Mining giant Rio Tinto (LSE: RIO) has already made huge payouts to shareholders in recent years. So today’s news that the latest Rio Tinto dividend is a whopping $10.40 (around £7.64) per share should not come as much of a surprise. With the announcement of its highest dividend ever, I continue to be tempted to add Rio Tinto to my portfolio for its income potential.

But I am going to wait before I do that. This is why.

5 Stocks For Trying To Build Wealth After 50

Markets around the world are reeling from the coronavirus pandemic… and with so many great companies trading at what look to be ‘discount-bin’ prices, now could be the time for savvy investors to snap up some potential bargains.

But whether you’re a newbie investor or a seasoned pro, deciding which stocks to add to your shopping list can be a daunting prospect during such unprecedented times.

Fortunately, The Motley Fool UK analyst team have short-listed five companies that they believe STILL boast significant long-term growth prospects despite the global upheaval…

We’re sharing the names in a special FREE investing report that you can download today. And if you’re 50 or over, we believe these stocks could be a great fit for any well-diversified portfolio.

Massive Rio Tinto dividend

A dividend of over £7 per share is unusual. It would make a lot of income investors very happy. Rio Tinto is a mining giant and with demand for its products booming, it has been able to fund a big payout. Last year it generated $25bn in net operating cash flow, a 60% jump on the prior year. It has increased its ordinary dividend by 71% and special dividend by 166%, meaning that the total annual dividend is 87% higher than the year before.

Investor expectations were already high. Indeed, the Rio Tinto share price barely moved in this morning’s trading. Over the past year it has fallen 10%. That means, based on the dividend declared today, the Rio Tinto dividend yield is now 7.4%. That sounds attractive and I would be happy to be earning it.

Cyclical industry

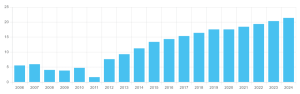

A 7.4% yield already sounds pretty good. But if I had bought Rio Tinto shares six years ago, when they briefly traded at 30% of their current price, I would now be yielding an incredible 24.7%. Earning a 20%+ yield from a FTSE 100 giant is very unusual.

So, why did the shares more than triple in six years? The movement reflects the highly cyclical nature of the mining industry. Typically, a strong economy leads to a surge in demand for metals and other commodities. That leads to prices soaring. As the prices surge, mining projects that would otherwise be loss-making become viable. So supply starts to increase, just as demand falls – and prices can crash. Mines may be closed, supply tightens and a few years later, the whole cycle starts again.

Waiting for a downturn

Right now, prices are strong in mining. They may remain that way for some time, so if I bought Rio Tinto shares today I could possible have several more years of bumper dividends. But my concern is that the next time the mining cycle goes downwards, the Rio Tinto share price could fall and the dividend will be cut.

The current dividend is over six times as high as the payout back in 2016, when the mining industry was in a cyclical downturn. The next time that happens, I expect the dividend to fall again. That could drive the share price down. In fact, I think that explains why the Rio Tinto share price has fallen over the past year, despite blockbuster results.

My next move on the Rio Tinto dividend

I would like to have the juicy Rio Tinto dividend in my portfolio. But I do not want to buy shares at or near the top of the mining cycle.

I plan to wait –probably for some years – until the mining cycle falls again. I will be looking for headlines about miners like Rio slashing their dividends and their share prices tumbling. At that point, I will be keen to add Rio Tinto to my long-term portfolio.

Our 5 Top Shares for the New “Green Industrial Revolution”

It was released in November 2020, and make no mistake:

It’s happening.

The UK Government’s 10-point plan for a new “Green Industrial Revolution.”

PriceWaterhouse Coopers believes this trend will cost £400billion…

…That’s just here in Britain over the next 10 years.

Worldwide, the Green Industrial Revolution could be worth TRILLIONS.

It’s why I’m urging all investors to read this special presentation carefully, and learn how you can uncover the 5 companies that we believe are poised to profit from this gargantuan trend ahead!

Access this special “Green Industrial Revolution” presentation now

Christopher Ruane has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

This post was originally published on Motley Fool