Last year, there were 4,000 Stocks and Shares ISA millionaires in the UK. And the number’s expected to keep growing as people get financially savvier and look for better returns than those from traditional savings accounts.

But how much does a investor need to invest to build a magic million-pound portfolio?

The magic number

The answer to this isn’t a simple one. It depends on a variety of factors, including the rate of return I’m seeking. A higher return of, say, 12% will mean I don’t have to invest as much. But targeting a larger return also means I’ll typically be taking a bigger risk with my cash.

But in order to get an idea, let’s use the average return that Stocks and Shares ISA investors have enjoyed over the past decade. This stands at 9.64%, according to financial services provider Moneyfarm.

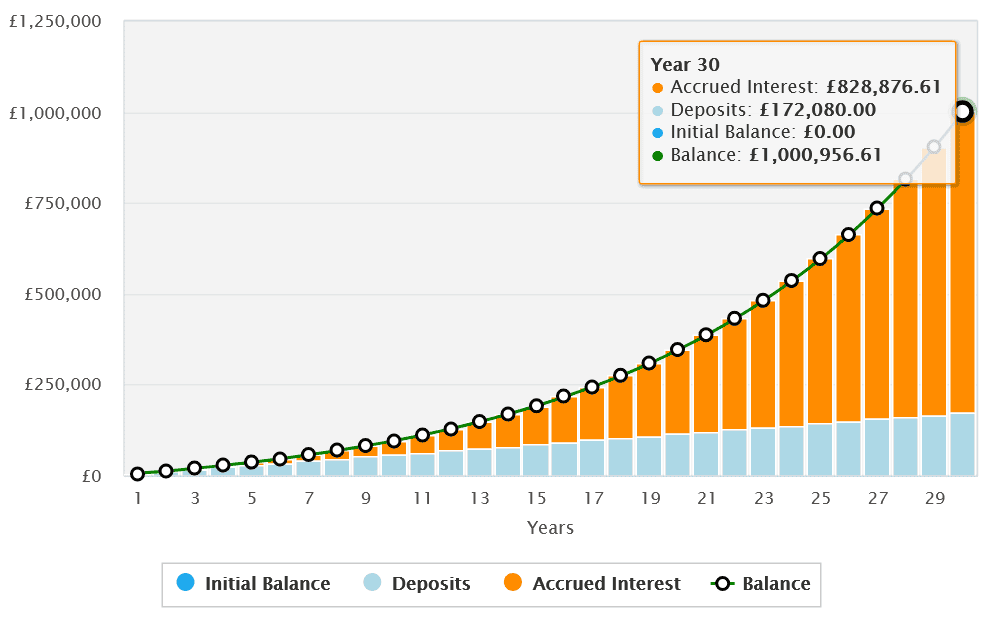

If I was looking to reach millionaire status after 30 years of investing, I’d need to invest exactly £478 each month based on this figure. A breakdown of total deposits and earned interest over the period can be seen below.

Tax boost

Past performance is no guarantee of future returns, of course. I may find myself making a sub-9.64% return over the long term. With a bit of luck, I may even beat that figure.

But I’m boosting my chances of hitting that million-pound target straight away by using a Stocks and Shares ISA. This way I don’t have to pay the taxman a penny on any capital gains or dividends I receive.

Over time, this can add up to a significant chunk of cash. Asset manager Netwealth reckons an additional rate taxpayer investing £100,000 in an ISA would save £44,000 in taxes over a decade. That’s based on a 5.9% average annual return, and excludes broker fees.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Two top tips…

There are other important things I can do to try and reach millionaire status. One is to reinvest any dividends I receive, allowing me to earn money on this ‘interest’ alongside my initial capital.

As I buy more and more shares, which in turn gives me an increasing number of dividends, a snowball effect’s created that can supercharge the size of my portfolio over time. This mathematical miracle is known as compounding.

The other thing I’d do is invest in a wide range of shares, exchange-traded funds (ETFs), and other assets. Spreading my money across asset classes, sectors, and geographies gives me exposure to different investment opportunities and also spreads risk.

… and one great ETF

A fund like the iShares Edge MSCI USA Quality Factor UCITS ETF (LSE:IUQA) could help me achieve this in an easy and cost-effective way. This particular product invests in 125 US companies that have great records of generating strong and stable earnings.

Major names it holds include microchip manufacturer Nvidia, pharmaceuticals giant Eli Lilly, retailer Costco and credit card provider Visa.

Its narrow focus on US shares could create problems if sentiment towards the Stateside stock market deteriorates. But, on balance, I think it’s still worth a close look.

This quality factor fund’s delivered an average annual return of 14.39% since its inception in 2016. If this continues, a £478 monthly investment here could help me hit millionaire status much sooner.

This post was originally published on Motley Fool