UK stocks are a terrific way of generating a passive income. While the London Stock Exchange doesn’t offer much choice in tech stocks, it’s riddled with dividend-paying companies. And some have the most generous shareholder payouts in the world.

Many investors often underestimate the power of dividends. Most chase share price growth. And to be fair this can be a winning strategy. But, in the long run, dividends are the dominant source of returns for British investors. In fact, they’ve been the difference between earning a 40% or a 140% return over the last 12 years looking at the FTSE 100.

I’d buy UK stocks and relax

The UK’s flagship index currently offers a solid yield of 3.6%. That’s almost triple what the US S&P 500‘s currently paying!

So let’s say I invest £10,000 right now into a low-cost index tracker. Within a single transaction, I’d have a diversified portfolio generating a passive income of £360 a year without having to do an ounce of work. And assuming the FTSE 100 continues to deliver its historical total return of 8% thanks to dividend reinvestment, my portfolio will grow considerably over time.

After 40 years, I’d have £242,734 from starting with just £10,000! But if I up the ante and throw in an extra £500 each month, then my nest egg would reach a staggering £1,988,238.

Needless to say, retiring on almost two million pounds is a delightful thought. As is the passive income such a portfolio can generate. Following the 4% withdrawal rule, that’s an income stream of £79,530. And best of all, since only half the gains are being taken, the portfolio and passive income would continue to grow even more during retirement.

Investing to relax

As thrilling as this prospect sounds, there are a few caveats to consider. Most critically, I’m relying on the FTSE 100 to continue delivering an average gain of 8% a year until 2064. Sadly, there’s no way to guarantee this’ll happen. And even if it does, 40 years is plenty of time for multiple crashes and corrections to derail my portfolio’s progress. A badly timed downturn in the market could leave me with less than expected.

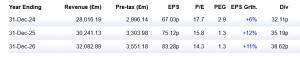

So to combat this risk, I can take a more active approach to investing. Even in the FTSE 100 there are plenty of stocks that generated market-beating returns over the years. Take Diploma (LSE:DPLM) as an example.

The company operates at the heart of other businesses’ supply chains, acting as a critical distributor of parts and components for the aerospace, defence, and biotech industries. It very much operates behind the scenes. But as product complexity’s increased with technology, the company’s achieved tremendous success.

While the FTSE 100’s delivered a total return of 140% since 2012, the Diploma shares are massively ahead at 1,128% — in large part thanks to dividends. Sadly, these sorts of gains seem unlikely to repeat now that the business has a market-cap of almost £6bn. And finding the ‘next Diploma’ in the stock market’s hardly an easy task.

But it goes without saying I could earn considerably more passive income by discovering similar UK stocks over the next four decades.

This post was originally published on Motley Fool