Shares in Beyond Meat (NASDAQ: BYND) took a big hit yesterday. When the US market closed, the plant-based meat stock was down 13% at $82 – its lowest level since April 2020. This time a year ago, the stock stood at $129, around 57% higher.

So why did Beyond Meat’s share price plummet yesterday? And has the share price weakness created a buying opportunity for me?

5 Stocks For Trying To Build Wealth After 50

Markets around the world are reeling from the coronavirus pandemic… and with so many great companies trading at what look to be ‘discount-bin’ prices, now could be the time for savvy investors to snap up some potential bargains.

But whether you’re a newbie investor or a seasoned pro, deciding which stocks to add to your shopping list can be a daunting prospect during such unprecedented times.

Fortunately, The Motley Fool UK analyst team have short-listed five companies that they believe STILL boast significant long-term growth prospects despite the global upheaval…

We’re sharing the names in a special FREE investing report that you can download today. And if you’re 50 or over, we believe these stocks could be a great fit for any well-diversified portfolio.

Why Beyond Meat’s share price just crashed

The reason the BYND share price fell yesterday was that the company’s third-quarter 2021 results, posted on Wednesday night, were very disappointing and missed Wall Street’s estimates.

For the quarter, the company posted revenue of $106.4m, which was below analysts’ forecast of $109.2m, and well below Q2 revenue of $149.4m. Meanwhile, the adjusted loss for the quarter came in at 87 cents per share, which was far higher than the consensus forecast of 39 cents per share.

However, what really spooked the market was the outlook. Here, Beyond Meat advised that for the fourth quarter of 2021, it expects net revenue in the range of $85m-$110m. This was miles below the consensus forecast of $132m.

Looking ahead, the company said its operating environment continues to be affected by near-term uncertainty related to Covid-19 (consumer behaviours are quite hard to predict right now) as well as labour availability and supply chain disruptions.

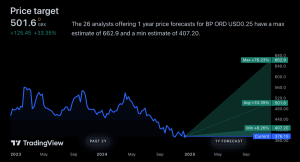

On the back of these Q3 results – which one analyst described as “disastrous” – a number of brokers cut their price targets for the stock. One such broker was JP Morgan, which cut its target price to $54 from $79. Another was Credit Suisse, which went from $70 to $65.

“We view the results as further evidence that Beyond’s business is reaching market saturation faster than expected and that the company has deeper problems that won’t be easy to fix,” wrote Credit Suisse analyst Robert Moskow.

Should I buy BYND stock now?

I’m quite bullish on the prospects for the plant-based meat industry as a whole. According to Markets and Markets, this industry is set to be worth $8.3bn by 2025, up from $4.3bn last year. That represents annualised growth of 14%. That kind of industry growth is likely to generate plenty of returns for long-term investors like myself. And BYND could be huge beneficiary.

Yet I’m not convinced that investing in Beyond Meat stock is the best way to capitalise on the growth of the industry. One concern I have here is the level of competition the company faces. Today, there are now lots of brands offering similar products including the likes of Meatless Farm, Future Burger, Naked Glory, The Vegetarian Butcher and Vivera.

Does Beyond Meat have a genuine competitive advantage over these kinds of companies? I’m not sure it does. Without a competitive advantage, these other companies could capture market share.

Another concern I have is the high level of short interest here. Currently, Beyond Meat has short interest of around 35% which is extremely high. This indicates that a lot of institutions are betting against the stock.

So while the BYND share price has fallen a long way recently, I’m not tempted to step in and buy the stock just yet. To my mind, it’s too risky.

Given that many growth companies are absolutely on fire right now, I think there are much better stocks to buy today.

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Edward Sheldon has no position in any of the shares mentioned. The Motley Fool UK has recommended Beyond Meat, Inc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

This post was originally published on Motley Fool