For most investors, Bunzl (LSE:BNZL) probably isn’t a household name. But it’s handily outperformed the FTSE 100 over the last 10 years and I think there’s more to come.

Past performance isn’t a guarantee of future success. But whether it’s growth or income, the company’s a lot to offer investors.

Income

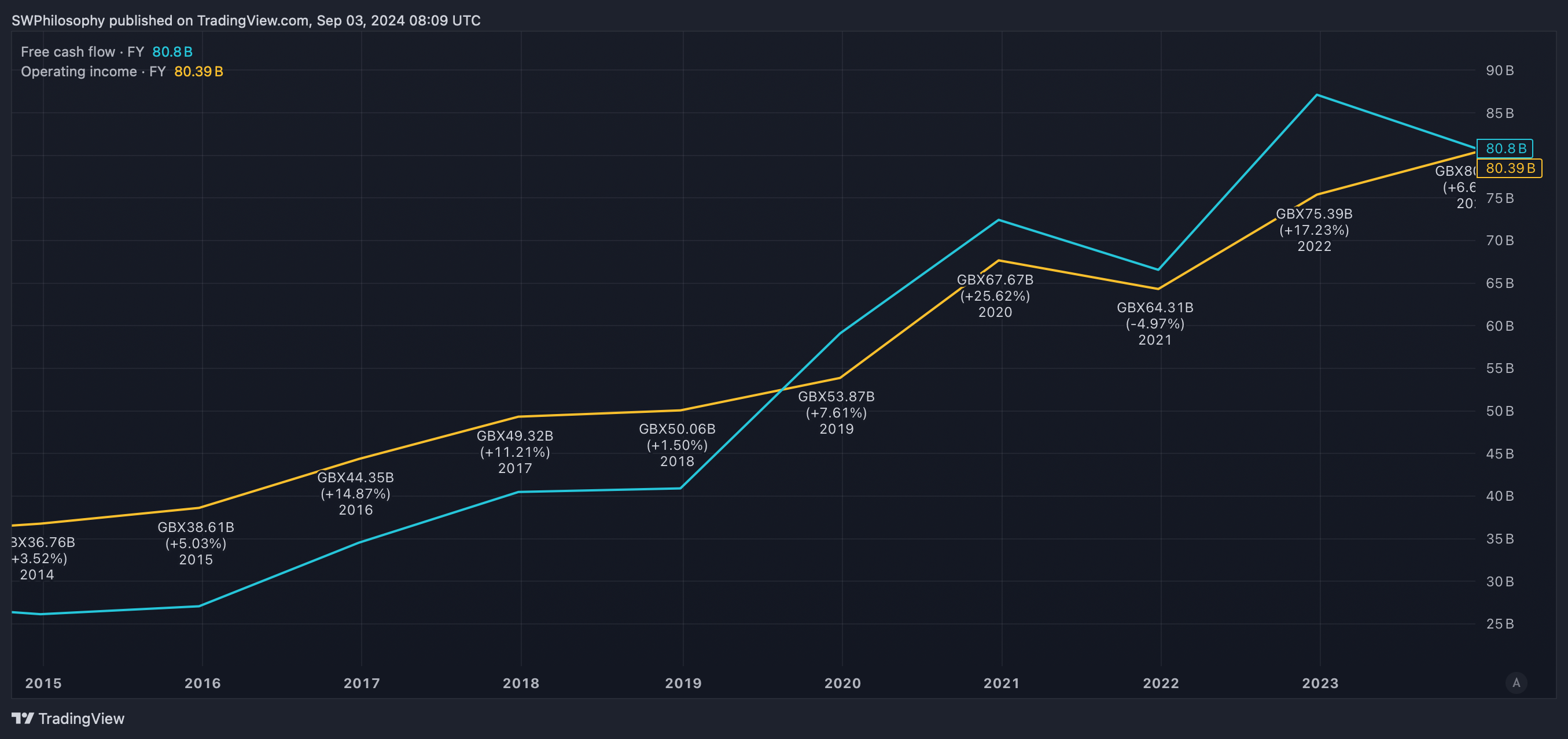

The success of any investment comes down to the cash it generates. And one of the things Bunzl does better than most businesses – FTSE 100 or otherwise – is generate cash.

In general, a lot of the company’s operating income becomes free cash. This can then be used either to fund growth or returned to shareholders via dividends.

Bunzl operating income vs. free cash flow 2014-24

Created at TradingView

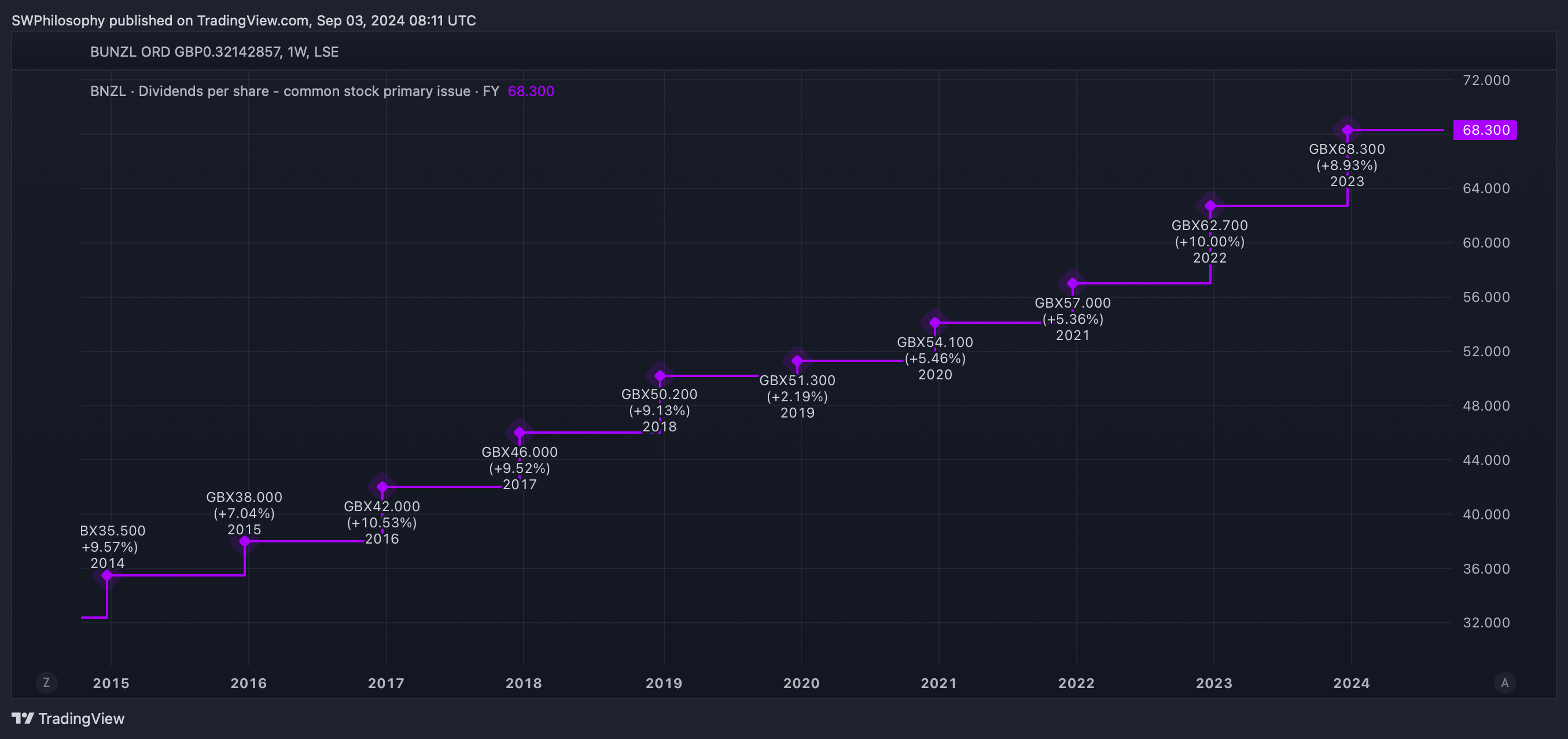

On the latter point, Bunzl has an excellent record. The firm’s increased its dividend consistently over the last 10 years, including during the Covid-19 pandemic.

At an average of 7% a year, these haven’t just been token increases. The company’s been growing its dividend at a meaningful rate, even during a challenging economic environment.

Bunzl dividends per share 2014-24

Created at TradingView

Growth

Dividends only account for around half of the firm’s earnings though. Management’s used the rest of the company’s net income to reinvest in future growth opportunities.

Acquisitions have been key to Bunzl’s growth, which has resulted in revenues growing at around 7% a year. But this can be risky for even the most experienced investors.

Warren Buffett’s probably the best in the business when it comes to investing. But the Berkshire Hathaway CEO has been known to overpay for acquisitions.

Investors would therefore be unwise to overlook this risk when considering Bunzl shares. But I think there are some important considerations that help offset this.

Capital allocation

Since 2014, Bunzl’s reinvested just over half of its net income. And while its revenue growth’s been impressive, there are also signs it’s been deploying cash carefully.

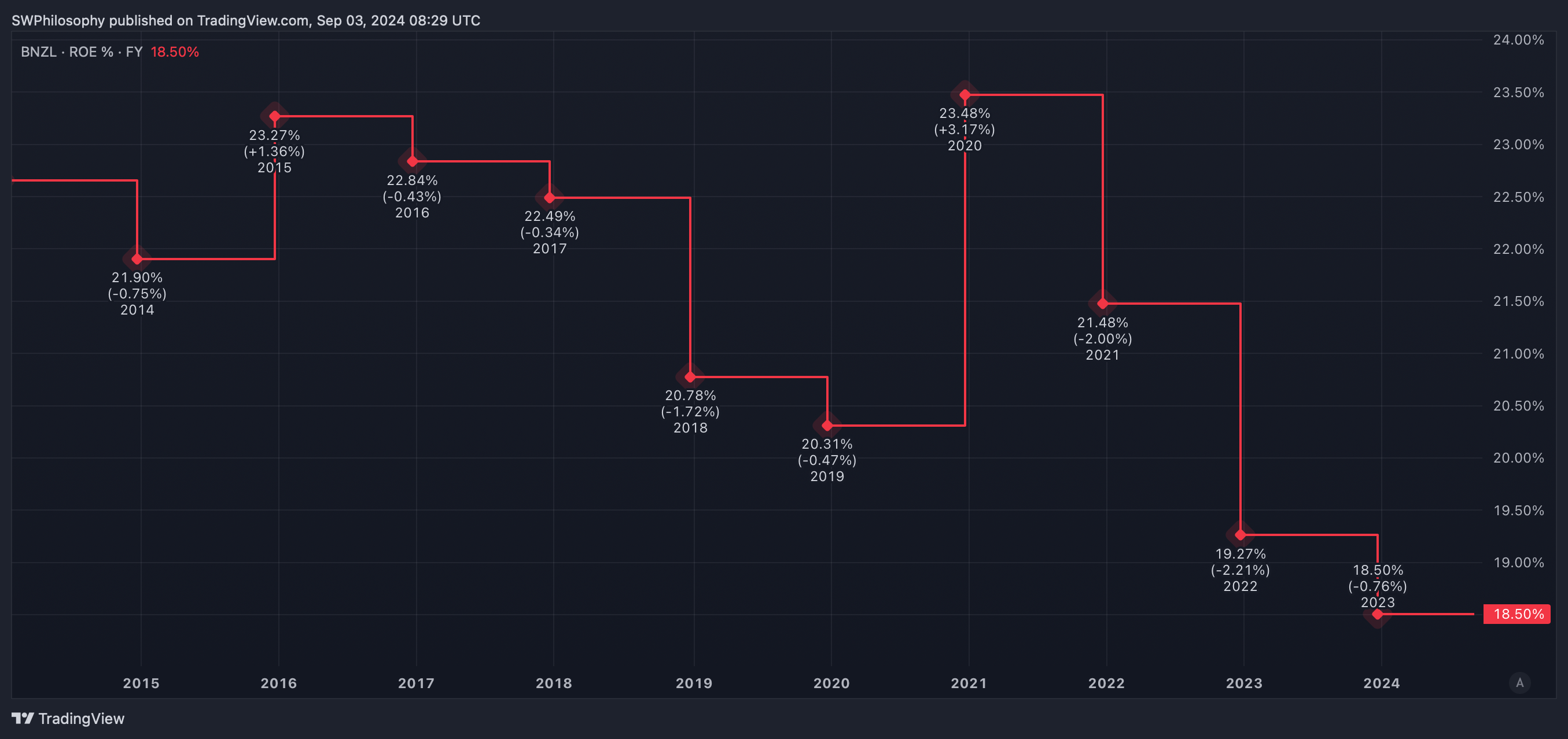

One of these is the company’s return on equity. This helps measure how well management generates returns with the cash it retains on its balance sheet.

Bunzl Return on Equity 2014-24

Created at TradingView

It’s worth noting that this metric’s dropped recently. But I think this looks like a temporary issue for a business that’s consistently maintained high returns.

Moreover, despite this falling to 18.5%, it’s still well ahead of the 11% average for the FTSE 100 as a whole. In other words, Bunzl’s still doing very well in terms of profitable growth.

Outlook

Overall, I think Bunzl’s a terrific business with an impressive track record. Furthermore, its big competitive advantage – the unmatched scale of its operations – should help it continue to do well.

Right now, the stock’s slightly higher than the level I’d like to buy it at. But if the share price finds its way back to £32, I’ll be looking to add it to my portfolio.

This post was originally published on Motley Fool