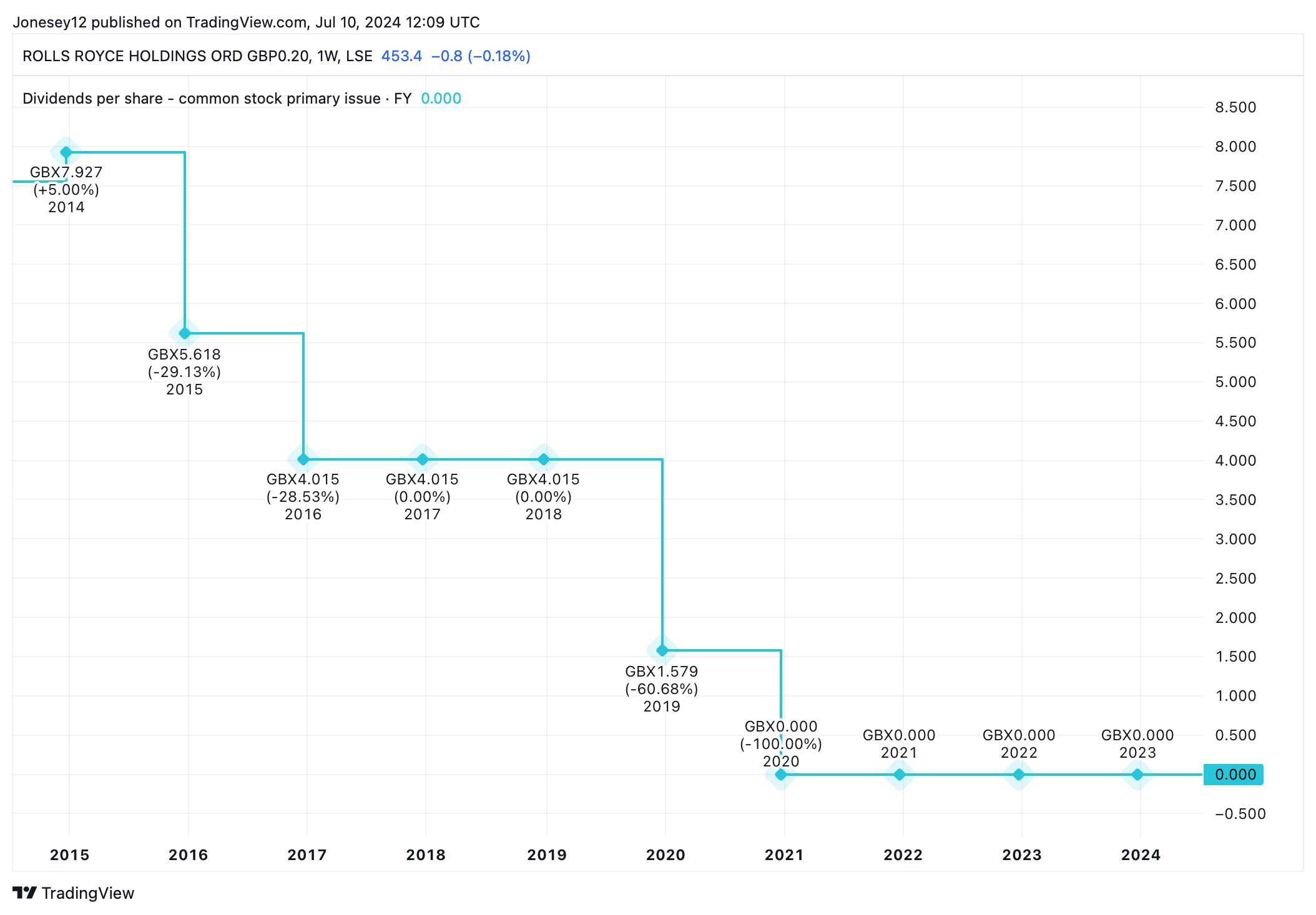

Rolls-Royce (LSE: RR) shares have smashed the FTSE 100 and S&P 500 lately, growing 400% in the last two years. Yet loyal investors haven’t received a penny in dividend income since it axed shareholder payouts in April 2020. They were declining anyway, as were profits. Let’s see what the charts say.

Chart by TradingView

That could be about to reverse. There is growing speculation that Rolls-Royce will restore its dividend this year. The income it offers will pale alongside the insane levels of capital growth investors have enjoyed, but will still be cause for celebration for two reasons.

First, restoring shareholder payouts will offer further proof that Rolls-Royce has put its turbulent recent history behind it. And second, it means the stock will continue to reward shareholders, even as the share price slows.

This FTSE 100 stock is slowing

Rolls-Royce simply cannot maintain its recent breakneck pace. In fact, it’s already slowing. It rose 201% over 12 months, but just 8.6% in the last three.

Rolls-Royce is now “comfortably within an investment grade profile”, which it lost in May 2020. Restoring that was one of the hurdles the board set before restoring the dividend. The big three ratings agencies – Fitch, Moody’s, and Standard & Poor’s (S&P) – have all now given it the thumbs up.

The board is now “committed to reinstating and growing shareholder distributions”. There’s a chance it could happen when Rolls-Royce publishes its half-year results on 1 August. Or we may have to wait until full-year results.

Consensus estimates suggest the board will pay a dividend of 2.854p per share in 2024. At today’s share price of 453.90p, that works out as a 0.63% yield. That’s well below the FTSE 100 average of around 3.7%, but better than nothing.

Not quite a dividend hero

To generate a solid monthly income of £100 a month from Rolls-Royce dividends this year, I’d have to buy 42,046 shares. Today, that would cost me £190,847. Sadly, I can’t afford that.

However, this is purely the year one dividend. In 2025, analysts estimate the dividend per share will climb more than 70% to 4.899p. To generate £100 a month, I’d ‘only’ need to buy 24,495 shares, which would cost me £111,183. Which is still a lot of money that I don’t have.

Today, the attraction of investing in Rolls-Royce shares is clearly growth not income. Yet how much more can we hope for? It now trades at a hefty 32.56 trailing earnings. That’s almost three times the average FTSE 100 valuation.

In fact, I wouldn’t be surprised if the share price retreated, should investors decide to embark on a bit of profit-taking.

Rolls-Royce is in a good place. It has whittled down its debt to just £162m. Next year, it should have net cash of £1.9bn. That should help secure shareholder payouts. But it’s no longer a shoot-the-lights-out recovery play. Instead, it is slowly transforming itself into a long-term dividend growth stock. That’s fine, but personally, I’d prefer a lower entry price. I’ll look elsewhere for my £100 a month yield. And my growth.

This post was originally published on Motley Fool