Treasury yields continued to decline Thursday, ahead of data on U.S. inflation at the wholesale level in September.

What are yields doing?

-

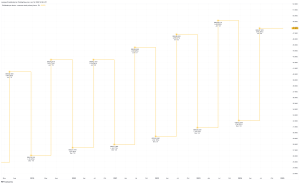

The yield on the 10-year Treasury note

TMUBMUSD10Y,

1.530%

fell to 1.53%, down from 1.549% at 3 p.m. Eastern on Wednesday. -

The 2-year Treasury yield

TMUBMUSD02Y,

0.358%

was at 0.354%, compared with 0.368% late Wednesday. -

The 30-year Treasury bond

TMUBMUSD30Y,

2.031%

yielded 2.043%, up slightly from 2.041% on Wednesday.

What’s driving the market?

The yield curve — a line that plots yields across Treasury maturities — flattened on Wednesday even though the headline September consumer-price index came in slightly above expectations, though minutes of the September Federal Reserve meeting affirmed policy makers are leaning toward beginning to taper monthly asset purchases before the end of the year.

Some analysts said the fall in longer-dated yields despite the somewhat hotter-than-expected inflation data partly reflected fears that the Fed may eventually be forced to more aggressively raise interest rates than had been anticipated, risking a policy error that could undercut future economic growth. Others said it could reflect fears of a scenario in which lower growth makes it difficult to begin an extended cycle of rate increases after the Fed completes the tapering process.

Read: Stronger-than-expected U.S. inflation data has bond traders weighing the risk of a Fed policy error

Meanwhile, the Fed minutes indicated the tapering process could begin by mid-November or mid-December, in line with signals from Fed officials and market expectations.

The U.S. producer-price index for September is due for release at 8:30 a.m. Eastern. Economists surveyed by The Wall Street Journal are looking for a 0.6% monthly rise, after a 0.7% increase in August.

Weekly data on jobless benefit claims is also set for release at 8:30 a.m.

What are analysts saying?

Market participants have “constantly underestimated the (PPI) data so far this year and we don’t think it is going to be any different today,” said Steve Barrow, head of G-10 strategy at Standard Bank, in a note. “But just whether this brings any more

angst to the Treasury market is hard to say as sensitivity to the PPI data seems pretty low.”

This post was originally published on Market Watch