Michael Murray is the chief executive of Frasers Group (LSE:FRAS). That’s the FTSE 100-listed owner of numerous retail brands, including Sports Direct. And he’s decided to waive his £1m salary.

This means his remuneration is entirely based on the company’s stock market performance. That’s because he’s part of an Executive Share Scheme that will see him receive stock worth £100m, if he can get the group’s share price to £15 — for 30 consecutive days — by the end of October 2025.

I’ve been crunching some numbers to see whether he’s likely to receive his bumper bonus.

Current situation

All things being equal, for the share price to reach £15, the group’s annual profit will need to increase by 74%. For the year ending 27 April 2025 (FY25), analysts are forecasting a profit before tax (PBT) of £586m.

Even if the group exceeds all expectations, the required earnings growth is unlikely to come organically. I suspect it will need to complete at least one major acquisition for Murray to earn his multi-million pound bonus.

Having said that, the group’s share price has been the best performer on the Footsie over the past five years.

Minority interests

In recent times, Frasers has built stakes in a number of retail businesses. But some of the companies in which the group has invested are small and others are barely profitable.

For example, the company owns 24% of boohoo. The online fashion retailer is expected to make a loss before tax of £29m in its current financial year (28 February 2025). Until its business model can be proven to be sustainable, acquiring more shares is unlikely to materially change the market cap of Frasers.

As a contrast, analysts are forecasting that Currys, in which Frasers has a 6.59% stake, will make a PBT of £215m, for the year ending 26 April 2025. But even if Murray bought the rest of the electrical retailer, which currently has a stock market valuation of £914m, Frasers would still need another £250m of profit for the share price to reach £15.

Intriguingly, the group also owns 7.99% of Hugo Boss. The German fashion house reported a PBT of €357m (£303m) for the year ended 31 December 2023. This would go a long way to finding the extra earnings that Murray needs.

But it wouldn’t come cheap. It has a market cap of €2.68bn (£2.28bn).

Does this matter?

To be honest, I suspect the October 2025 deadline isn’t that important. The incentive was approved by shareholders in 2021. And if necessary, I believe it would be extended again. That’s because 73.5% of Frasers is owned by one person, Mike Ashley, who happens to be Murray’s father-in-law.

But leaving aside the issue as to whether £15 is attainable, the company’s shares do appear to offer good value at the moment. This suggests they could soon start to rise.

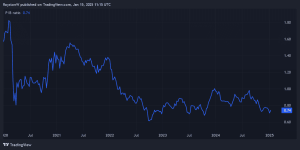

Analysts are forecasting earnings per share of 100.39p for FY25. With a current (22 August) share price of 860p, the stock currently has a forward price-to-earnings ratio of 8.6.

This is lower than, for example, JD Sports.

Of course, I’d have to do more research before deciding whether to invest or not. But irrespective of whether I do take a stake, it will be interesting watching what the company does between now and October 2025.

This post was originally published on Motley Fool