These FTSE 100 shares are on sale right now. Here’s why I think dip buyers should have a close look at them.

Antofagasta

Investing in mining stocks like Antofagasta (LSE:ANTO) can be an uncomfortable ride at times. Profits are highly sensitive to the price of the underlying commodity or commodities they produce, which can slump on signs of rising supply or sinking demand.

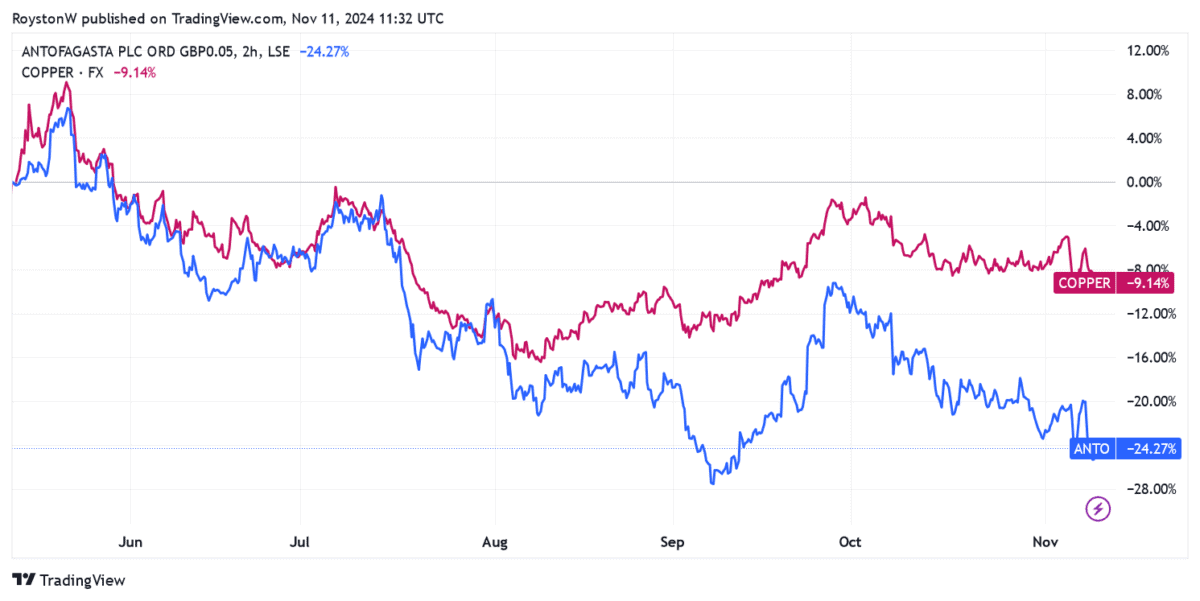

Unfortunately for Antofagasta, it’s also disappointed on the production front in 2024, causing its share price to slip even more sharply. In July, it warned on full-year output because of lower ore grades and recoveries at its Centinela project.

Market sentiment towards the mining giant could remain weak, too, if production issues continue and China’s economy keeps spluttering. But as a long-term investor, I think recent weakness represents a dip buying opportunity.

While down almost a quarter since 11 May, Antofagasta’s share price is up 94% over the past five years. Over that time it’s outperformed the broader copper price, which has risen 63% over that time.

It reflects investor optimism over the long-term copper share price and the FTSE firm’s potential to capitalise on this. It’s the world’s fifth-biggest red metal producer, and huge investment in key mines (like Los Pelambres) means mineral resources have leapt since 2019.

They now sit at a whopping 2.5bn tonnes.

Expansion is continuing at current mines, and Antofagasta has a string of exploration projects in Chile and the broader Americas region. It could be one of the best ways to capitalise on the growing green economy.

Associated British Foods

Budget clothes retailer and food supplier Associated British Foods (LSE:ABF) also operates in a fast-growing market. Like Antofagasta, its share price has also slumped due to recent market issues, and is down 16% over six months.

ABF plummeted in September after saying wet weather dampened sales at Primark. It was therefore tipping a 3.1% like-for-like sales decline for July to September, worsening from a 0.6% drop in the prior quarter.

Poor weather, combined with stark market competition, are constant threats to clothing retailers. Yet despite this, I believe the FTSE firm merits a close look from patient investors.

Demand for so-called fast fashion continues to strengthen. And this is helping to drive ABF’s profits through the roof. Adjusted operating profit at Primark leapt 51% in the last financial year (to September), driving profit at group level 32% higher.

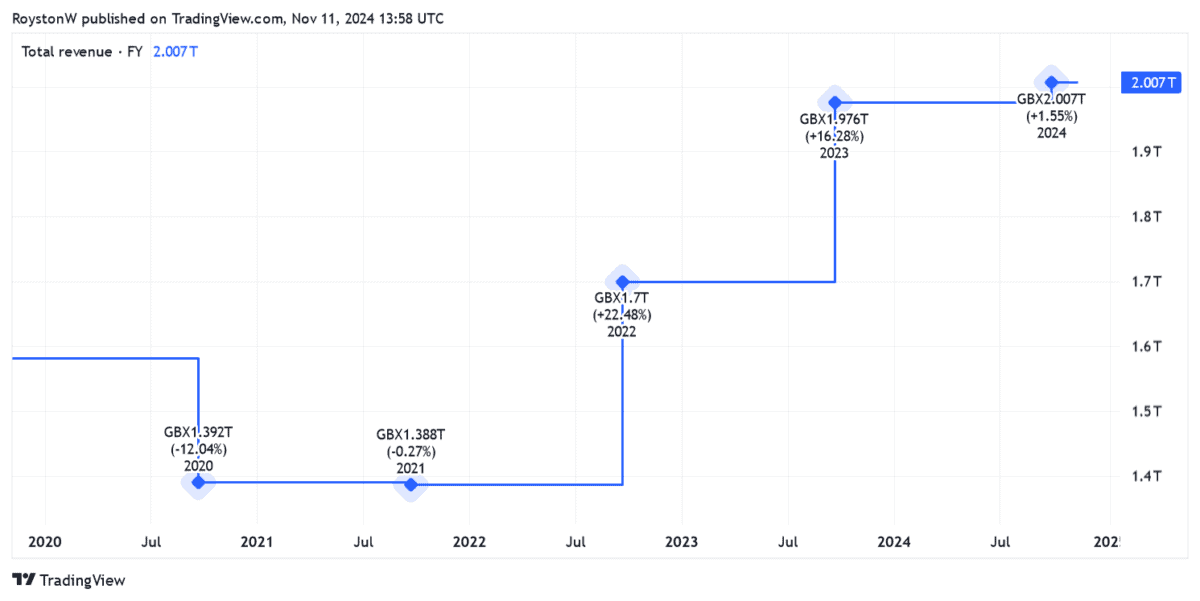

Primark is effectively expanding its store network across the US and Europe to capitalise on this market opportunity. As the chart shows, sales have risen strongly for years since the end of Covid-19 lockdowns.

And ABF thinks its store rollout plan should keep paying off. It’s expecting new stores “[will] contribute around 4% to 5% per annum to Primark’s total sales growth for the foreseeable future“.

Given its exceptional record of execution and strong brand power, I expect ABF’s shares to rebound sharply following recent weakness. Trading on a forward price-to-earnings (P/E) ratio of just 12 times, I think it’s a great stock to consider buying.

This post was originally published on Motley Fool