As the dust settles on the recent UK election, Persimmon shares (LSE:PSN) are at the crossroads of political ambition and market opportunity. Following years of relative uncertainty in the sector, the new Labour government’s bold housing strategy could be the catalyst that propels this FTSE 100 housebuilder higher. Let’s take a closer look.

A new government

The government’s manifesto pledge to “get Britain building again” isn’t just political rhetoric – it’s a concrete plan to construct 1.5m new homes over the next parliament. This ambitious target, equating to 300,000 homes annually, hasn’t been achieved since the swinging sixties. For Persimmon, this could be music to shareholders’ ears.

The new chancellor, Rachel Reeves, has already begun laying out the blueprint. Mandatory local housebuilding targets, abandoned by the previous administration, are set to make a comeback. Even more striking is the government’s willingness to relax planning restrictions on certain greenbelt areas and potentially overrule recalcitrant local authorities. It’s a clear signal that the government means business when it comes to housing.

This seismic shift in housing policy could provide fertile ground for Persimmon shares. At present, the shares trade at around £15 a piece, with a market cap of £4.7bn. Analysts suggest it’s significantly undervalued, trading 38.5% below fair value estimates, according to a discounted cash flow (DCF) calculation. Couple this with projected earnings growth of 15.12% per year, and the foundation for a potential rally becomes apparent.

Persimmon’s recent performance adds weight to this optimistic outlook. The shares have surged 41.4% over the past year, outpacing both competition and the broader UK market. It’s worth being cautious though. Such a strong rally can easily break down if the market changes, or if investors decide to take profits.

Not all good news

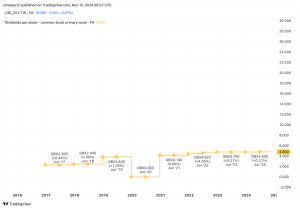

However, the company clearly faces challenges, including compressed profit margins and a dividend yield that, while attractive at 5.39%, isn’t well-covered by free cash flows. This concerns me, as many investors may be considering taking profits now that the election is over. If the dividend suddenly becomes difficult to commit to long term, then a sharp decline could be on the cards.

The broader housebuilding sector’s cautious stance also adds an element of uncertainty. Industry giants like Barratt Developments and Taylor Wimpey are forecasting lower completion numbers for the coming year, indicating a degree of sector-wide hesitancy.

Yet, it’s precisely this caution that could play into the company’s hands. If management can utilise the government’s pro-building stance to gain market share and boost output, it could find itself ahead of the curve as the sector responds to the new political landscape. With an exceptionally strong balance sheet, and zero debt, I’d expect some interesting moves over the coming years.

The government’s housing plans represent a potential game-changer. For the firm, it’s an opportunity to align its growth strategy with national policy, potentially unlocking significant value for shareholders.

One for the future

Investors eyeing Persimmon shares should do so through the lens of this evolving political and economic context. The firm’s potential undervaluation, combined with promising growth forecasts and a supportive policy environment, presents a really compelling proposition for those willing to weather some short-term volatility.

In the grand scheme of UK housebuilding, I feel that the company could be laying the foundations for a remarkable growth story. As the new government’s housing plans begin to materialise, I think this could be just the beginning for Persimmon shares. I’ll be adding the shares at the next opportunity.

This post was originally published on Motley Fool