FTSE 250 airline Wizz Air (LSE:WIZZ) saw its share price fall 20% in a day after its latest earnings release, as engine reliability issues caused profits to dive 98%. But this looks a lot like a short-term issue.

I don’t see this as a good reason to avoid the stock. But the business also has a fundamental pricing dilemma that I think is much more significant and that’s enough to keep me well away.

Engine trouble

Despite revenues increasing slightly, Wizz reported a 98% decline in profits. This is partly due to 46 of its 179 aircraft being grounded due to engine issues.

The company has been leasing planes and staff to boost its capacity, but this has been expensive. Nonetheless, I don’t think this is why the stock just fell 20%.

There are three reasons for my view. One is that the engine troubles are likely to be a short-term issue and another is that Wizz is receiving compensation.

Most importantly, though, this isn’t news. The market has known about this since March, so I don’t think it’s why the stock suddenly fell after earnings.

A dilemma

I think Wizz is facing a dilemma. Over the long term, it either has to either find a way to charge lower prices than its rivals, or charge higher prices without losing customers.

I don’t like the company’s chances in a pricing war. Put simply, I don’t think the firm is in a strong enough financial position.

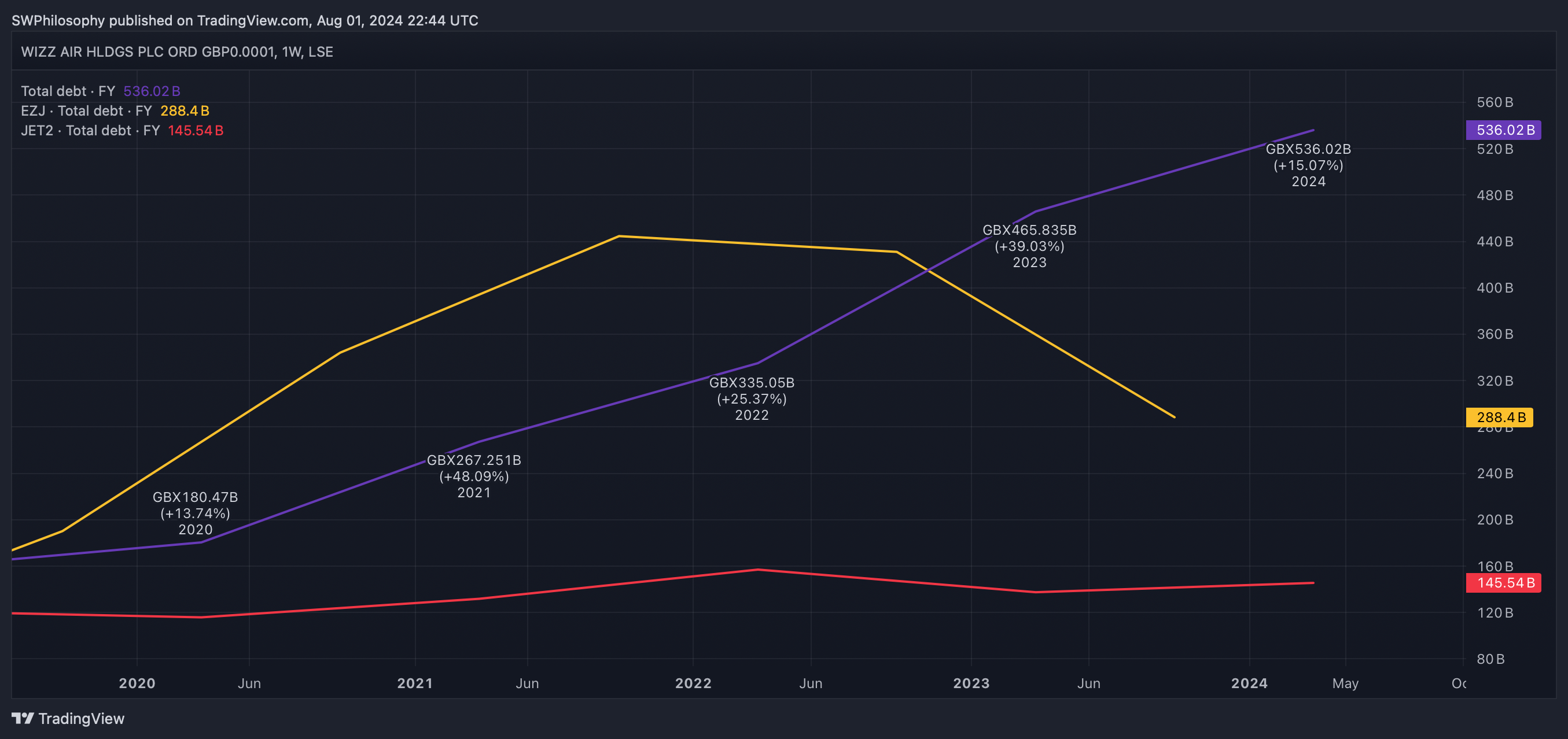

Wizz vs. easyJet vs. Jet2 Total Debt 2019-24.

Created at TradingView

A lot of airlines took on debt during Covid-19. But unlike a number of its rivals, Wizz still has a lot of this left on its balance sheet.

That puts it in a bad competitive position when it comes to keeping costs down. Paying out more in interest makes it hard to charge customers lower prices.

Pricing power

The alternative is to try and maintain prices. But CEO Jozsef Varadi stated that competition is making this difficult.

This is likely to weigh on profits. The latest news is that net income for the year is likely to be between 25% and 30% lower than previously expected.

Short-haul air travel is something of a commodity, so this shouldn’t be a big surprise. The trouble is, the airline said the opposite back in May.

That’s why I think the stock has been crashing. Wizz’s balance sheet means it needs to be able to maintain its prices, but this looks like a challenge.

Reasons to sell

Aircraft being grounded means profits at Wizz are down dramatically. But I don’t think this is the biggest problem.

As I see it, Wizz faces a dilemma. Its balance sheet makes it ill-equipped for a pricing war, but maintaining prices in a commoditised industry is nearly impossible.

That’s why I’m avoiding the stock, even after the latest decline. I don’t mind taking advantage of a downturn to invest in an airline, but this isn’t the one I’d choose.

This post was originally published on Motley Fool