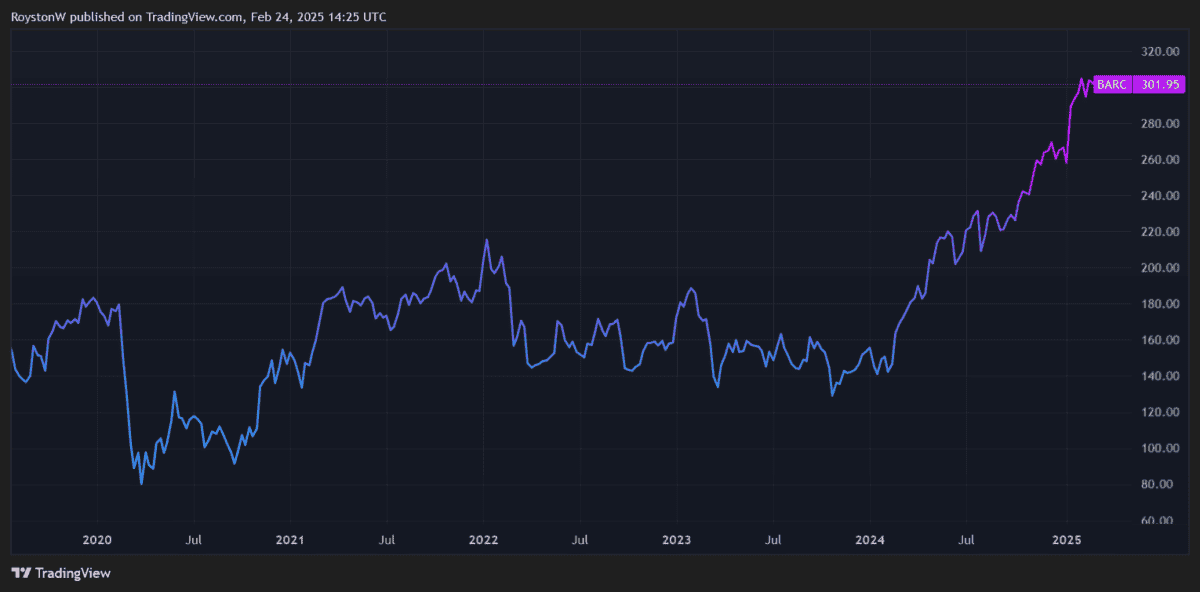

Demand for Barclays (LSE:BARC) shares hasn’t been dampened by alarm bells ringing for the UK economy and uncertainty in the US.

At 302p per share, the Barclays share price is up 14% since the start of 2025. This takes total gains for the past year to a whopping 83%.

City analysts don’t believe the FTSE 100‘s bull run is finished yet either. They’re tipping more double-digit increases over the next 12 months.

Should I consider snapping up Barclays shares?

11% more to go?

First, it’s worth noting that there are some large variances across brokers’ current forecasts.

One particularly bullish analyst thinks Barclays’ share price will rise an extra 29% over the next year, to 390p. At the other end of the scale, one pessimistic forecaster has set a 12-month price target of 230p, down 24% from current levels.

Having said this, the overall picture painted by City brokers is pretty upbeat. The average price target among 17 brokers is 335.20p per share. That represents an 11% premium to today’s price.

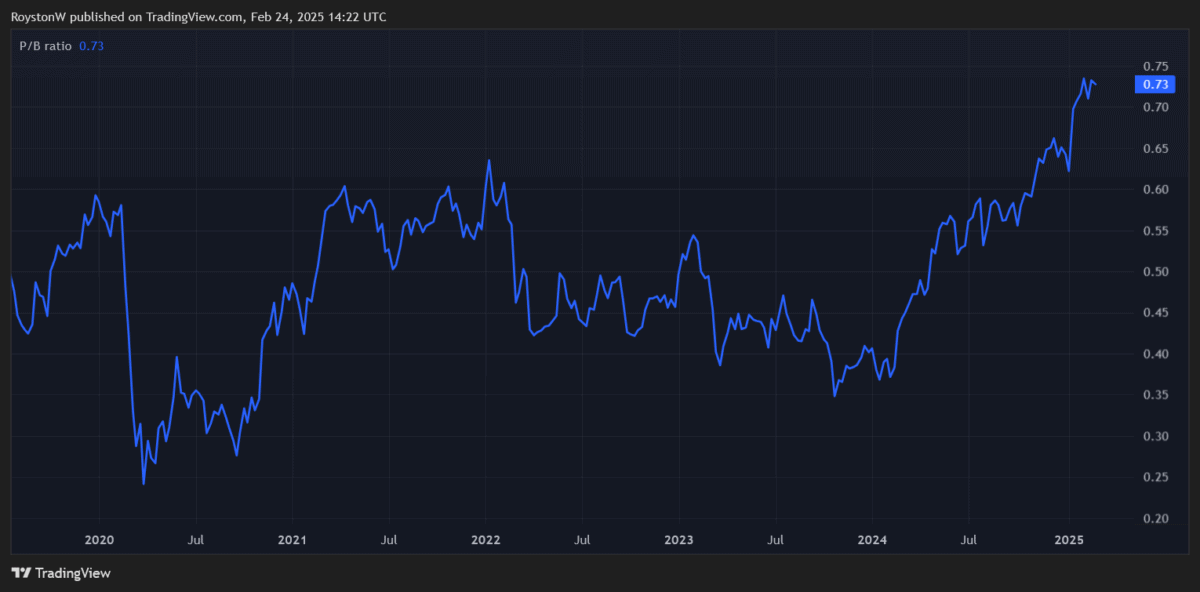

Cheap on paper

One reason why analysts think Barclays shares will rise could be because of its relative cheapness.

The number crunchers think the bank’s annual earnings will jump 17% in 2025. This leaves it trading on a price-to-earnings-to-growth (PEG) ratio of 0.4.

Any reading below one indicates that a share is undervalued.

Furthermore, Barclays’ price-to-book (P/B) value is also below one, indicating it trades at a discount to the value of its assets.

Finally, the firm’s price-to-earnings (P/E) ratio of 7.1 times for this financial year is also extremely low, including relative to those of its peers.

Other UK-focused banks Lloyds and NatWest carry forward earnings multiples of 9.9 times and 8 times, respectively.

Reward vs risk

With brokers tipping an 11% price rise, and the Footsie bank also offering a 3% dividend yield, it’s easy to see why Barclays shares are so popular today.

The company’s forecast-beating results for 2024 and revised medium-term targets have also boosted investor appetite. The bank now expects to deliver a return on tangible equity (ROTE) of 11% and 12%-plus in 2025 and 2026, respectively, up from 10.5% last year.

This is thanks largely to impressive performances at the firm’s large investment bank.

But with inflationary pressures increasing, and other new hazards (like fresh trade tariffs) threatening the fragile economy, trading conditions here might become a lot tougher from this point.

At the same time, the threats to Barclays’ retail business are also considerable. Net interest margins (NIMs) could shrink sharply thanks to a double-whammy of rising competition and falling interest rates.

I’m also fearful of the prospect of weak loan growth and rising impairments if economic conditions remain tough. Worryingly, the bank incurred a forecast-topping £2bn worth of credit impairment charges last year, up 5% from 2023 levels.

Finally, Barclays risks facing substantial financial penalties if found guilty of mis-selling car finance. It’s set aside £90m to cover possible costs, though experts warn the actual figure could be far higher.

While City brokers are bullish on Barclays’ share price, I don’t plan to add the bank to my own portfolio. The risks are too great for my liking, even despite the cheapness of its shares.

This post was originally published on Motley Fool