Investing in exchange-traded funds (ETFs) can be a great way to diversify a Stocks and Shares ISA in a cost-effective way.

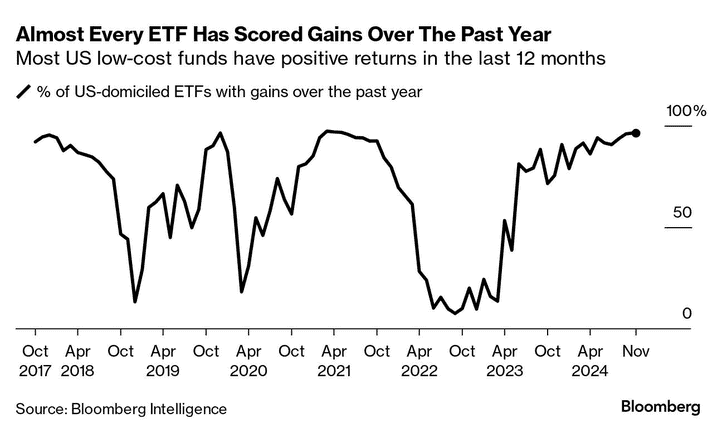

Putting money in one of these financial instruments has been especially lucrative over the past 12 months. According to Bloomberg Intelligence analysis, 96% of ETFs in the US have posted positive returns over this period, with the majority of products delivering double-digit returns.

Bloomberg comments: “If you’ve put money in an exchange-traded fund — those cheap products designed for the masses — you’re likely enjoying stellar gains, no matter what you’ve been betting on”.

Strong performers

It’s not just US funds that have been performing strongly over the past year. A number of London-listed ETFs I’ve bought for my own portfolio have delivered healthy gains.

The Xtrackers MSCI World Momentum ETF, for instance, has risen by exactly a third since November 2023. And the HSBC S&P 500 ETF’s up 28%, bolstered by the bull run in US shares.

UK-focused funds have also performed valiantly in recent times. The iShares Core FTSE 100 ETF’s up 15% since last November.

Past performance is no guarantee of future returns. And predicting how shares and funds will perform near-term in the current geopolitical and macroeconomic landscape’s especially tough.

But this doesn’t mean I’m not looking for more ETFs to buy. This is because I invest with a long-term view. The L&G Cyber Security ETF’s (LSE:ISPY) a fund I think ISA investors like me should pay close attention to.

L&G Cyber Security ETF

This fund — which is administered by Legal & General — has rocketed in value since its launch in 2015. It’s up 24% in the past 12 months alone.

The broader tech sector’s been powered by the buzz around artificial intelligence (AI) during the last year. This fund meanwhile, has been helped by speculation that AI development will create a new opportunity for hackers and other cyber criminals.

Analysts at Fortune Business Insights think the global cybersecurity market will be worth $562.7bn by 2032. That represents compound annual growth of 14.2% from today’s levels.

Investing in this L&G cybersecurity ETF could be an effective way to capitalise on this growing market. It holds shares in more than 30 sector players including Cloudflare, Crowdstrike, Palo Alto, and Cisco Systems.

Operational problems (like system failures and competitive pressures) could impact the performance of these companies. But by investing in a basket of these cyber firms, the impact could be minimal.

A wider threat is that 90% of the fund’s earnings are reported in US dollars. It could be more vulnerable to movements in the greenback than ETFs with wider currency diversification.

But on balance, I still expect the fund to keep delivering excellent long-term returns.

This post was originally published on Motley Fool