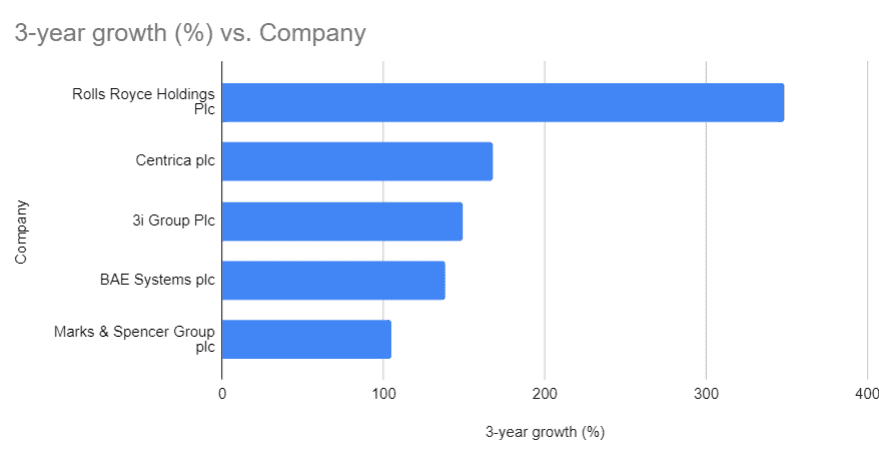

Rolls-Royce has been the undefeated champion of FTSE 100 growth stocks for the past three years, gaining 350%. That’s more than double the second-highest on the list, Centrica, which is up 167%.

However, after looking at the figures last month I decided to sell my Rolls-Royce shares. I may be proven wrong but I believe the stock is heavily overbought and heading for a sharp correction. Don’t get me wrong, I’ve enjoyed watching the rally — and the returns far outmatched anything else in my portfolio!

But as we head into a period of economic uncertainty, I’m rebalancing my portfolio into more reliable income shares. Still, there remains one promising growth stock that I’ve had my eye on for some time. Could this undervalued gem be the next mega-rally share like Rolls?

Betting on the future

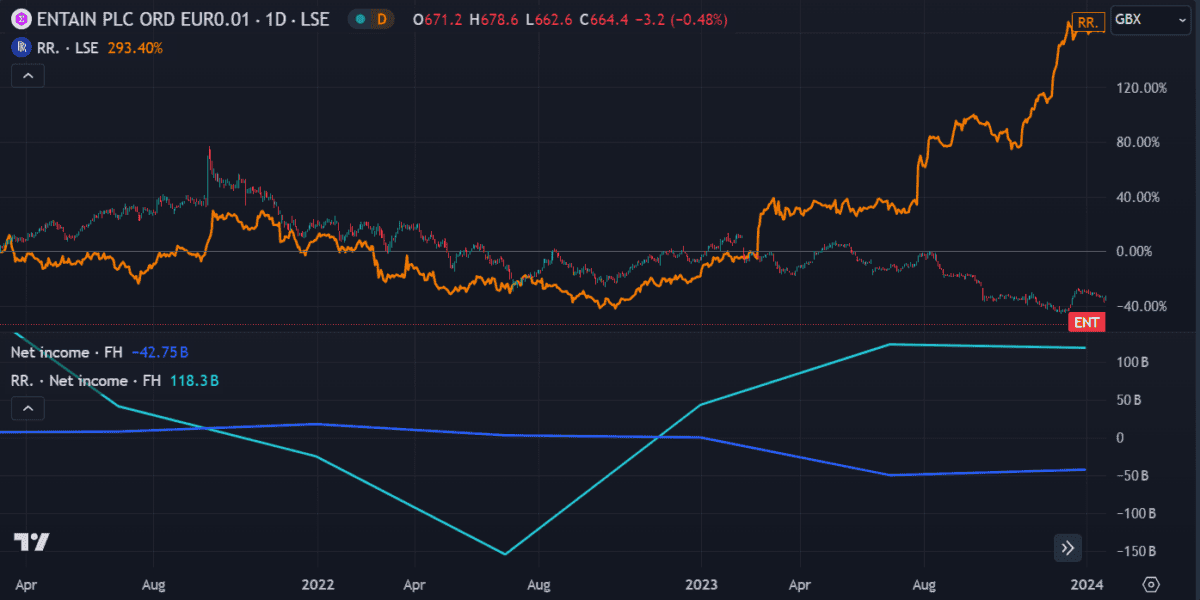

Down 65%, Entain (LSE: ENT) has been the worst-performing company on the FTSE 100 list for over three years. The international sports betting and gambling company has had a tough time recently, as high inflation forces consumers to cut spending on non-essential activities.

In the FY 2023 earnings results, earnings per share (EPS) fell from 6.4p to a £1.41 loss and net income came out at a £870m loss, leading the company to become unprofitable. Subsequently, its 3.4bn debt load is now 24% higher than its equity.

Things look pretty dismal, to be honest.

But circumstances may be improving. The Euro final has brought fans flocking to the popular Entain-owned bookies Ladbrokes, helping boost the share price by 6% this week.

Earnings are forecast to increase at an annual rate of 97%, which could bring the company’s price-to-earnings (P/E) ratio down to 24.3. That’s still slightly higher than the main competitor, Playtech (17.8), but much closer to the industry average of 22. It’s certainly a step in the right direction.

Independent analysts evaluating the stock are in good agreement that the price will rise more than 50% in the coming 12 months. On paper, that should bring the company back into profitability. If I remember correctly, Rolls was in a similar position not long ago.

Reliance on economic recovery

At face value, comparing a multinational aerospace and defence engineer to a gambling company might seem illogical. And the factors that drove the Rolls rally certainly aren’t comparable to Entain. But considering it was over £22 only a few years ago, the current £6.66 price looks cheap to me. A return to those prices in the coming years could triple any investment made today — similar to how the Rolls share price tripled since October 2021.

Realistically, expecting anything to grow that much is hopeful. There’s no concrete evidence yet that the economy will improve. The general election results ignited some positive sentiment regarding the UK stock market. But changes to listing requirements have rattled some shareholders. Some worry that the new rules, aimed at keeping companies from leaving for the US, will dilute the quality of a London listing.

Overall, I think there’s a good chance Entain will begin a recovery this year. Maybe not quite to the extent of Rolls-Royce, but who knows? I like its odds, so my money will be on Entain in my next buying round.

This post was originally published on Motley Fool