While the S&P 500 as a whole has done well recently, a lot of its constituents have struggled. The strong overall returns are largely due to great results from a handful of stocks, especially in the tech sector.

This might indicate there’s a lot of value on offer elsewhere. But when it comes to US stocks, the opportunities that stand out to me the most are outside the S&P 500.

The Magnificent Seven

Analysts at Goldman Sachs are forecasting 10% gains for the S&P 500 – roughly in line with the historical average. And they are again anticipating strong growth from the companies known as the ‘Magnificent Seven’.

Importantly though, this isn’t the only area that’s expected to do well. Businesses that are exposed to the US economy are set to benefit from lower taxes from the new government.

Goldman’s forecast is that the Magnificent Seven will outperform again in 2025. But while the index as a whole is for a more modest gain, growth should come from a broader range of sectors.

The idea that smaller companies are set to do well is encouraging for the stocks I’m looking to buy. But I’m not just thinking about the next 12 months – I’m looking for long-term opportunities.

Five Below

Top of my list is Five Below (NASDAQ:FIVE) – the discount retailer that sells things for $5… or less. In terms of growth, the company’s looking to roughly double its store count by the end of 2030.

If it achieves this, I expect margins to expand as the business benefits from economies of scale. But even if it doesn’t, double the outlets should make for double the profits.

A price-to-earnings (P/E) multiple of 23 looks expensive, but it’s actually towards the lower end of its historic range. And the same is true on a price-to-book (P/B) basis (which I think is a better metric to use here).

Five Below price-to-book ratio 2015-24

Created at TradingView

The company depends heavily on households with low incomes and this source of revenue can be fragile. So while I’m looking to buy the stock at these prices, the risks shouldn’t be underestimated.

Polaris

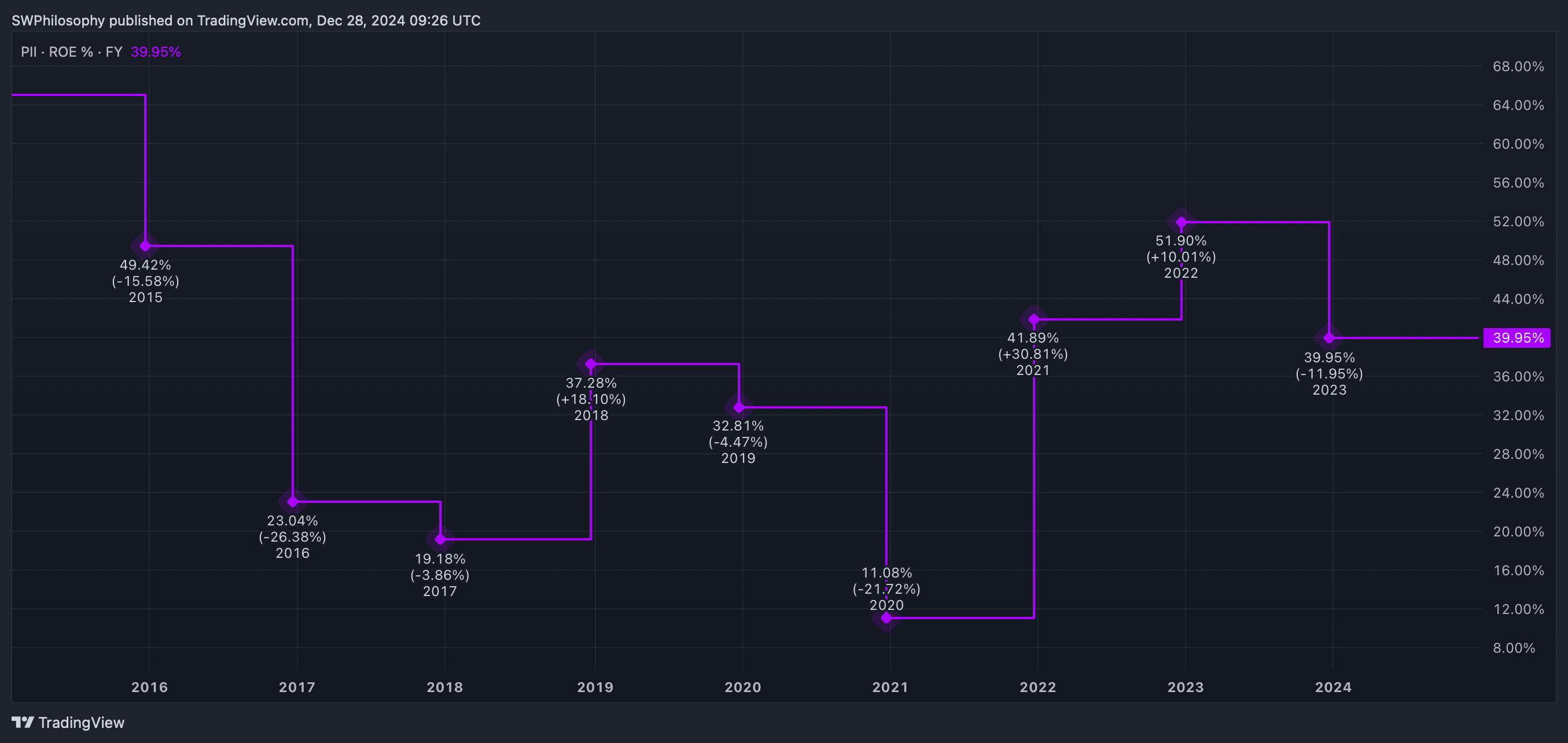

Polaris (NYSE:PII) makes recreational vehicles, including snowmobiles, motorbikes, and boats. It’s one of the oldest brands in the industry and its name is a key asset that allows it to earn strong returns on equity.

Polaris return on equity 2015-24

Created at TradingView

Aside from cyclicality, the big challenge for Polaris is that it’s easy for customers to switch to another manufacturer’s product. And that’s a long-term challenge.

As I see it though, the current share price is worth the associated risks. Earnings are highly cyclical, but the current share price seems to reflect a pessimistic outlook, which I think is temporary.

Polaris price-to-book ratio 2015-24

Created at TradingView

Right now, the stock trades at a price-to-book (P/B) multiple of 2.5. That’s unusually low and I think this is an opportunity to add shares in a quality company to my portfolio at a very decent price.

US stocks

I don’t consciously look for opportunities outside the S&P 500. But sometimes companies like Five Below and Polaris present opportunities I find attractive.

In both cases, I’m hoping for something very positive over the long term. That’s why I’m looking to buy both in the New Year.

This post was originally published on Motley Fool