The FTSE 100 boasts some of the most exciting passive income stocks in the world. I own a heap of them, including Phoenix Group Holdings, which yields 9.84%, and Legal & General Group, which yields 8.89%.

Those are really incredible rates of income, and will look even better when base rates are finally cut and savings rates and bond yields tumble.

I like to diversify to spread the risk around, and three more tip-top FTSE 100 blue chips caught my eye today.

Top dividend play

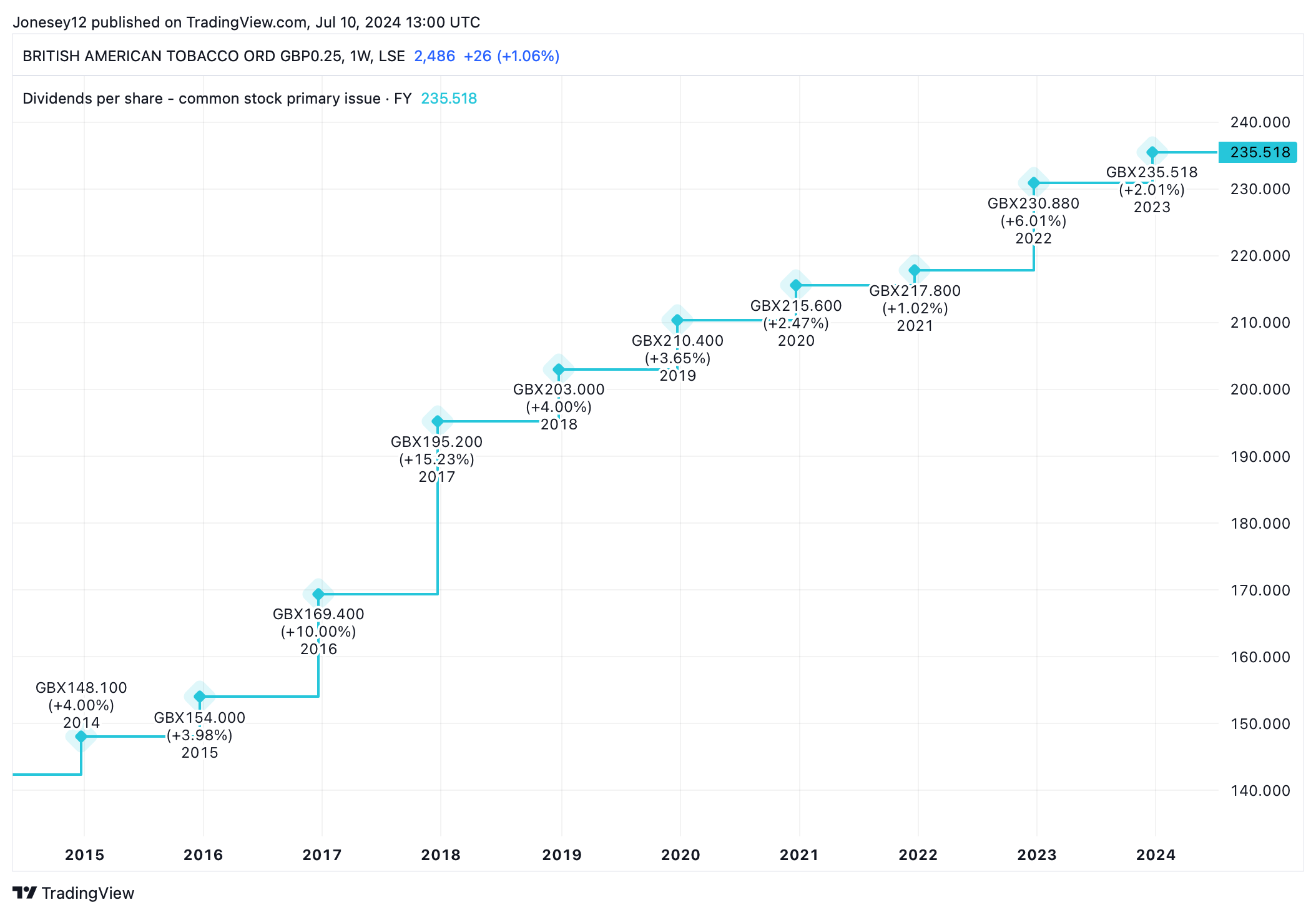

The first is cigarette giant British American Tobacco (LSE: BATS). Personally, I don’t buy tobacco companies, but that doesn’t stop me checking them out from time to time, to see what I’m missing. In this case, it’s a bumper 9.51% yield. Better still, it’s a growing income. Let’s see what the charts say.

Chart by TradingView

Smoking may be in inexorable decline, but strong brand names like Rothmans, Dunhill, Benson and Hedges and Lucky Strike help slow the speed of descent. Alternative nicotine products like Vuse and glo may offset cigarette declines.

The stock is cheap, trading at 9.6 times earnings. Share price growth is likely to be in short supply, though. The British American share price has fallen 3.77% over the last year. It remains at the mercy of regulators. There are risks, but that income is hard to beat.

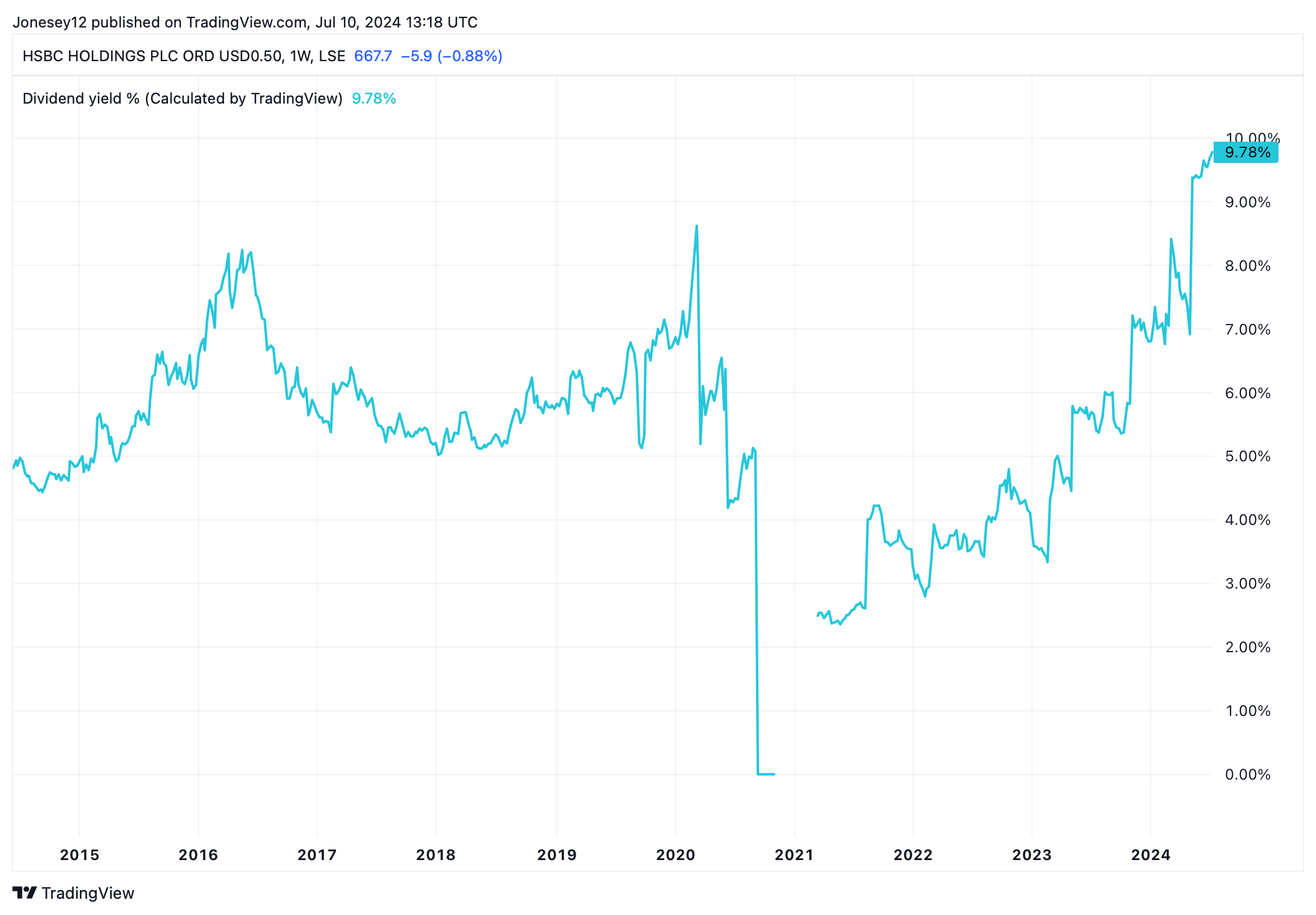

China-focused bank HSBC Holdings (LSE: HSBA) also offers a winning combination of a dirt-cheap valuation (7.44 times earnings) and a high trailing yield (7.29%). The HSBC share price is up 9.77% in a year but remains at the mercy of geopolitical events amid tensions between China and the West.

In February, it suffered a shock $3bn charge on its stake in a Chinese bank as bad loans mounted due to the country’s property slump. It still posted a 78% jump in full-year profits to £30.3bn, though. And unveiled a new $2bn share buyback.

FTSE 100 stars

The share price has dipped lately driving the yield towards an unbelievable 10%. Let’s see what the charts say.

Chart by TradingView

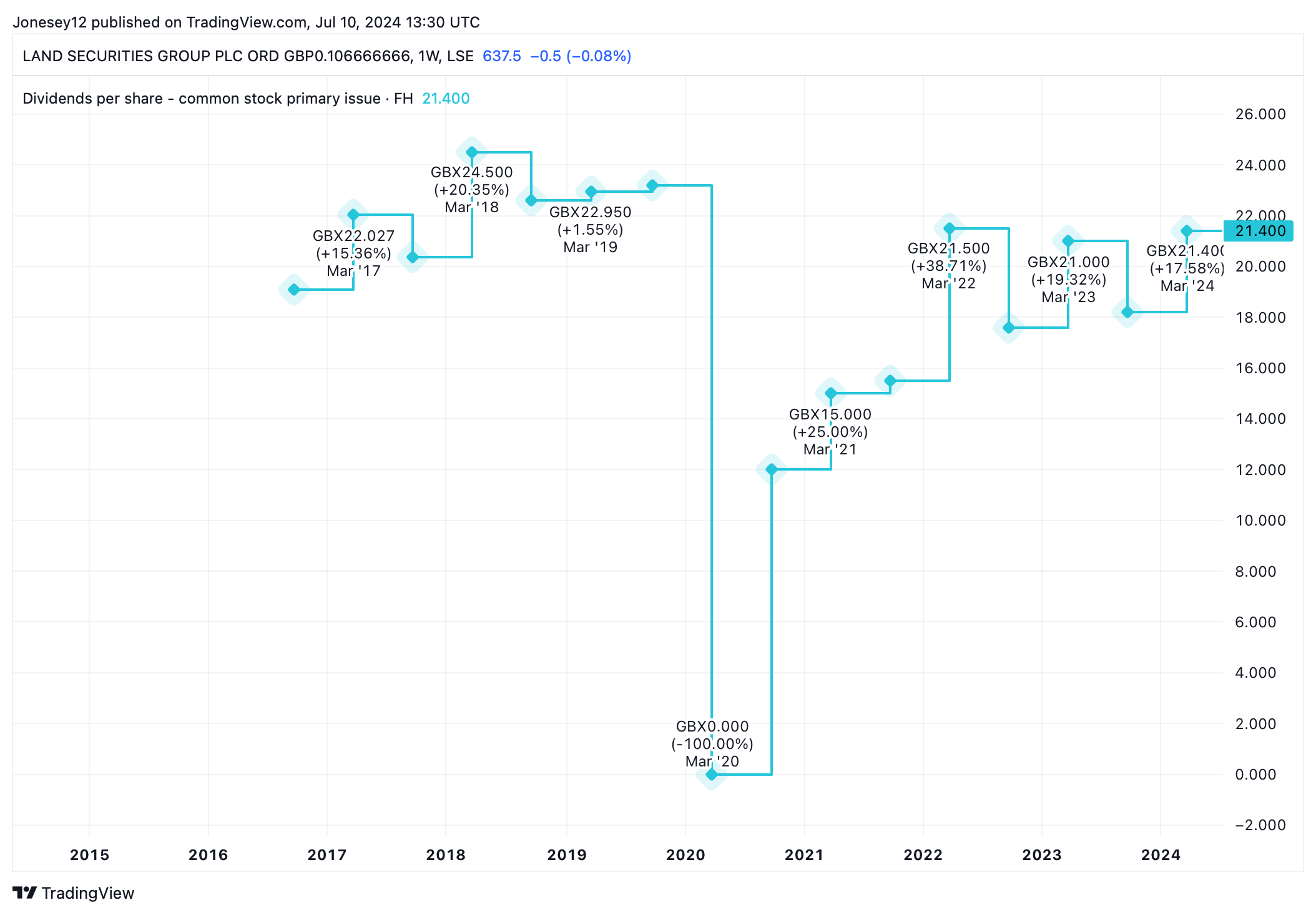

Finally, I’m tempted by Land Securities Group (LSE: LAND), which would give me exposure to a sector I don’t have at the moment, commercial property. It’s had a horrendous time lately, as Covid lockdowns and working from home hit retail centres and office blocks. High borrowing cost only made matters worse.

Yet when interest rates start falling, firms like LandSec could lead the recovery. That will both reduce its borrowing costs and make the group’s 6.4% yield look even juicier. Trading at 12.4 times earnings, it isn’t that expensive.

The company has made a loss in four out of the last five years, including a £341m loss in 2023. Yet its dividend track record is pretty solid, pandemic year aside. Let’s see what the charts say.

Chart by TradingView

If I split this year’s Stocks and Shares ISA allowance evenly between these three, I’d get an average yield of 7.73%. That would pay me a grand passive income of £1,467 a year.

As I said, I’d have to shun British American Tobacco. I’d replace that by buying even more shares Phoenix, which yields marginally more.

This post was originally published on Motley Fool