When I consider the potential investment yields on offer for a second income, I always set a Cash ISA as the benchmark. At the moment, the best easy access rate I can find is 5.1%. Given that the risk of loss of capital is low, alternatives like dividend stocks need to pay me a higher yield, given the fluctuations in share prices. Based on the current market, I think I could potentially earn a yield of 10%. Here’s the lowdown.

Using the power of diversification

It might surprise some to know that there are currently five stocks in either the FTSE 100 or FTSE 250 that have a dividend yield above 10%. I could simply invest in these options and call it a day. However, five income stocks in a portfolio isn’t that diversified. If one of those five decided to cut the dividend, my income would fall by 20%.

After all, we’re talking about ultra-high yield dividend shares here. The risk is higher than with companies with a lower yield. Therefore, I want to try and add more to the pot. This isn’t impossible and can actually be done fairly easily.

For example, Ithaca Energy has a dividend yield of 16.72%. The TwentyFour Income Fund (LSE:TFIF) has a yield of 9.33%. Even though this is below the 10% threshold, if I invest an equal amount in both stocks, my average yield becomes 13.03%.

Therefore, I can build my portfolio up using similar companies and still have an average yield at 10% even though some of the individual shares have a yield below my target.

A contender to include

In terms of a stock I’d look to include if I was pursuing this strategy, the TwentyFour Income Fund would definitely be on the list.

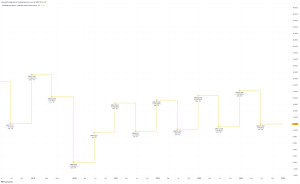

I’d use the stock as a sustainable dividend payer. It has a strong track record of consistent payments over several years. It typically pays out funds on a quarterly basis, which I see as a positive as it avoids me having to wait an entire year to get paid.

The fund primarily invests in asset-backed securities. As the name suggests, these are financial products that have some form of protection attached. For example, a mortgage is an asset-backed security. The owner of the loan gets paid interest, but also has the physical property as an asset in case of default from the borrower.

By targeting high-yield securities, TwentyFour can generate good levels of income that can be paid out to shareholders on a regular basis. The share price should reflect the overall value of the portfolio. Over the past year, the stock is up 8%.

As a risk, the firm does have exposure to areas like student loans and credit card debt. There’s a higher chance of default and so the company needs to carefully choose what to invest in.

Weighing it all up

I’m not going to claim that this portfolio averaging 10% is a low-risk idea. But I do think that it goes to show that with some imagination and research, I can make my money work harder than simply putting it in a Cash ISA.

This post was originally published on Motley Fool