth. With an annual ISA contribution allowance of £20,000, investing in dividend-paying stocks or funds can generate a steady income stream.

For example, a portfolio with an average dividend yield of 4% could produce £800 annually — completely tax-free. Reinvesting these dividends or investing in growth-oriented companies accelerates growth through compounding, a key driver of long-term wealth.

Capital growth adds another dimension. Diversified investments in stocks or funds have historically delivered average annual returns of 6-8%, depending on market conditions. This combination of regular dividends and appreciation makes the Stocks and Shares ISA an effective tool for building a passive income stream, particularly over the long term.

Moreover, discipline, diversification, and regular reviews ensure the formula works to its fullest potential.

Making the figures add up

In order to earn £2,000 a month in dividends, an investor would need £600,000 invested in stocks averaging a 4% dividend yield. However, a higher dividend yield would allow an investor to achieve the same passive income with a smaller portfolio — for example, 5% yield at £500,000 would generate £25,000 annually.

Of course, many Britons may say “well, I don’t have £500,000”. But the answer lies in compounding and starting early. If an investor were to start with £5,000 today, and contribute £500 a month for 22 years, achieving 10% annualised growth, they’d have more than £500,000 at the end of the period.

However, to achieve 10% annualised growth, an investor must make wise investment decisions. Poor decisions can result in investors losing money.

Dividends can rise

There’s another angle too, and perhaps one that I sometimes neglect. Many investors are keen to invest in Dividend Aristocrats. These are stocks with a track record for increasing their dividend yield.

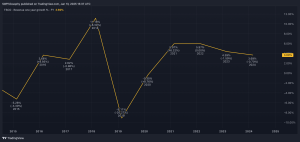

A well-known UK Dividend Aristocrat is Diageo (LSE:DGE). Diageo, a global leader in alcoholic beverages, has a strong track record of consistently increasing its dividends. The company owns iconic brands such as Johnnie Walker, Guinness, and Tanqueray, which contribute to its steady revenue and profit growth.

While Diageo’s current dividend yield stands at 3.3%, its track record of consistent dividend growth makes it a compelling long-term investment. Over the past decade, the company has steadily increased payouts, reflecting its resilience and commitment to shareholders.

This growth can significantly enhance returns over time, particularly when dividends are reinvested to compound gains. For example, a modest yield today could effectively double in 10 years if Diageo maintains its historical growth rate. As such, the effective yield for an investment today would be 6.5% in a decade’s time.

However, it’s worth bearing in mind that changes in alcohol consumption, especially among younger generations, presents a risk to Diageo’s long-term prospects. The company has moved towards prioritising more premium brands in recent years, reflecting consumer demand shifts.

It’s not a stock that I hold, but I think it’s worth considering.

This post was originally published on Motley Fool