There’s an abundance of stocks on the FTSE that are piquing my interest right now. On the flip side, I see a fair few I plan to steer well clear of.

Here’s one I’d love to buy more shares of if I had the cash, and one to which I’m giving a wide berth.

A stock I love

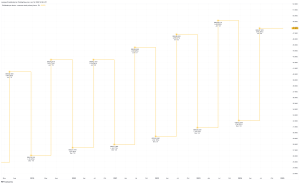

Without a doubt, one of my favourite stocks in my portfolio is Games Workshop (LSE: GAW). The price is up an impressive 120.8% in the last five years.

During that time, the firm has posted powerful growth. Last year, the business recorded its best performance ever, with revenue for the 53-week period to 2 June climbing to £525.7m from £470.8m the year prior.

With its growth, Games Workshop has become the leader in the miniature wargames industry. That gives it a competitive advantage over its peers.

CEO Kevin Rountree said in its latest results that the business has “a very clear strategy, which remains unchanged, a detailed operational plan for the year ahead and a great team to deliver it”.

There’s also passive income on offer with its 3.6% dividend yield. Its payout has steadily risen in the last decade. And with its incredibly strong balance sheet, I reckon we could see it keep increasing in the times ahead.

Competition is a threat. As the market becomes bigger and more lucrative, naturally more players will enter the space.

However, with its loyal customer base, I’m bullish on the stock. With that in mind, I’m eager to keep adding to my holdings in the months to come with any investable cash.

I’m steering clear

One stock I don’t plan on buying any time soon is Vodafone (LSE: VOD). In the last five years, the telecommunications titan has lost 52.1% of its value.

I reckon it could be a value trap. On paper, the stock looks dirt cheap at 72.1p. But I think there are plenty of other better options out there for investors to consider. Its shares trade on 19.4 times earnings. That looks too expensive to me.

I’m not writing off its turnaround potential. And in all fairness, it has made decent progress with its streamlining mission.

It has offloaded its Spanish and Italian businesses, raising €13bn in the process. With some of the proceeds, it intends to commence a share buyback scheme. In its latest Q1 update to investors, it said an initial €500m tranche of buybacks was almost complete.

But I see a handful of issues that deter me from dipping my toe in the market and buying some shares right now.

It still has plenty of debt on its balance sheet. It currently stands at €33.2bn. For comparison, its market capitalisation is £19.3bn.

On top of that, the business has struggled to grow its top line in recent years. Last year total group revenue fell by 2.5% to €36.7bn.

We’re still in the early stages of its turnaround. However, I’ll need to see its debt come down before I consider investing. That’s a major concern of mine.

This post was originally published on Motley Fool