I can’t wait to start populate this year’s ISA and now looks like a great time to do it as I can see cheap shares everywhere I look.

They got that little bit cheaper last week, with the FTSE 100 falling 1.18% to close at 8,155.72 on Friday. That only makes me want to buy them more.

I won’t be able to max out my full £20k Stocks and Shares ISA allowance this year. However, I’ll invest as much as I can. Given time, I think it’s possible for me to go from a standing start to saving a large lump sum, like £275,000. That would make my retirement look a lot rosier.

FTSE 100 buying spree

I won’t put a penny into a Cash ISA. I have an easy access savings account for short-term emergencies, but shares are the best way I know to build long-term wealth. While it’s possible to get 5% on cash today, that will drop once the Bank of England cuts interest rates.

By contrast, these two FTSE 100 shares pay income of around 7% and with luck, may continue to do so whatever happens to base rates.

FTSE 100 mining giant Rio Tinto (LSE: RIO) looks really cheap today, trading at just 8.8 times earnings. That’s well below the FTSE 100 average of 12.7 times.

It has a trailing yield of 6.9% a year, decently covered 1.7 times by earnings. It’s forecast to yield 6.9% next year too.

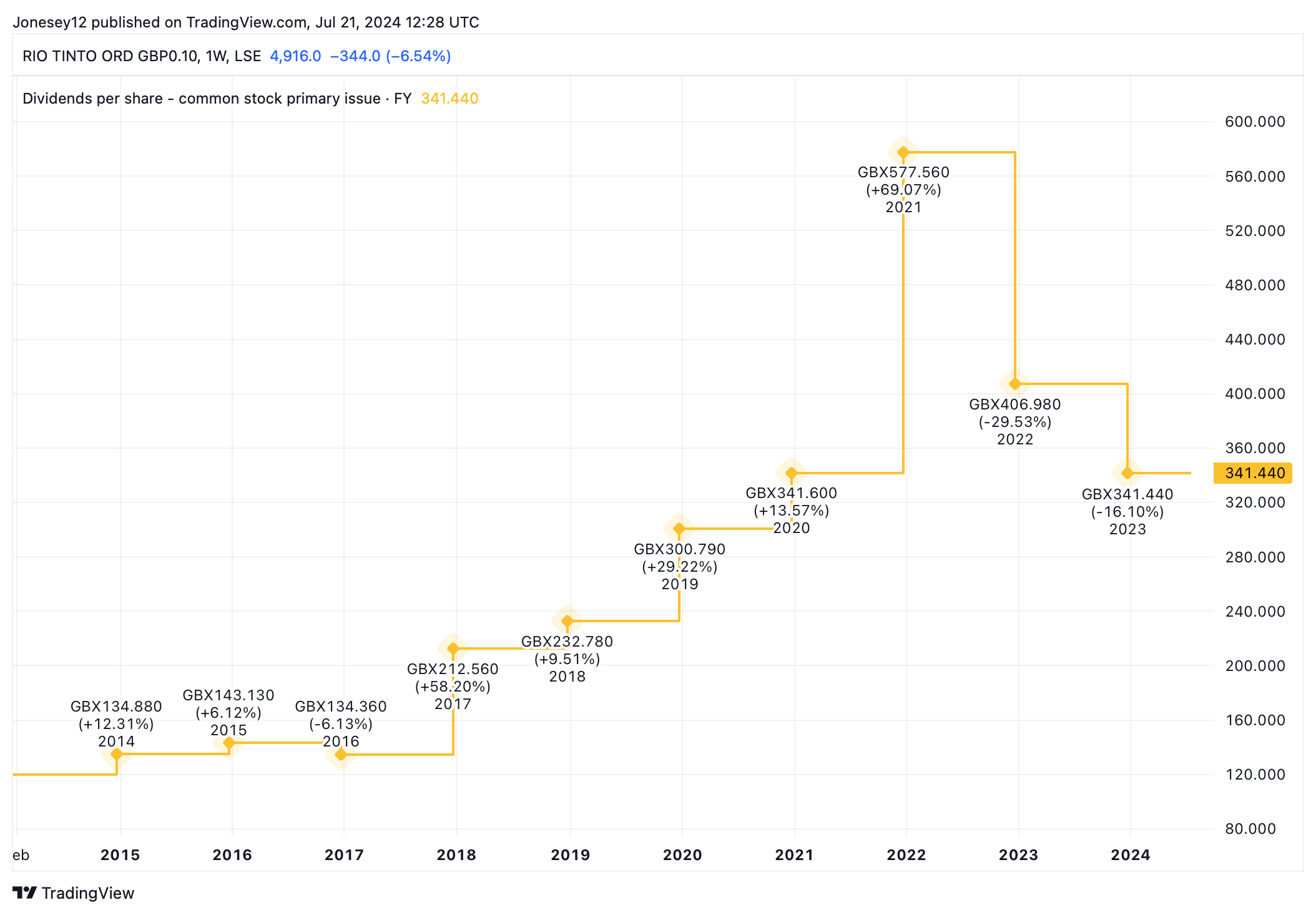

Dividends are never guaranteed. As this table shows, Rio Tinto’s board has cut the shareholder payout recently.

Chart by TradingView

Like all mining stocks, Rio Tinto has been hit by the slowdown in China. Revenues hit $63.5bn in 2021 but slipped to $55.6bn in 2022 and $54bn in 2023.

Sales are forecast to continue slowing to $53.1bn in 2024 and $53.7bn in 2025. So there’s a reason why it’s cheap.

Great value stocks

The Rio Tinto share price crashed 6.54% last week and is down 3.53% over one year. Yet with a long-term view, today’s low valuation offers a brilliant entry price. I’ll buy it as soon as I have the cash, then sit tight and wait for the recovery.

Now, let’s say I had £10k to invest in my ISA this tax year and put £5k into Rio Tinto and £5k into FTSE 100 insurer Aviva, which is forecast to yield 7.2%.

Combined, that would give me an average forward yield of 7.05%. From a £10k stake, I’d get income of £705 in year one.

If these stocks delivered an average total return of 7% a year it would take me 49 years to hit my £250k target. That’s far too long.

However, if I put another £10k into an ISA every year I’d get there in just over 14 years. And if I my stock picks did well and delivered a total annual return of 9%, I’d get there in less than eight years. Of course, there’s a risk that it may not happen and I could lose money too. But that’s my strategy and I’ll be pursuing it over the summer, by filling my ISA with cheap UK shares.

This post was originally published on Motley Fool