European stocks struggled to hold on to positive territory on Thursday, amid mixed results from a bevy of blue chip companies, with disappointing results from Credit Suisse and a warning over inflationary pressures from Unliever.

Early gains for the Stoxx Europe 600

SXXP,

eroded as it traded flat at 473, putting a second day of gains on the line. The euro

EURUSD,

was steady and the pound

GBPUSD,

was modestly higher. Investors on both side of the Atlantic will be closely watching U.S. inflation data, due later.

Economists surveyed by The Wall Street Journal were forecasting January consumer price inflation will rose 7.2% annually, following a nearly 40-year high of 7% in December. Stock futures

ES00,

YM00,

were mixed, with Nasdaq-100 futures

NQ00,

lower ahead of those data.

Bond yields have been ratcheting up globally on expectations of central bank policy tightening, though fallout from the COVID-19 pandemic continues to linger. After a recent respite, the yield on the 10-year German bund

TMBMKDE-10Y,

was up 3 basis points on Thursday to 0.246%.

Read: Will hot inflation data kill the stock-market bounce? What investors want to see

Earnings were driving the action in Europe. Near the top of the gainers’ list, Siemens’

SIE,

stock climbed more than 5%, after the German engineering and technology conglomerate reported forecast-beating revenue and orders, which jumped 42% on a comparable basis.

Several major banks reported, including Société Générale

GLE,

which reported a net profit rise that beat analysts’ expectations, and set a shareholder distribution policy equivalent to 2.75 euros ($3.14) per share. Those shares jumped over 4%.

Credit Suisse shares

CS,

CSGN,

meanwhile, dropped 4%, after the Swiss bank reported a wider-than-expected fourth-quarter loss as revenue fell. The bank warned 2022 will be a year of transition as its balance sheet and reputation have taken hits, with 2021 marked by massive losses from the twin collapse of Greensill Capital and Archegos Capital Management.

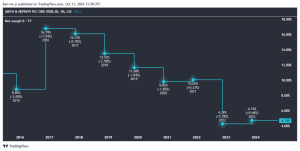

Shares of consumer-goods giant Unilever

UL,

ULVR,

fell more than 2%. The company reported higher 2021 net profit that beat market expectations, and said it plans to launch a share buyback program worth up to $3.43 billion. But it warned of rising costs due to inflationary pressures, in the first half of 2022 that could total more than €2 billion ($2.2 billion).

“This may moderate in the second half to around €1.5 billion, although there is currently a wide range for this that reflects market uncertainty on the outlook for commodity, freight and packaging costs,” the company said.

Thyssenkrupp shares

TKA,

fell nearly 3%, as the German industrial group said first-quarter sales and earnings beat expectations, though it said continuing supply shortages and a slowdown in the automotive industry hit growth.

The company reported break-even cash generation as a key target for 2022, but said negative free cash flow before mergers & acquisitions of €858 million came in below consensus expectations.

Another big name was AstraZeneca

AZN,

AZN,

which reported higher revenue, but swung to a fourth-quarter loss due to a charges related to its acquisition of Alexion Pharmaceuticals. The U.K.-Swiss pharmaceutical group expects to incur a $2.1 billion post-acquisition restructuring charge.

Shares of ArcelorMittal

MT,

MT,

dropped more than 2%, after Europe’s biggest steelmaker reported higher fourth-quarter sales and adjusted earnings, helped by higher steel prices. But earnings fell short of expectations.

This post was originally published on Market Watch