Having a lot of cash to invest isn’t the most important thing when it comes to passive income. Being able to invest regularly for a long time is a much bigger advantage.

The average price of a pint in London is £6.75. With enough time, investors looking for extra income could generate a meaningful return with less than half of that each day.

What can a £3 habit achieve?

Over 30 years, investing £91 a month – the equivalent of £3 a day – can earn significant passive income. And reinvesting the returns can provide a big boost to this.

Exactly how much depends on the average return over that time. At an average 5% a year, £3 a day results in £3,524 after 30 years.

At 7%, the returns are dramatically higher. Investing £91 a month at that rate generates £6,971 a year – or £580 a month – in passive income.

That’s the same as I’d get if I invested £14,000 today at 7% and reinvested the returns for 30 years. So over three decades, £3 a day could be the equivalent of £14,000 today.

Dividend stocks

I think the best place to look for passive income opportunities is dividend stocks. These are shares in businesses that distribute some – or all – of their profits to shareholders.

Not all dividend stocks are the same though. Essentially, investors typically face a choice between higher yields and better growth prospects.

Shares in Imperial Brands, for example, come with a 7.25% dividend yield. That’s quite high, but investors need to consider the risk of declining tobacco sales in future.

By contrast, consumer products company Unilever has much more stable prospects. But the dividend yield is much lower, at around 3.5%.

A stock to consider buying

Right now, I think Tesco (LSE:TSCO) might be a good stock to consider buying. It currently has a dividend yield of around 4% and I think it looks like an attractive opportunity.

The threat of competition – especially from Lidl and Aldi – is a risk. But its size and scale make Tesco difficult to displace and this shows up in its ability to sell products.

The best retailers shift stock quickly, get more in, and repeat. Imaginatively, the number of times a company turns over its inventory each year is called… its inventory turnover ratio.

Tesco’s ratio is 24. Higher is better and this comfortably beats its nearest competitor Sainsbury (15) as well as the likes of CostCo (13) and Marks & Spencer (11).

Growth prospects

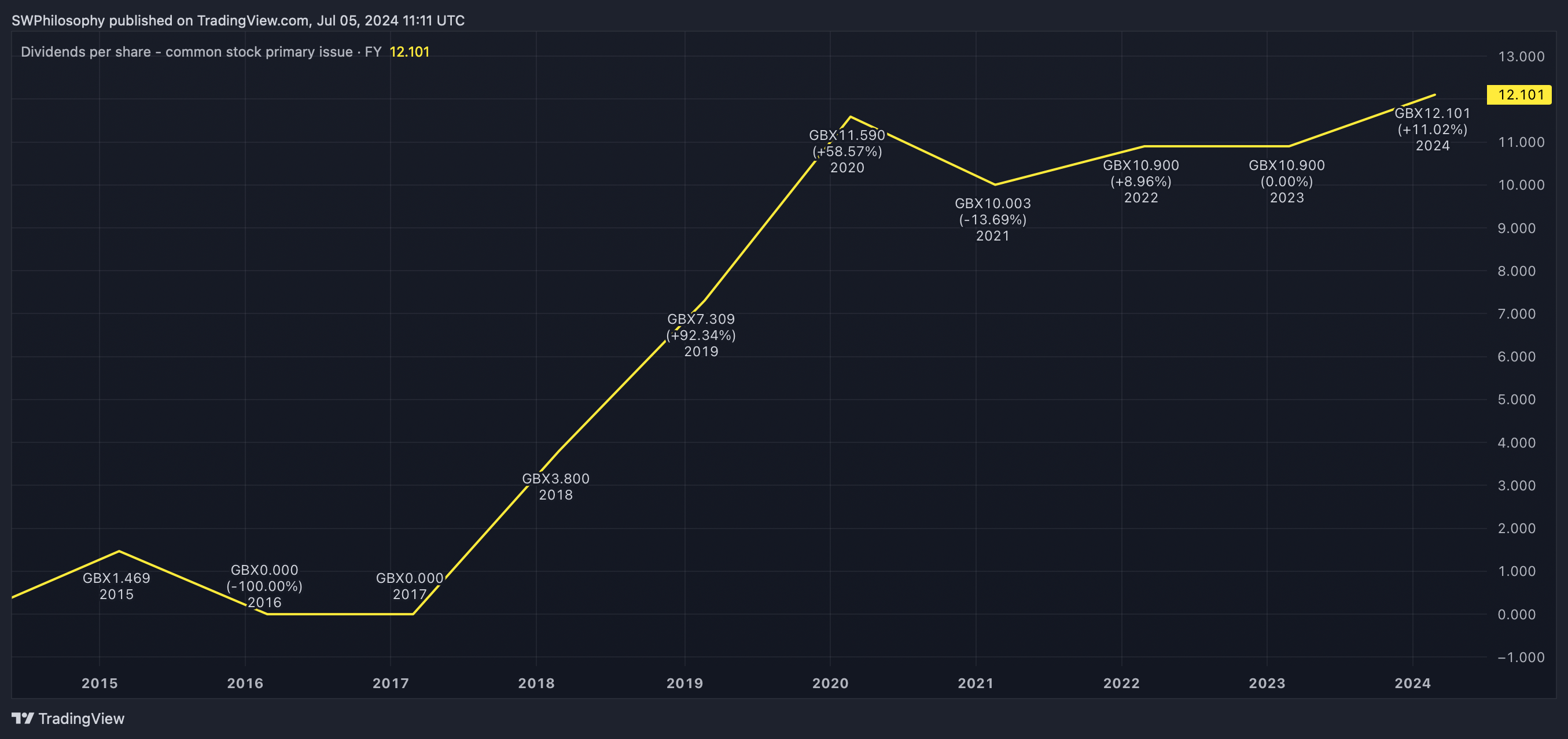

A company like Tesco, with a strong position in an important industry, should be able to increase its dividend over time. And it has done this fairly well over the last decade.

Tesco dividends per share 2015-24

Created at TradingView

As a result, I’d expect to do better than 4% on average over 30 years by buying Tesco shares. That’s why I think it could be a great choice for someone starting a passive income portfolio.

If things go well, I don’t think an average annual return of 7% over the long term is out of the question. And that could turn the equivalent of £3 a day into something substantial.

This post was originally published on Motley Fool