A Stocks and Shares ISA can be a good way to invest over the long term.

Part of the appeal could be the possibility of share price appreciation. But in my opinion, some passive income along the way in the form of dividends would be most welcome too!

If I wanted to target a 7% yield from my ISA – in other words, £1,400 per year of passive income in the form of dividends – here is how I would go about it.

Find shares that answer two questions

I would not start with the yield in mind.

After all, no dividend is ever guaranteed. While high yields sometimes last, on other occasions they can be an early (or late!) warning sign of a possible dividend cut.

So, I would ask myself a couple of questions when looking for shares to buy. First, is this business in a position that it is likely to generate substantial excess cash for years to come, that it can use to pay dividends?

Secondly, is the share price attractive? After all, if I overpay for a share then even if it maintains a juicy dividend, I could still lose money if I end up selling it for much less than I paid.

Is a 7% yield unrealistically high (or high risk)?

Only at that point would I start looking at yield.

A 7% yield is much higher than the current FTSE 100 average, of under 4%.

Still, there are quite a few companies offering one that I would be happy own in my ISA. That is helpful, as I would want to spread my £20K over multiple shares to reduce my risk if a given choice performs poorly.

To illustrate the point, consider the financial services sector alone for a moment. I already own FTSE 100 shares in that line of business that yield well over 7%: Legal & General and M&G.

But there are others I do not own. For example, income investors could consider buying shares in insurance giant Phoenix (LSE: PHNX). Unlike many giants, it is not a household name. But it owns a number of well-known insurance brands.

In fact, taking its subsidiaries together, Phoenix is the UK’s largest long-term savings and retirement business with around 12m customers. That is a strong basis from which to generate free cash flows (one reason billionaire investor Warren Buffett has always been so keen on insurance shares).

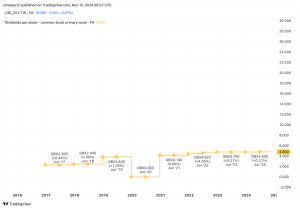

Those cash flows have enabled Phoenix to grow its payout per share annually in recent years, something it has said it plans to keep doing.

One risk I see is its mortgage book. If the property market suddenly sinks, the asset value could fall further than expected, hurting Phoenix’s earnings.

Aiming for 7%

With a number of quality blue-chip shares offering yields higher than 7%, it would be possible to hit that target even including some shares yielding less than 7%

That is helpful as I would not want to invest only in the financial services sector, despite its attractions. Fortunately, in today’s market, I think I could realistically target a 7% yield for my ISA while diversifying across blue-chip shares in different lines of business.

This post was originally published on Motley Fool