What exactly is passive income? Well, the clue is in the name – by definition, earning such income involves no effort at all. But things aren’t always as straightforward as they seem.

Before the cash comes rolling in, there can actually be a lot of work involved. And while I think UK dividend stocks are a great source of effortless income long term, building a portfolio can take time and effort earlier on.

Money makes money

The best thing about dividend stocks is they really do generate cash with no work. If I buy shares in Unilever, I don’t have to sell products, manage suppliers, or run advertising campaigns.

If I could build a portfolio of dividend stocks that eventually pay enough income to allow me to retire, I’d never have to work again. The trouble is, building such a portfolio takes quite a lot of cash.

According to the Pensions and Lifetime Savings Association, financing a basic retirement for an individual requires £14,400 per year. And to earn even that, I’d need a big investment portfolio.

Right now, the average dividend yield for the FTSE 100 is 3.59%. At that level, I’d need an investment portfolio of £401,114 to make £14,400 per year – and that’s where the work comes in..

Building a portfolio

Building a £401,114 portfolio from scratch is likely to take time – that’s £1,000 per month for 33 years. But there are some things investors can do to speed up the process.

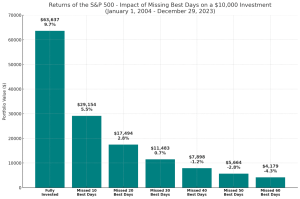

Investing regularly in the stock market is one of the best methods. The average annual return from the FTSE 100 over the last 20 years has been 6.5%.

That rate of return turns £1,000 per month into £401,114 within 18 years. That’s still a lot of work, but this is the challenge with earning passive income from dividend stocks.

It might be tempting to look for stocks with higher dividend yields to try and accelerate the process. But investors should note that this can be a risky business a lot of the time.

High yields

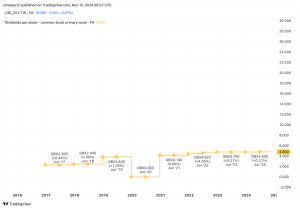

Right now, there are some stocks with very eye-catching dividend yields. At just over 9%, Legal & General (LSE:LGEN) is one of them.

Investors should note a few things, though. One is that the new CEO has suggested buybacks might be a more efficient way of returning cash to shareholders than dividends in future.

Another is the risky nature of the company’s operations. Long-dated liabilities, such as pensions, can turn out to be significantly more expensive than the company might initially anticipate.

Legal & General has an outstanding record of managing its dividend responsibly and I don’t see any imminent danger. But there’s a lot that can go wrong given a long enough timeframe.

Dividend stocks

Building a portfolio of dividend stocks can take a lot of time and effort. So while it’s my favourite approach to earning passive income, there’s still work involved at the outset.

This is especially true for investors looking to identify specific opportunities. This can be rewarding, but comparing, say, Legal & General with the likes of Phoenix Group isn’t always easy.

For investors who do this well, though, the results can be spectacular. With a portfolio of dividend stocks set up, there really isn’t much else to do but sit and watch as the cash rolls in.

This post was originally published on Motley Fool