The Vodafone (LSE:VOD) share price is currently (14 August) around 74p. It was last above 80p in September 2023. Since August 2023, the shares have risen in value by a meagre 2.5%.

The stock appears to be going nowhere.

But I believe there’s some evidence to suggest that the company is significantly undervalued. However, I think it will be a while before a sufficient number of investors are persuaded to push the share price higher. Let me explain.

The evidence

Deutsche Telekom is Europe’s most valuable telecoms company. For the year ending 31 December, the consensus forecast of analysts is for earnings per share (EPS) of €1.81. With a current (14 August) share price of €24.85, the price-to-earnings (P/E) ratio‘s 13.7.

Vodafone’s currently undergoing a restructuring exercise. Excluding the parts that the group is currently looking to sell, analysts are expecting EPS of 9.22 euro cents (7.89p) for the year ending 31 March 2025 (FY25). If correct, this implies a P/E ratio of 9.4.

If Vodafone were to achieve the same valuation multiple as its German rival, its share price would be 46% higher (108p).

It’s a similar story when it comes to dividends. Deutsche Telekom’s forecast to pay 0.85 euro cents a share in 2024. This gives a current yield of 3.4%.

Vodafone’s expected to return 4.50 euro cents (3.85p) to shareholders in FY25 — a yield of 5.2%.

As shareholders in the UK company know all too well, dividends are never guaranteed. Vodafone halved its payout in 2019 and announced another 50% reduction — for FY25 — in May.

A company’s dividend is intended to compensate for the risk associated with holding its shares. If Vodafone’s shareholders were comfortable with a yield 3.4%, its share price would be 113p — an increase of 52% over its current level.

Investor sentiment

As a shareholder in Vodafone, I’m tempted to think this is unfair.

But it’s only part of the story. Deutsche Telekom’s recently reported its 26th consecutive quarter of growth in EBITDAaL (earnings before interest, tax, depreciation and amortisation, after leases) in the European Union. And it’s increased its earnings in Germany for 31 successive quarters.

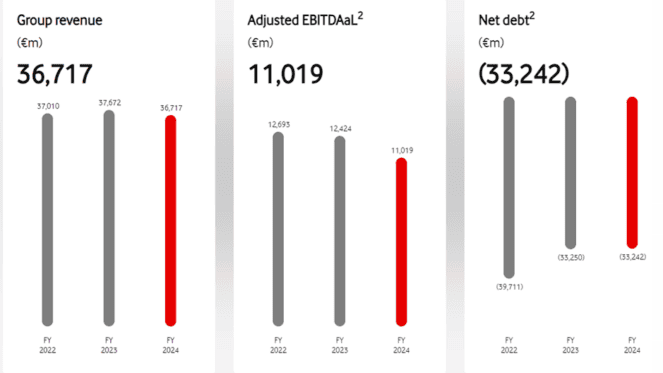

During this time, Vodafone’ share price has fallen by around two thirds. Vodafone’s group revenue in FY24 was lower than in FY22. And its EBITDAal — adjusted to take into account a slimmed down group — was €1.67bn less.

I’m certain this explains the difference in the valuations of the two companies. One’s growing whereas the other’s undergoing a radical restructuring.

But by exiting Spain and Italy, Vodafone’s trying to deal with its huge debt and improve its return on capital which is lagging some of its peers.

Looking further ahead

And if Vodafone’s reorganisation proves to be successful — and it can demonstrate it’s growing once more — then I see no reason why its share price wouldn’t rise by around 50%.

But it’s going to take time. Its first quarter results for FY25 showed some signs of a recovery. Revenue was up 3.2%, compared to a year earlier. And EBITDAaL was nearly 2% higher.

However, one swallow doesn’t a summer make. Several quarters of increased revenue and earnings are needed before — I believe — investors will view the company as favourably as, for example, Deutsche Telekom.

This post was originally published on Motley Fool