Having £1,000,000 invested in a Stocks and Shares ISA might seem like an impossible dream. And while nothing is guaranteed, but the reality is that it might be more attainable than it sounds.

According to HMRC, there are over 4,000 ISA millionaires already. So what does someone like me have to do to join them?

9.64%

Historically, the average Stocks and Shares ISA has managed an annual return of 9.64% per year. There are no guarantees that will continue, but at that rate, the amount an investor needs to deposit to reach £1,000,000 isn’t that high.

At that rate, investing £1,000 each month for 25 years results in a portfolio worth £1,186,480. That’s a long time, but the process can be accelerated with larger deposits.

The maximum contribution for an ISA is £20,000 per year. Compounding that much each year at the average rate from a Stocks and Shares ISA generates £1,000,000 tax-free within 18 years.

A 9.64% annual return is enough to turn a £500 monthly investment into £978,155 over 30 years. But the question for investors is where the returns come from.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Investment returns

There are essentially two ways for investments to generate returns. Profits can increase, or the amount investors are willing to pay for the same earnings can go up.

Diploma (LSE:DGE) is a good example of both factors working together. Over the last 10 years, shares in the FTSE 100 conglomerate are up 549%.

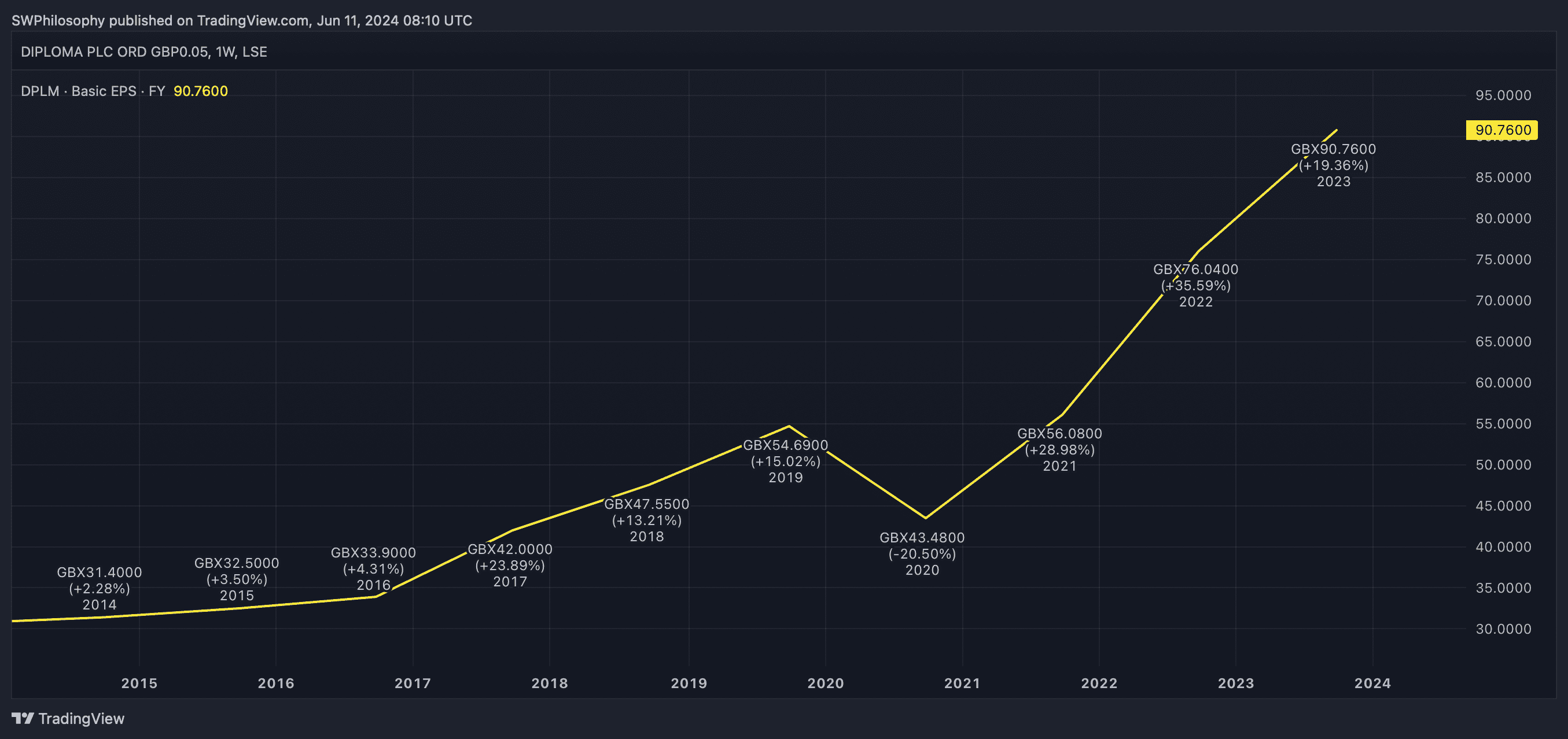

Diploma EPS 2014-23

Created at TradingView

This is partly the result of the company’s earnings per share (EPS) growing. Driven by increased revenues, Diploma’s EPS has gone from 31.4p to 90.7p during the last decade.

At the same time, investors are willing to buy the stock at a higher multiple than they were before. The stock’s price-to-earnings (P/E) ratio has gone from 22 in 2014 to 47 today.

Diploma P/E ratio 2014-23

Created at TradingView

Investment

Investors who bought shares in Diploma have done exceptionally well over the last decade. But past performance doesn’t guarantee future success and the question today is how things will look going forward.

The outlook is probably mixed. The company’s earnings could well continue to grow, but the stock’s P/E ratio is unlikely to keep expanding from here.

Diploma’s earnings growth has been built on making acquisitions. While opportunities to keep doing this this will eventually subside, I think there’s a long time until this happens.

By contrast, the stock already trades at a high P/E ratio, making it riskier than it was a decade ago. It’s probably more likely to contract than to expand, which will slow down earnings-driven growth.

Aiming for a million

Diploma’s returns are unlikely to be as impressive in the future as they have been over the last 10 years. But it could still be a very good stock to own if its growth prospects are as good as they look.

Investing £1,000 per month at an average annual return of 9.64% generates a portfolio worth £1,000,000 within 25 years. There are no guarantees here, but Diploma could be a good place to start.

This post was originally published on Motley Fool