Lloyds‘ (LSE:LLOY) share price has surged by an impressive 47.2% over the past year. And yet, at 63.1p per share, the FTSE 100 bank still looks dirt cheap across various value metrics.

With a price-to-earnings (P/E) ratio of 9.3 times and 5.4% dividend yield for 2025, Lloyds shares look cheap based on expected profits and predicted cash rewards.

Finally, with a price-to-book (P/B) multiple just below one, the bank also trades at a slight discount to the value of its assets.

Risky business

But are Lloyds shares really the bargain they first appear? I’m not convinced.

On the plus side, revenues may improve and bad loans drop as interest rates fall. But the risks to profits (and consequently shareholder returns) remain considerable, including:

- Sinking margins as interest rates drop.

- Prolonged poor sales growth as the UK economy struggles to grow.

- Additional revenues and margin pressure as competition intensifies across sectors.

- High claims costs, if found guilty of mis-selling car loans by the regulator.

Against this backcloth, I believe Lloyds shares will continue delivering poor returns (its annual average is a paltry 1.1% since early 2015).

So while they’re cheap, I think they could end up costing me as an investor a packet in the long run.

I’m looking East

I’d rather invest my hard-earned cash in HSBC (LSE:HSBA) shares instead.

It faces the same industry pressures as Lloyds, like increasing competition and interest rate pressures. Its large operations in China also leaves it vulnerable to the country’s creaking property market.

Yet its significant emerging markets exposure provides long-term opportunities too. I’m expecting profits to lift off as rising wealth and population growth supercharge financial services demand.

The bank’s said that “over the medium to long term, we continue to expect mid-single digit year-on-year percentage growth in customer lending“.

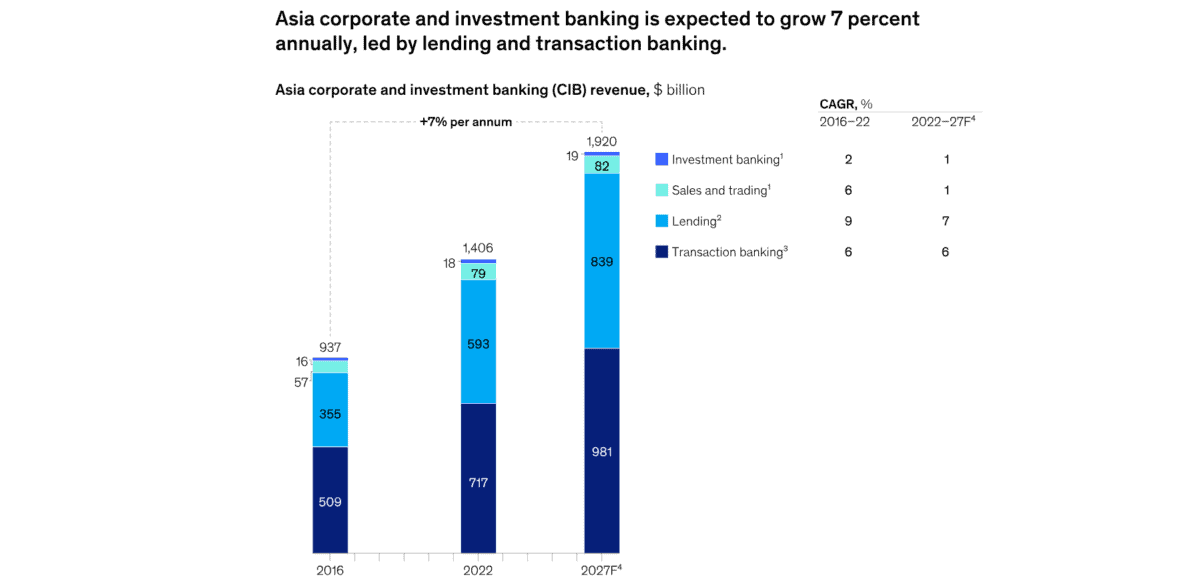

Analysts at McKinsey & Company expect Asia’s corporate and investment banking sector to grow 7% per annum between 2022 and 2027 alone, continuing the rapid expansion of recent years.

HSBC is trimming its non-Asian operations to better focus attention and resources on these hot growth markets, too. Last month, it announced plans to slim its investment banking operations in the US, UK, and Europe as it rejigs its global footprint.

An 8% annual return

I’m confident this will lead to exceptional shareholder returns in the years ahead.

Past performance is not a guarantee of future profits. But the 8% average annual return on HSBC shares over the past decade illustrate the potential gains investors could make.

That’s better than the 1.1% return on Lloyds shares over the same period. It’s also better than the 6.5% return delivered by the broader FTSE 100.

I don’t think HSBC’s blistering potential is reflected in its low share price. It trades on a forward P/E ratio of 8.6 times, which is even lower than that of Lloyds.

The bank’s 5.8% dividend yield also gives value investors something to shout about.

While it’s also not without risks, I think HSBC shares are worth a close look at today’s price of 897.2p.

This post was originally published on Motley Fool