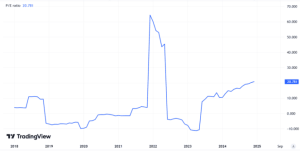

The Fresnillo (LSE: FRES) share price has collapsed since its 2021 peaks, and it didn’t move much in response to H1 results on 30 July.

That’s despite, in the words of CEO Octavio Alvídrez, “an increase in profitability over the period, driven by a steady production performance combined with careful cost management and higher gold and silver prices.“

The company lifted the interim dividend to 6.4 cents (5p) per share. That’s still a yield of only 0.8% though, so maybe that’s why investors are less than excited. Over at Rio Tinto, for example, there’s a forecast yield of 6.8% on the cards.

I wonder if, also, the muted response is down to the bit about higher gold and silver prices. Those are driven by whichever way sentiment is blowing, and could just as easily fall tomorrow as rise further.

And gold, at $2,390 an ounce at the time of writing, might be a bit peaky now. It’s been climbing steadily since late 2022, and it’s up 60% in the past five years.

At $28 per ounce, silver is only just off its five-year high. Some observers do expect it to go a fair bit higher though.

Judging solely by precious metals prices, I can see why investors might want to stay away. But I’ve always much prefered the idea of buying mining stocks over the metals themselves. And I can’t help feeling those who follow the bears might miss out on something here.

Show me the cash

Never mind the price of gold, it’s profits that count. And forecasts at the moment are very strong for Fresnillo.

They suggest earnings per share (EPS) could more than double between 2023 and 2025. And that would drop the price-to-earnings ratio (P/E) down under 10.

In the first half, adjusted revenue grew by 9% to $1,560m, and we saw EBITDA soar by 39% to $392m.

That’s impressive, but rising costs make me a bit nervous. The period also saw production costs rise by 9.1%, while total cost of sales increased by 3.3%.

Still, bottom-line profit is up 31% to $117m. And free cash flow came in at $187m. Cash flow can be very volatile in this business though, having managed to reach just $19m in the first half of 2023.

My bottom line?

For me, the bottom line for Fresnillo has to be about silver. It shovels up lots of gold. But it’s the world’s biggest silver producer.

And while the price of silver has risen close to $30, it was up in the $40 range back in 2011. And it’s been even higher in the past.

Those who think silver is set for a bright future in the coming years might see Fresnillo shares as super cheap now. And the board did keep its upbeat full-year guidance unchanged.

Me? I don’t have a crystal ball, so I think it might be safer if I sit this one out.

This post was originally published on Motley Fool