The best time to buy shares in any company is when they’re out of favour with investors. And this has been the case with InterContinental Hotels Group (LSE:IHG).

The stock’s down 22% over the last month, but it’s outperformed the FTSE 100 over the decade. So could this be my opportunity to buy a stock I’ve had my eye on for some time?

Cash generation

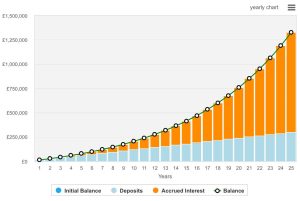

The thing I like most about InterContinental Hotels Group is that it has a business model that delivers huge cash generation. And at the end of the day, that’s what investing’s all about.

Over the last 10 years, the company’s reinvested just 5% of the cash it has generated through its operations back into its business. The rest has been made available for shareholder returns.

Importantly however, this hasn’t come at the expense of growth. Revenues have grown at an average of 12.5% a year during this period, which includes the heavily-disrupting Covid-19 pandemic.

A business that can grow while returning almost all of the cash it generates to shareholders has to be worth a closer look. And InterContinental’s success over the last 10 years hasn’t been an accident.

Business model

The key to the company’s success has been its asset-light business model. In other words, it doesn’t actually own the hotels in its network. Instead, it enters into franchise agreements with individual operators. In exchange for a percentage of revenues, the hotels benefit from its marketing, booking management system, and expertise.

As a result, InterContinental doesn’t pick up any of the costs associated with running hotels. Things like maintaining buildings, paying staff, and buying supplies are all handled by individual operators.

That means there isn’t much for the company to spend its cash on internally. And with the cost of adding a hotel to its network negligible, most of its earnings become available to shareholders.

Why is the stock down?

All of this sounds great, but it means the obvious question is why the stock’s down? If the business is a cash machine, why have investors been going off it over the last few months?

The company’s latest update was generally strong, but there was one important negative point that stood out. Higher net debt has been leading to an increase in interest costs, cutting into profits.

This is partly the result of IHG using its cash for share buybacks, instead of boosting its balance sheet. As such, the decision to spend a further $900m on shares repurchases has to be considered a risk.

I’d rather see the cash used for debt reduction, but that’s a minor objection to what is otherwise a terrific company. Hotels might not look exciting, but I think this is an unusually good business.

Time to seize the moment?

When shares in a quality company fall 22%, I think investors should pay attention. But a stock isn’t automatically cheap just because its share price is lower than it once was.

The stock still trades at a price-to-earnings (P/E) multiple of 28, which is high by most standards. So while I like the business very much, I think there are better opportunities for me elsewhere.

This post was originally published on Motley Fool