From a customer’s perspective, bank fees can be very annoying. From a shareholder’s, though, they may be less annoying if they help a bank earn profits and deliver dividends. Take HSBC (LSE: HSBA) as an example — the dividend yield is currently a juicy 7%, and the lender is generating significant excess capital despite funding that.

Could things get even better from here – and ought I to invest?

Impressive dividend payout

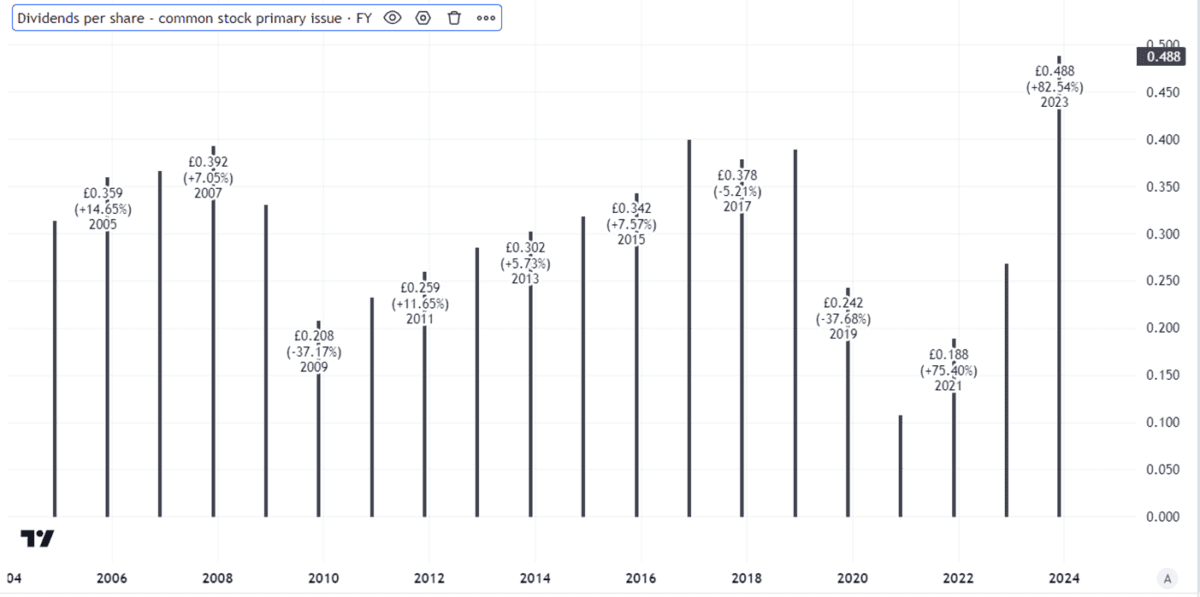

To begin, we should put the current dividend in context. The high yield is based on the payout last year. But that was unusually large.

Created using TradingView

Dividends are never guaranteed – and the HSBC payout is a good illustration of this.

As the chart above shows, the dividend has been cut twice over the past couple of decades, once after the financial crisis and again during the pandemic. On both occasions, it took many years for it to get back to where it had been before the cut.

That is a common risk with banks, including HSBC. When the economy does well, it is easier for them to make money. But when economic storm clouds gather, that can hurt profits – and dividends can be cut fast.

In this sense, HSBC’s increased exposure to Asia due to moves like getting rid of Canadian and French businesses means that any economic downturn in Asia may hit the bank more compared to better diversified rivals.

Solid performance

Still, looking at its interim results released today (31 July), the bank seems to be performing well.

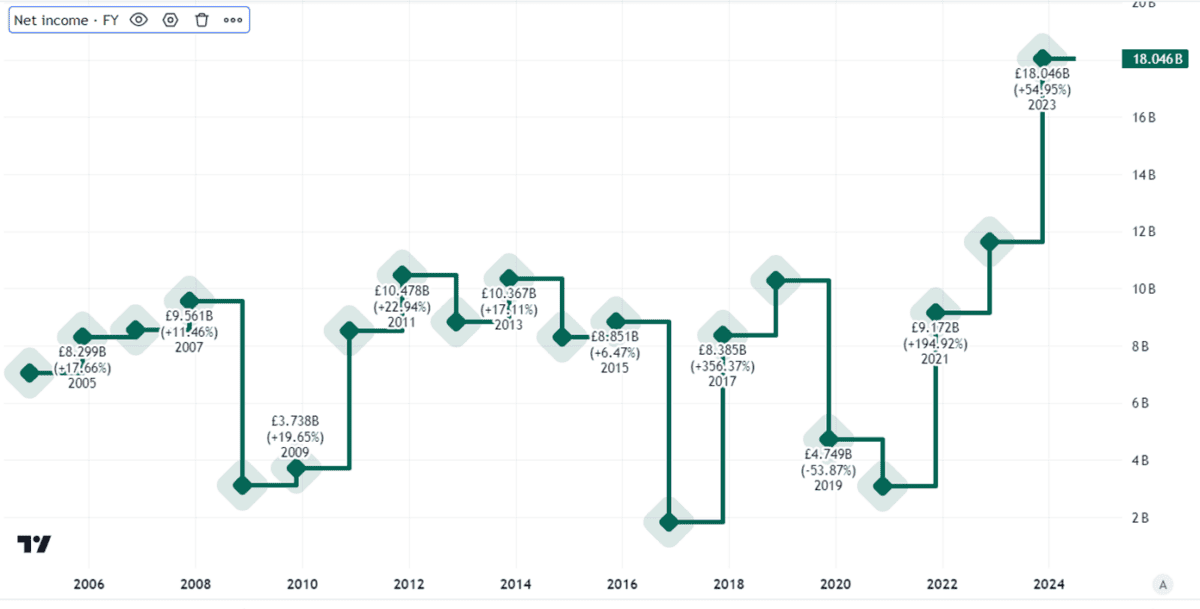

For the first half of the year, revenue fell slightly compared to the same period last year. So too did profits after tax. That fall was only around 2%, though, and profits after tax still came in at a whopping £13.7bn. That continues the strong performance seen last year.

Recent profits after tax have been far above historic levels, so there is a risk we are in a boom time for HSBC that will not last. On the other hand, bulls could argue that the bank’s strategic focus and cost-cutting in recent years have put it in better shape than before and the strong recent results demonstrate that.

Created using TradingView

Indeed, the company generated so much excess cash that it announced plans to buy back up to around £2.3bn of its shares over the next three months.

Still, while there was a special dividend in the first half, the two ordinary dividends declared for the six-month period were the same as last year.

I’m not buying

HSBC shares are up just 9% in five years, so the dividend yield is a key part of the investment case at the moment in my view.

Strong cash generation, as suggested by the share buyback, is reassuring.

But the flat ordinary dividend combined with historically high profit levels over the past 18 months mean that I fear the dividend could be cut when there is another banking downturn. For now I have no plans to invest.

This post was originally published on Motley Fool