Passive income is just the sort of thing I like – money coming in without me working for it. One of my favourite passive income streams is investing in UK dividend shares. I can sit back and earn money from the success of leading companies with tens of thousands of skilled employees.

Here’s how I would target average weekly passive income of £100 by investing in UK dividend shares.

One Killer Stock For The Cybersecurity Surge

Cybersecurity is surging, with experts predicting that the cybersecurity market will reach US$366 billion by 2028 — more than double what it is today!

And with that kind of growth, this North American company stands to be the biggest winner.

Because their patented “self-repairing” technology is changing the cybersecurity landscape as we know it…

We think it has the potential to become the next famous tech success story. In fact, we think it could become as big… or even BIGGER than Shopify.

Click here to see how you can uncover the name of this North American stock that’s taking over Silicon Valley, one device at a time…

The significance of yield

When discussing UK dividend shares,’yield’ is a word that comes up a lot. It’s the annual percentage payout a company makes relative to its current share price. For example, currently shares in electricity network operator National Grid trade at around £9.43. Its dividends last year totalled 49.2p a share. So its yield is 5.2%.

Note that this is also sometimes referred to as historic yield. The forecast payouts for this year are the prospective yield, “future yield” or projected yield. In recent years, National Grid has grown its dividend by 1%-4% annually, so the prospective yield is actually slightly higher than 5.2%. But dividends are never guaranteed, so projected yield is just that – a projection.

A key thing to note about the yield calculation is that my yield changes based on the purchase price of the shares. So, while M&G currently offers a 9% yield, if I’d bought the shares at their low point last year and held them, my yield would currently be 17%. So, for every £100 I put in, I would be receiving £17 a year in passive income. That’s why, when picking passive income streams among UK dividend shares, I don’t just try to buy companies with strong dividend potential. I also focus on buying them when their share prices make their yields attractive.

Starting with the end in sight

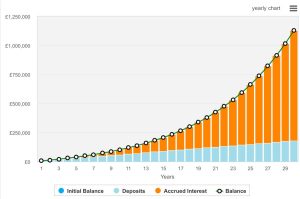

For a target of £100 a week in passive income, I’d need my UK dividend shares to generate £5,200 annually. With a yield close to 5%, like National Grid, that would mean I’d need to invest £104,000 to meet my target.

But even the best companies can run into difficulties. So I wouldn’t simply put my money in one company. I’d diversify across different companies and business sectors.

I have to remember that the higher the average yield, the less capital I would need to meet my £100 weekly target.

That might tempt me to buy riskier shares with very high yields – something commonly referred to as a value trap. It’s important for me to avoid that temptation. Instead, I would focus on shares with an attractive yield and that I felt had strong dividend prospects for coming years. To assess that, I would look at the firms’ free cash flow and debt levels. Along with the sustainability of their competitive advantages, that would help me understand how likely they are to be able to pay out dividends in the future at a certain level.

Weekly passive income

It’s possible to get dividends every week, but it takes a lot of planning. Some shares only pay out once a year. So picking shares that offered me a weekly payout would mean a lot of research and holding a large number of different companies.

So, even if targeting £100 a week in passive income, in reality I’d expect the passive income to come in unevenly. I’d use the weekly target as a guide to my annual goal.

Is this little-known company the next ‘Monster’ IPO?

Right now, this ‘screaming BUY’ stock is trading at a steep discount from its IPO price, but it looks like the sky is the limit in the years ahead.

Because this North American company is the clear leader in its field which is estimated to be worth US$261 BILLION by 2025.

The Motley Fool UK analyst team has just published a comprehensive report that shows you exactly why we believe it has so much upside potential.

But I warn you, you’ll need to act quickly, given how fast this ‘Monster IPO’ is already moving.

Click here to see how you can get a copy of this report for yourself today

Christopher Ruane has no position in any shares mentioned. The Motley Fool UK has recommended National Grid. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

This post was originally published on Motley Fool