A low price-to-earnings (P/E) ratio doesn’t always mean a stock’s cheap. But I think value investors should take a close look at Aercap Holdings (NYSE:AER) shares at a P/E multiple of 8.

The company makes money by buying and leasing aircraft. And it looks to me a potentially better pick than either of the FTSE 100 airlines.

Overview

With a few exceptions, airlines typically don’t like owning the aircraft they operate. And the reason’s straightforward – they’re expensive.

Buying and maintaining aircraft involves a lot of cash. By contrast, leasing involves a relatively small capital outlay early on and this gives airlines the possibility for rapid profits when demand’s strong.

The downside – and the reason I mostly don’t like airlines as investments – is that making ongoing lease payments requires constant cash generation. And in a cyclical industry, that’s very risky.

Aercap however, has the opposite approach. It used debt to buy aircraft outright and generates income by leasing them to airlines.

Valuation

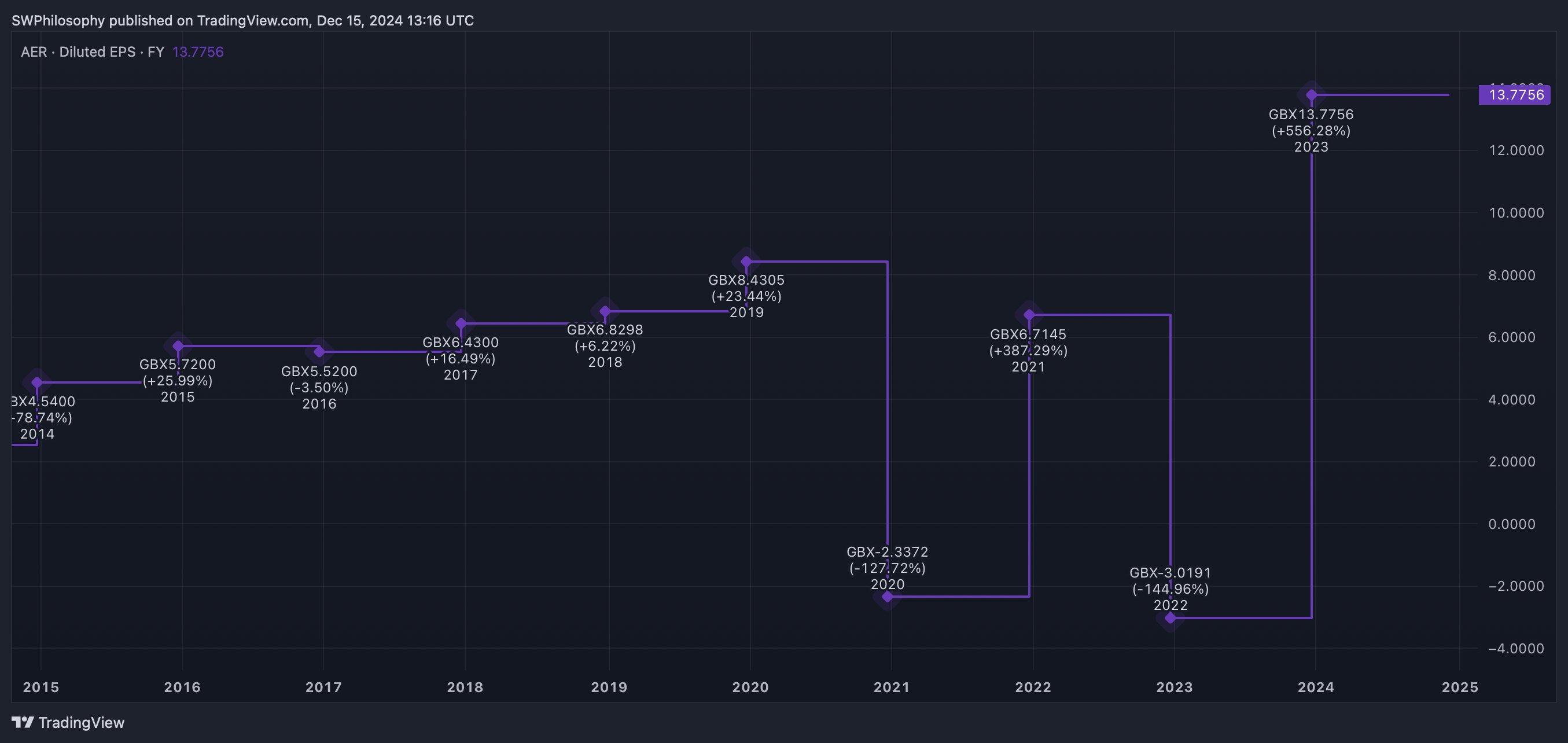

At a P/E ratio of around 8, the stock looks cheap, but investors should be careful with jumping to conclusions here. Aercap’s earnings don’t just go down in a cyclical downturn – they go negative.

Aercap EPS 2015-24

Created at TradingView

That means investors need to make enough when things are going well to offset the effect of loss-making years. This is why a low P/E ratio doesn’t automatically make the stock a bargain.

A better way of assessing the stock from a valuation perspective is the price-to-book (P/B) metric. Unlike the company’s earnings, its book value’s relatively stable through the business cycle.

Aercap P/B ratio 2015-24

Created at TradingView

On a P/B basis, the stock‘s towards the higher end of its historic range. Given this, my instinct is to keep the stock on my watchlist for the next downturn, rather than buying it now.

Aercap Vs airlines

When a downturn comes – and the cyclical nature of air travel means I’m convinced it will come – I’d rather buy shares in Aercap than an airline. I think the risk of bankruptcy’s much lower.

They can make big profits during strong periods and I could be wrong, but airlines that have to make lease payments can find themselves in trouble in a downturn. Aercap however, has a collection of assets it can sell if needed.

It’s worth noting that the firm‘s been selling its older aircraft at around twice what it carries them on its balance sheet at. And this has allowed it to reduce its share count by almost 25% since 2022.

Neither easyJet nor International Consolidated Airlines Group has managed to do this. And I see that as a clear reason to prefer Aercap over either of the FTSE 100 airlines.

When to buy?

I’m usually wary of cyclical stocks trading at historically high multiples. But Aercap shares might be good value right now, even given the threat of a downturn.

The company’s managed an average 10% return on equity over the last decade. On top of this, it’s selling aircraft at twice their book value.

Given this, a P/B multiple of 1 for the stock doesn’t look high. So there’s a decent case for considering the stock right now.

This post was originally published on Motley Fool